Diversifying Your Net Worth Assets

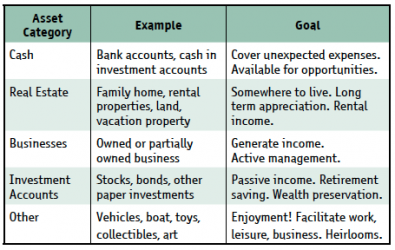

This is the third article in a series on asset allocation and rebalancing. The second article introduced the concept of Net Worth Asset Categories, which are used to group your assets into categories that reflect their risk and earning potential, but also the utility they provide for you in your life. Here are the categories and some examples:

This is the third article in a series on asset allocation and rebalancing. The second article introduced the concept of Net Worth Asset Categories, which are used to group your assets into categories that reflect their risk and earning potential, but also the utility they provide for you in your life. Here are the categories and some examples:

The starting point is to calculate what percentage of your assets (net of liabilities) is represented in each category. Next, take an objective look at whether that level is appropriate and if not, what the target should be. Finally, put a plan in place to get to your targets.

But what should your targets be for each category? And how do they change over time? I would like to describe how my personal situation has changed over the years and the process I have used to come up with my current targets, in the hopes that this will help you with yours.

Overeducated And Underemployed

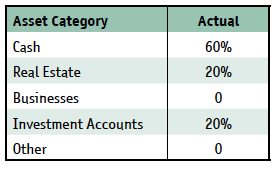

After a taxing four years in the College of Commerce in Saskatoon, Saskatchewan, I was finally done school and ready to take on the world. Upon graduation, my matrix looked like this:

It looked pretty good—except that my total worldly assets consisted of a hundred bucks in a chequing account. The “Other” category would have been much higher, except that I had recently sold my 1968 Dodge Dart for $400 and had paid back my dad for some cash he loaned me to get through the last months of school. But because I was able to live at home during these years and work at summer jobs, I graduated with no student debt, putting me financially miles ahead of many others.

It looked pretty good—except that my total worldly assets consisted of a hundred bucks in a chequing account. The “Other” category would have been much higher, except that I had recently sold my 1968 Dodge Dart for $400 and had paid back my dad for some cash he loaned me to get through the last months of school. But because I was able to live at home during these years and work at summer jobs, I graduated with no student debt, putting me financially miles ahead of many others.

Go Forth And Travel

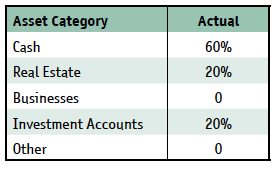

My next ten years were spent overseas as a hedonistic, sleepless bachelor who devoted all my spare time to enjoying myself. The saying “burning the candle at both ends” couldn’t have been truer as I worked long, tough hours on contracts in many countries around the world, making great money while still managing to get time off between jobs for extensive travel. Though long-term financial planning was not a priority, I did begin to experiment, and despite a lavish lifestyle I still was able to save. For the first time in my life I finally had some money to work with so I purchased a rental property in Saskatoon (that my family managed for me) and I invested some money in mutual funds. My matrix looked like this:

who devoted all my spare time to enjoying myself. The saying “burning the candle at both ends” couldn’t have been truer as I worked long, tough hours on contracts in many countries around the world, making great money while still managing to get time off between jobs for extensive travel. Though long-term financial planning was not a priority, I did begin to experiment, and despite a lavish lifestyle I still was able to save. For the first time in my life I finally had some money to work with so I purchased a rental property in Saskatoon (that my family managed for me) and I invested some money in mutual funds. My matrix looked like this:

This initial foray into investing taught me some valuable lessons on market timing. I bought the mutual funds just in time to watch them plummet in value during the dot-com crash in 1999. And I sold the rental pro perty before the fabulous run-up in property values in Saskatoon. To this day I remain terrible at predicting the future and don’t expect to become better at it anytime soon.

During this time I met a beautiful girl who would soon become my wife, and we traveled internation ally together for several more years before deciding to return to Canada to start a family.

Welcome Back To Reality, Sucker

Once back in Canada, it was time to get serious. My system of owning only what could fit into two suitcases came crumbling down and I found myself living in Calgary with a job, a house, a cabin, mortgages, vehicles, children and all that other junk my peers had been dealing with for a decade. Life became more complicated. I was still sleepless, but I spent my nights warming up milk bottles and cleaning up diaper messes instead of drinking in exotic taverns around the world.

Despite having a degree in finance, I really knew nothing about financial planning. Fortunately my uncle Gerry, who is an investment genius, took me under his wing and taught me all about investing. He recommended an endless stream of finance and investing books which I devoured. In fact, the first thing he urged me to read was the Canadian MoneySaver, and I’ve had a subscription ever since! Soon, my matrix was like this:

My primary goals during this time were to increase my investing knowledge and experience. Our family finances became the top priority and we started building up assets that would serve us well in the long term.

