Determining Your Asset Class Percentages

This is the fourth article in a series on asset allocation and rebalancing. This article will focus on how to set targets for each of the asset classes you hold in your investment accounts.

This is the fourth article in a series on asset allocation and rebalancing. This article will focus on how to set targets for each of the asset classes you hold in your investment accounts.

Previous articles introduced the concept of asset classes and periodic rebalancing. The first step is to first decide which asset classes you will invest in. The three primary asset classes are equities, fixed income and cash, but these can be broken down into an unlimited number of more specific categories if desired, limited only by what the individual investor is comfortably able to manage and track. The second step is to select a target percentage holding for each of these classes. The final step is to do a periodic rebalancing where you sell investments in the asset classes which have risen in value and buy investments in the asset classes which have dropped in value. The end result is to remove the emotion from the investing process and make it a mechanical exercise which forces you to buy low and sell high, providing higher long term portfolio returns and lower risk.

But how do you decide what your target percentages should be for each asset class?

How Do I Love Thee? Let Me Count the Ways.

Allow me to pose a question: Is it possible to calculate my ideal asset allocation percentages taking into consideration my age, risk tolerance and investment time frame? The answer to this question is a resounding NO! If you supply a hundred investment professionals with this data they will return a hundred different proposals for what your asset allocation should be. There is no ideal asset allocation for an individual.

Asset allocation is a product of a finance theory called Modern Portfolio Theory whose goal is simply to maximize a portfolio’s return for a given amount of risk or, alternatively, minimize risk for a given level of required return. While there is a mathematical calculation that produces a theoretically ideal set of asset allocations (called the Efficient Frontier), it relies on some pretty big assumptions, such as normally distributed asset returns (they are not), rational investors (we are an emotional bunch), fixed and constant correlations between asset classes (untrue), and no taxes or transaction costs (I wish).

What we are left with instead are a thousand different approaches, systems, techniques and recommendations on building your own asset allocations with real world information and assumptions. Here’s an experiment – go to your favourite internet search engine and type in “asset allocation system”. Browse through any of the hundred of pages it returns to get an appreciation for the sheer volume of possibilities. Many of these systems will be familiar territory for Canadian MoneySaver readers - the key is to find one that makes sense for you.

An Example:

When I first started horsing around with asset allocation I had a dozen asset classes, changed my percentages frequently, and tried throwing other strategies into the mix. High yield investing, Dripping, Graham’s method, tax loss selling, momentum investing, barbelling, technical analysis, fundamental analysis, Couch Potato, dividend growth investing, derivative investing, Gone Fishin’, and low cost index investing are just a few of these. Every new book or article gave me ideas and systems I was anxious to try out and frequently did; the temptation to fiddle was overwhelming. Since then I have really tried to simplify my investing style and I now use a small number of asset classes, do a yearly rebalancing and focus on reducing the overall cost of my portfolio and making it as tax efficient as possible.

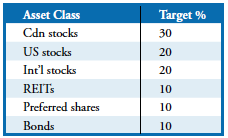

My current asset allocation looks like this:

I have one or two ETFs for each category plus I own about 10 individual stocks. My overall allocation is 80% equities and 20% debt (including preferred shares). Some of the individual investments I hold within the bond category are high yield with higher risk, and the preferred shares class itself isn’t strictly debt, so the portfolio is probably more risky than it appears.

I decided on my asset allocation targets taking the following areas into consideration.

Simplicity

I spend enough time on my family finances without trying to manage balancing 20 asset classes. Yes, each of my classes could be broken into many smaller subclasses such as Growth versus Value, industry specific, commodities and so on, but in the end I think the benefits would only be marginal.

Risk Tolerance

I have been through three major stock market downturns and have never let myself get spooked and sell. This tells me my tolerance for risk is high, therefore I can trust myself to be heavily invested in equities and weather the inevitable downturns.

Time Horizon

I do not expect to be withdrawing any money from investments for at least fifteen years so my investment horizon is quite long. As time goes on, I will probably adjust my targets to include an increasing amount in safe bonds.

Net Worth

As my net worth grows, capital preservation does become more important to me. But instead of allocating my investment money towards safe, low yielding investments, I simply limit the amount of my net worth I expose to paper investments. In other words, I don’t put 100% of my savings into the markets; a sizeable percentage is invested in real estate, businesses and plain old cash. If 90% of the stock market is wiped out in a black swan style market apocalypse, I can take shelter in my other investments. Yes it would hurt, but I could survive it.

At this stage of the game, doubling my net worth would really make no difference to my lifestyle so I don’t need to be overly aggressive. But a young investor with little to lose stands much to gain, and can afford to invest aggressively.

Income Sources

Because both my wife and I have stable, secure, well paying jobs we can afford to put a larger percentage of our assets into investments with higher anticipated risk and return. If we had sporadic or unpredictable income, with a high probability of having to dip into our investment savings, then I’d have more money allocated to safer asset classes.

Moreover, I have an excellent pension plan and we both anticipate collecting CPP and Old Age Security. These future earning streams are effectively low risk, fixed income annuities, which allows me to be more aggressive with our personal investments.

Tracking Error

My portfolio behaves differently than one entirely invested in Canada. The correlation of one’s portfolio to the performance of a benchmark is called “tracking error”. Because I have money invested outside of Canada, some years my portfolio will seriously underperform the TSX, while other years it will outperform it. If this bothered me, then I would have a low tolerance for tracking error and be better off with a high percentage of Canadian stocks. But I am okay with this because I know it will perform well over the long term.

What Really Matters

In the end, what may matter more to the performance of your portfolio is not the precise percentage allocations you use, but rather being disciplined with your rebalancing. Selling off portions of your portfolio that are doing well is exceptionally difficult and will go against all your instincts. If you are able to successfully rebalance through several market cycles and stick to your plan, the benefits of asset allocation will become apparent.

Steps to Follow

These are the steps you can use to decide on your own asset allocation percentages:

- Calculate your current asset allocation percentages on the asset classes you own. Don’t worry if it’s a dog’s breakfast, you have to start somewhere.

- Using financial books, a DIY investment professional, or the internet, research asset allocation models and find one that you are comfortable with. Keep it simple.

- Decide on your desired allocation percentages. Take into consideration your age, risk tolerance, sensitivity to tracking error, investment time horizon, security of non-investment income and total amount of investable money.

- Put a plan in place to get where you want to go from where you are. You do not need to do this all in one day and may instead decide to move to your desired targets in a gradual fashion. Choose low cost investments and pay attention to the tax consequences of different account types.

- Once per year, calculate your current percentages and rebalance to get back to your targets. Don’t read any newspapers the day you do this.

- Once every three years review and adjust your asset allocation targets as required. When modifying, try to adjust percentages opposite to valuation changes. If your international stocks target is 25% and your actual percentage is 30%, your adjusted target should be less than 25%, not higher, otherwise you are simply chasing returns.

Kris Olson, B.Comm, DIY Investor, Traveler, Author of “The Found Vagabond”, Paris, ON, (519) 442-3020 kris@ lifeisgrand.org, www.lifeisgrand.org