Parsing The Pension Debate

With the closing of the Ontario elections and the rest of Canada’s eyes on the possibility of a provincial pension plan being created, there has been a lot of talk about what tends to be a rather boring (sorry, actuaries) topic: Pensions. While mundane, it is an important issue that should and needs to be discussed, and one that affects the country, if not North America as a whole. Before we can all weigh in on an opinion with the issue, however, we need to make sure we understand where the ‘buzz’ comes from.

The concern lies primarily with that of defined benefit plans where employers or institutions have essentially promised to pay the eligible participants a guaranteed amount in retirement based on some sort of formula. The formulas are typically a function of income (averaged over a number of years) and years employed. While we are referring more to the private sector with any calculations, the general idea still pertains to the public sector. In order to understand what some are concerned about, we need to look at the components of an individual’s pension.

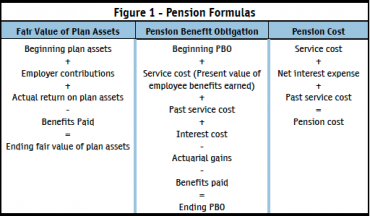

Defined benefit pension plans consist of the fair  value of plan assets (FVPA), the present value of the pension benefit obligation (PBO), and the pension cost. Figure 1 outlines what makes up the three components as defined by the CFA Institute. The funded status—the amount that shows whether pensions are over or underfunded—is equal to the FVPA minus the PBO. By looking at Figure 1, we can begin to see where some of the concern comes from; in short, the issue could be summarized as bad timing.

value of plan assets (FVPA), the present value of the pension benefit obligation (PBO), and the pension cost. Figure 1 outlines what makes up the three components as defined by the CFA Institute. The funded status—the amount that shows whether pensions are over or underfunded—is equal to the FVPA minus the PBO. By looking at Figure 1, we can begin to see where some of the concern comes from; in short, the issue could be summarized as bad timing.

The benefit obligation—what the company owes employees at some point—grows with pension costs as employees work longer. The pension cost rises with the service period and is discounted back to a present value in order to reflect the time value of money and the idea that money grows and compounds over time. An employee who has worked a year will have accumulated an amount owed to them at retirement, which is discounted back to the present (i.e. an amount owed for retirement in 30 years to a 25 year-old employee is discounted back 30 years). The number of years this obligation is being brought back for a young, new employee means that the obligation is smaller due to the time until retirement.

Contrast this with an employee nearing retirement and you see a larger obligation and expense that has been accumulated over the years of service. That larger value is also ‘discounted’ over fewer years, meaning the number will be even bigger as there is less time for growth. There is nothing new or surprising here as those who have worked get the obligation agreed upon. Where the bad timing occurs is with regard to interest rates and demographics. Lower interest rates have resulted in obligations rising (lower number in present value calculation denominator) while the largest demographic (baby boomers) approaches retirement en masse. This results in an increased obligation that will need to be paid out in a relatively short time period, during a time when interest rates (and in turn less volatile returns) are low and after a recession that has led to decreases in the funded status of pensions. To add to the ‘problem,’ we are all living longer than ever, which increases the length of time and amount of the pensions that need to be paid.

So essentially, for those who tuned out the last paragraph: we have a very large demographic that will be drawing on guaranteed pension payments in a short period of time while safe returns are hard to come by (exhibited by low interest rates). This applies to both the government level and to companies large or small. If the funded status is underfunded, companies will either need to increase contributions (potentially hurting growth), ‘borrow’ more from current employees or hope for strong returns on current assets (which isn’t a legitimate option). The ‘2013 Report on the Funding of Defined Benefit Pension Plans in Ontario’ (Table 2.7)1 shows that 91% of defined benefit pension plans are underfunded based on the solvency ratio (plan assets divided by plan liabilities) while 43% of plans have a solvency ratio below 0.8.

Implications For Investors:

Investors need to be aware of the potential liabilities that public companies with defined benefit plans may carry and the increases in expenses that could occur as actuarial assumptions are slowly walked down to more realistic levels. If interest rates remain low and pensions continue to be underfunded, it would not be a stretch to imagine companies issuing debt in order to meet these pension liabilities. While most companies should be able to handle such an issue, it is something to be aware of, especially for those companies with less liquid balance sheets.

Implications For Savers:

With rising costs of goods, lower expected returns and longer life expectancies, properly saving and budgeting has never been more of an important issue. Many (maybe most?) individuals will need more than pension payments in order to maintain their lifestyle and a proper, as well as realistic, savings plan should be created sooner than later.

Implications For New Entrants Into The Workforce:

The sad truth is that, for most, defined benefit plans are a thing of the past and the onus to properly save for retirement is being put more and more onto the individual. Similar to the Savers, proper budgeting and planning has never been more important. New programs, such as a provincial pension plan in Ontario, are being proposed in order to answer concerns regarding retirement prospects but these types of programs have both pros and cons that should be understood before forming an opinion.

The whole issue of underfunded pensions could be one that solves itself as markets remain strong and provide reasonable returns to investors. There is no assurance of this, however, and pensions are likely to become a more important issue over the next few years in terms of both company balance sheets and the broader, more politically charged issue of public pension plans and the role they should play in the overall retirement picture for Canadian citizens. Pensions are not a topic I find particularly exciting to think about but when Warren Buffett recently sounded alarms on potential issues, I took it as a sign to start listening.

Ryan Modesto, BBA, is a Managing Partner at 5i Research Inc. in Kitchener, Ontario. He can be reached at ryanmodesto@5iresearch.ca

1)http://www.fsco.gov.on.ca/en/pensions/actuarial/Documents/DBFundingReport2013.pdf