BTSX – 2014, Another Good Year

The first couple of days in January have been quite busy for me with data crunching, buying and selling stocks and writing this article. It has been another particularly good year for the BTSX strategy for the Jan-Dec 2014 time frame. As you would have read in the Nov/Dec issue of CMS, David Stanley has asked me to carry on the BTSX work that he started while he steps back from his investing and financial literacy work. I want to take this opportunity to thank him for the guidance he has provided to me through his countless articles over the years. I am quite excited about the opportunity to be writing the article containing this year’s stock picks, rather than just reading it, as I have been for the last 18 years.

The first couple of days in January have been quite busy for me with data crunching, buying and selling stocks and writing this article. It has been another particularly good year for the BTSX strategy for the Jan-Dec 2014 time frame. As you would have read in the Nov/Dec issue of CMS, David Stanley has asked me to carry on the BTSX work that he started while he steps back from his investing and financial literacy work. I want to take this opportunity to thank him for the guidance he has provided to me through his countless articles over the years. I am quite excited about the opportunity to be writing the article containing this year’s stock picks, rather than just reading it, as I have been for the last 18 years.

As David is irreplaceable, I will do my best to continue his work. Hopefully you will find it as useful as David’s contributions. I will follow a similar process, with some modifications that I have added. Even with modifications, my returns over the last 14 years have been similar to David’s 28 year average. As I have shared with readers in my e-book, Destination: Early Financial Independence, I have about 50% of my portfolio in these 10 stocks, so I need to be comfortable with my investment choices.

Here are my guidelines/modifications:

- I don’t want to be losing sleep over owning a particular stock. That is just not healthy for anyone. An example would be if a stock appears on the list, that I believe, is in a dying industry or just has too many problems that leave me uncomfortable. I also invest using the Dogs of the Dow process and in 2009 General Motors (GM) appeared on that list. I couldn’t bring myself to purchase it and not too long after that the stock became worthless.

- I always remove Husky Energy (HSE) from the list since its dividend payment history is erratic. The company pays out more when they make more and pays out less when they make less. This is really not the steady blue chip business that we are looking to invest in.

- When POW (Power Corp of Canada) appears on the list, I replace it with PWF (Power Financial Corporation). POW is the holding company for PWF. I prefer PWF as it has a higher dividend. Given that the performance of these two stocks track each other closely, it doesn’t matter which one you own.

- If a company cuts or reduces its dividend, then I sell the stock immediately. I have owned too many repeat dividend cutters. (About 75% of the dividend cutting stocks that I have owned went on to do a second cut 12 to 18 months later…live and learn.) Dividend cuts in the BTSX portfolio don’t happen often but unfortunately it did happen this year. TransAlta (TA) in February, 2014, reduced its dividend by 40%. I then replaced it with BNS, which was the next stock on the list as of the date of the dividend cut. TA’s purchase price and selling price at the time of the dividend cut was within a couple of pennies of each other so there wasn’t any capital loss or gain impact. It turned out that this was a good action to have taken as TA was down 22% by the end of the year and BNS was up 3.9%.

January-December 2014 Results

January-December 2014 Results

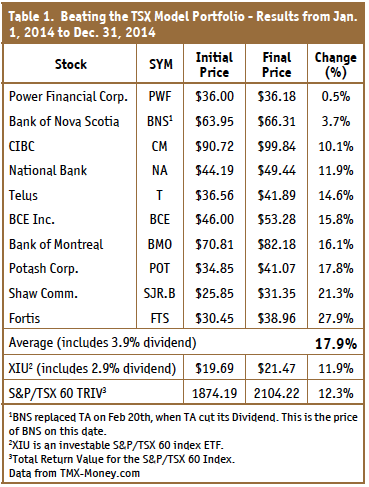

As you can see from Table 1, the return for the BTSX portfolio was 17.9%. It was a very good year beating XIU (iShares S&P/TSX index ETF) by 6%. I have also included the S&P/TSX 60 TRIV (Total Return Index Value) for comparison. The difference in return between XIU and TRIV can be accounted for by the MER charged by iShares and the tracking error of XIU.

XIU investors should be pleased with an 11.9% return on an easy to manage product with a low MER of 0.17%. I have always suggested using the XIU ETF as a starting point for new investors or experienced investors who don’t have time to invest in individual stocks.

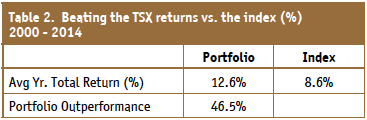

Table 2 shows the average results over the last 14 years, which has moved up slightly due to this year’s above average return. The BTSX portfolio, that I have been using, is outperforming the index by over 46%. It should be noted that after a number of years of outperformance we should expect a return to the mean before too long with an underperforming year. The goal is to have a long term average return that is greater than the index. We should not expect to beat the index every year.

have been using, is outperforming the index by over 46%. It should be noted that after a number of years of outperformance we should expect a return to the mean before too long with an underperforming year. The goal is to have a long term average return that is greater than the index. We should not expect to beat the index every year.

