Thoughts On Canada’s Retirement System

Over the first quarter of 2015, I’ve been updating my clients’ retirement projections. Over the course of the exercise, it struck me how different the prevailing assumptions are today compared to, say, a decade ago. The decisions being encouraged now would have been considered heretical only a few years ago. First among these is my earnest admonition to stay in the workforce longer – mostly because people are living longer, but also because returns in the future are almost certain to be lower than the returns experienced in the past. As it is, I’m telling people to plan for a 23-year lifespan in retirement. Seeing as I expect to live to be 90, that means that the absolute earliest I should be planning to retire is age 67. That’s fine by me. The federal government has already signalled as much by precluding me from collecting full OAS benefits until I reach that age.

Over the first quarter of 2015, I’ve been updating my clients’ retirement projections. Over the course of the exercise, it struck me how different the prevailing assumptions are today compared to, say, a decade ago. The decisions being encouraged now would have been considered heretical only a few years ago. First among these is my earnest admonition to stay in the workforce longer – mostly because people are living longer, but also because returns in the future are almost certain to be lower than the returns experienced in the past. As it is, I’m telling people to plan for a 23-year lifespan in retirement. Seeing as I expect to live to be 90, that means that the absolute earliest I should be planning to retire is age 67. That’s fine by me. The federal government has already signalled as much by precluding me from collecting full OAS benefits until I reach that age.

Other than working longer, there are only a handful of levers available to most people in planning for retirement. That said, the main variables within most people’s control are not realistic alternatives at any rate.

Those variables are:

- Save more (fat chance: debt levels are higher than ever) • Invest more aggressively (never a good idea and even so, returns might still be lower than historical numbers –even with a more aggressive asset allocation)

- Accept a lesser lifestyle in retirement (again, fat chance, since lifestyle enhancement is the primary culprit for bullet #1)

Over the years, I’ve become known as a “policy wonk” owing to my former involvement in party politics and to my having a graduate degree in Public Administration – with a particular interest in public policy. I feel gratified that one of our country’s major newspapers has weighed in with their suggestions to modernize Canada’s retirement system. The public debate is long overdue. I’d like to offer my own thoughts on this contentious but critically important subject. In a nutshell, my proposal has three elements:

- Increased RRSP contribution limits;

- Decreased RRIF withdrawal minimums; and,

- Maintained TFSA contribution limits.

Let’s look at each in turn. To begin, I’d like to draw your attention to an article I wrote in the October 2014 edition of MoneySaver. In it, I recommended both an absolute increase in contribution for nearly everyone and the introduction of a progressive element (wealthier people get increased room, but at a decreased rate). This would incentivize everyone to save more than they currently do, but with the benefit going primarily to people in the middle class. For the government, there would only be a modest amount of revenue foregone. People earning $200,000 a year or more would have $30,000 in annual contribution room. Given the massive increase in room, indexation would no longer be required.

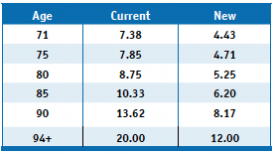

Second, I would recommend that the prescribed minimum RRIF withdrawal rate be re-calibrated to60% of its current level. Thatmeans that the minimum withdrawals at various ages would look like this:

This change would obviously cost governments some tax revenue in the short run, but, seeing as the money left in the plans would grow more quickly / deplete more slowly and since everyone dies eventually, this would really be just a deferral of tax revenues that would ultimately end up in the government’s hands. For those retirees where even lower mandatory withdrawals exceed their lifestyle costs, there would always be the option of paying your tax and diverting money into the third pillar of my program.

That third pillar says that the existing TFSA contribution levels ($5,500/person/year indexed to inflation in $500 increments) should be maintained, but not increased. If the TFSA system were to grow, as has been suggested by the current government, it would create a considerable long-term drag on both national GDP and federal government finances. Seeing as TFSAs, like the new rules for income-splitting, benefit primarily wealthy Canadians, maintaining the current policy puts a limit on the regressive nature of future plan increases. As it currently stands, wealthy people can now put about $30,000 a year into their government-sponsored retirement plans. If my plan were to be fully enacted, that room would grow to over $35,000 for wealthy people. Additional government-sponsored room at that point is likely to be overkill. My guess would be that only a small fraction of the population could pay off their debts, maximize both their RRSPs and TFSAs and still have money left over. Those people don’t need extra programs to meet their retirement goals. If the three changes noted here don’t do the trick, they could always enhance their retirement savings by investing in taxable accounts.

It should go without saying that another variable that many people do not consider is cost. As much as is reasonable, I always encourage people to trim costs when doing their investing—in the immortal words of John Bogle, “You get what you don’t pay for.” Most retirement plans do not dial down expected returns as a result of using higher-cost products. If Bogle is right (and I think he is), they absolutely ought to.

Taken together, my view is that these changes provide a healthy balance between maintaining the integrity of Canada’s retirement system while also providing a reasonable revenue stream for the government of Canada.

John J. De Goey is Vice President and Portfolio Manager at BBSL. The views expressed are not necessarily shared by BBSL. john.degoey@bbsl.ca @JohnDeGoey_BBSL

www.johndegoey.com