The Real Estate Experiment

We eventually moved to Ontario and began some serious real estate investing in the attempt to turn it into a business that we could grow and eventually sell or live off the proceeds. Though my wife and I were both working in full time jobs, we managed to purchase and renovate several multi-unit properties and learned an awful lot about the residential real estate business in Ontario.

After too many battles with tenants, property disasters, and long nights spent doing administration and taxes, we decided we just didn’t have the stomach for it and sold off the rental properties. We were also becoming increasing uncomfortable with the bubbly property market and wanted to reduce our exposure. Fortunately, throughout this time we were also continuing to plow money into investment accounts, so our overall percentages did not change significantly.

This is where I learned that time is an important variable when trying to find a good balance for your net worth. The increased concentration on real estate and business required a lot of time, which meant fewer hours to spend with my young children. The decision to move away from real estate had less to do with finances and everything to do with having a great life.

Where I Am At Now

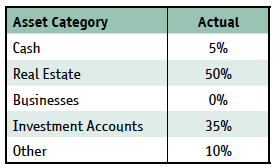

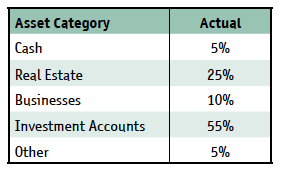

Right now my wife and I are early into our 40s with our children halfway through elementary school. As my brother says, I’ve gone from being a wild man in Bahamas to a pencil-pushing father of two, and my needs and goals have changed accordingly. These are my current targets and I expect these to remain constant for at least the next ten years:

My goals at this stage of life are spending time with my family, striking a good balance between capital preservation and growth, and looking for small business opportunities. Also, keeping that “Other” category at 5% means that we limit the money we spend on depreciating assets such as vehicles and fancy toys.

Where Are You At?

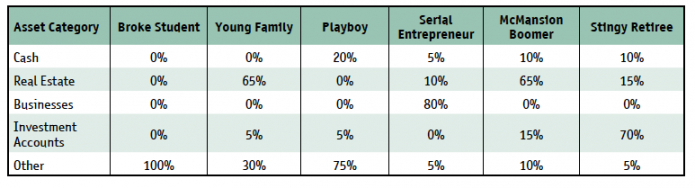

Take some time and calculate your own Net Worth Asset Category grid. Are you surprised by the results? Do you feel you have a good allocation to support your plans for the future? How would your net worth be impacted by a large stock market crash, or a real estate meltdown? Could your assets support you in the case of a job loss or a major health problem? Do you have cash available to take advantage of unexpected opportunities? The table below shows some sample profiles, followed by a description of each and some suggestions on rebalancing.

Broke Student

What little you have is invested in a car, a computer and a few other bits and pieces—but time is on your side! Start putting a little money in the markets. The pain you feel from losing a hundred bucks now will feel as bad as losing a hundred grand later in life when you have more assets. Learn those lessons early—get some skin in the game. Let compounding returns work their magic.

Young Family

Everything you own is tied up in your house, vehicles, camper and snowmobiles. Most of your salary goes toward living expenses and loan payments. Consider selling some of the toys and put that money into RESPs, TFSA’s and RRSPs to maximize grants and tax savings. Evaluate buying a rental property or starting a small business in addition to your job if you can manage the time commitment.

Playboy

You earn a great salary and blow a lot of it on fancy dinners, premium wine, exotic trips, sports cars and fancy clothes. You rent a spectacular condo in a trendy urban area. Start investing for the long term to protect against job loss or health issues. Consider buying a property or starting your own business to diversify your asset base. Get rid of the depreciating, money-gobbling toys.

Serial Entrepreneur

You are fully invested in your business or businesses and own a highly mortgaged house. The potential for high earnings is great, but risky. Start investing in markets to maximize tax benefits, grants and to diversify earnings.

McMansion Boomer

You make great money and live in a gigantic house, perhaps with your adult children in the basement. You have nice cars and a sailboat. You’ve invested in mutual funds over the years with a trusted financial advisor, though you’re not sure how they have performed or how much in fees you are paying. Learn about investing, get your portfolio in shape and fire your advisor if necessary. Invest as much free money as possible and get it working for you. Consider downsizing the house and vehicles and stoke up your liquid investment account. Construct a lower-cost lifestyle.

Stingy Retiree

You have invested well, made the right choices, live in a modest house and have a great pension and investment income. You are sitting on a pile of gold but are paralyzed by frugality after a lifetime of it. Buy the car you have always dreamed about. Give some money away to charity. Take the ultimate vacation. Time is now your most precious asset.

Kris Olson, B.Comm, DIY Investor, Traveler, Author of “The Found Vagabond” Paris, ON, (519) 442-3020 kris@lifeisgrand.org, www.lifeisgrand.org