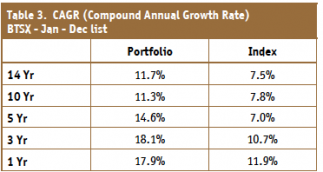

In Table 3 the CAGR (compound annual growth rate) is shown, rather than the simple average numbers I usually work with. The CAGR number will allow a comparison to mutual fund returns or any other investment returns that indicate their CAGR number. As you can see the BTSX portfolio currently is outperforming the index in all time frames.

2015 BTSX Portfolio

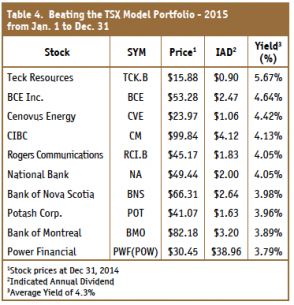

Table 4 lists the stock picks for 2015. These stocks are purchased Jan 1st and held till the end of the year. There have been quite a few changes to the components that make up the S&P/TSX 60 index over the past year but none that directly affect us. For example, a couple of former income trusts, PWT  and ERF were replaced with PPL and IPL both of which are former income trusts. Since we remove all former income trusts these changes don’t affect the ranking process.

and ERF were replaced with PPL and IPL both of which are former income trusts. Since we remove all former income trusts these changes don’t affect the ranking process.

You can use this list as you choose. You may wish to purchase all the stocks or perhaps use this list as a suggestion of high yielding stocks from the S&P/TSX 60 to review further. Some readers may want to follow the usual BTSX formula which would include TA and HSE, bumping a couple of stocks off the bottom of the list. The choice is up to you. I will have to look at TA in a year or two and decide if it should be added back to my purchase list or not.

The average yield of this year’s list is 4.3%. This number is another one of the exciting things about this strategy. If you are able to live off 4% or less of your portfolio, as is often recommended by financial experts, then you can fund your retirement income from the dividends received without having to sell any capital, making income management quite simple.

DOGs Of The Dow Portfolio

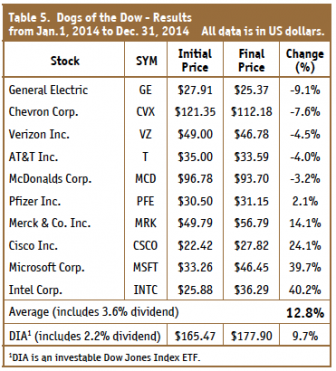

As readers of my book know, I also invest in Dogs of the Dow, so I havedecided to provide this list of stocks as well. This provides me with a US portfolio of high dividend paying blue chip stocks. As you can see from Table 5, for 2014 we had a return of 12.8% and thus beat the index by 3.1%. This return is in US dollars and thus does not take into account the additional gain in the portfolio due to the weakening Canadian dollar.

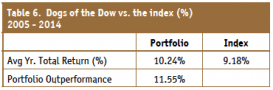

Table 6 shows the average results from the last 10 years with an outperformance factor of 11.5%. This result is lower than the BTSX result, but still in our favour.

Table 6 shows the average results from the last 10 years with an outperformance factor of 11.5%. This result is lower than the BTSX result, but still in our favour.

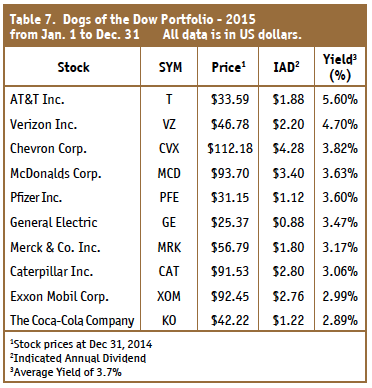

I will be purchasing all of the stocks in the 2015 lists for BTSX and Dogs of the Dow, and hoping for the best, as usual. Due to the dividend increases, one of the benefits of owning these dividend stocks is that the total income from the portfolio is growing at or above inflation each year. The total income gets anextra boost in January when the lower yielding stocks that move out of the top 10 are sold and then replaced with higher yielding stocks.Table 7 lists the stock picks for 2015 with the new additions of CAT, XOM and KO.

I will be purchasing all of the stocks in the 2015 lists for BTSX and Dogs of the Dow, and hoping for the best, as usual. Due to the dividend increases, one of the benefits of owning these dividend stocks is that the total income from the portfolio is growing at or above inflation each year. The total income gets anextra boost in January when the lower yielding stocks that move out of the top 10 are sold and then replaced with higher yielding stocks.Table 7 lists the stock picks for 2015 with the new additions of CAT, XOM and KO.

Fortunately with this system, all that is left to do for the next 12 months is to watch for any dividend changes. Hopefully there will be many more increases than decreases!

If you have any questions or would like more information on my book, please feel free to contact me.

Ross Grant is the e-book Author of Destination: Early Financial Independence, available on Amazon and Kobo for $5.99. Free e-reader software is available for PCs, MACs, etc. to view the books. Please email me if you need the links. You can reach him at RossGrantEFI@gmail.com