RRSPs, TFSAs, And US Withholding Tax

In many recent articles I have discussed the pros and cons of holding various asset classes (e.g., GICs, bonds, and stocks) in registered (e.g., RRSP and TFSA) versus non-registered accounts. These articles have focused on Canadian paying dividend stocks which offer preferential tax treatment.

In many recent articles I have discussed the pros and cons of holding various asset classes (e.g., GICs, bonds, and stocks) in registered (e.g., RRSP and TFSA) versus non-registered accounts. These articles have focused on Canadian paying dividend stocks which offer preferential tax treatment.

The purpose of this article is to provide some insights on the impact of holding US stocks across these three accounts. It is important to note that this area of taxation is very complicated and this article is only intended to provide general insights on the impact of US withholding tax for dividend-paying stocks. It is important that you research your specific circumstances considering your tax situation and the US stocks you hold.

Withholding Tax

It is important to understand US withholding tax when analyzing US stock holdings. Essentially, the US government withholds taxes on various levels of income, including employment income, payments for foreign persons, and dividends and interest. The type of income of interest to Canadian residents holding US stocks is in regards to payments to foreign persons.

When the withholding tax is charged, it is collected by the government before the dividend is paid. The withholding tax is not recoverable by the foreign investor, thereby, reducing the after-tax dividend amount. The withholding tax can result in a reduced rate of return on US dividend-paying stocks.

The withholding tax levied on dividends is based on the tax treaty signed by the US and Canada. Currently, the standard withholding tax on dividends from US companies is 30%. The rate can be reduced to 15% by filing U.S. Internal Revenue Service Form W-8BEN with your broker.

It is important to note that most large brokerage firms, including the large banks, will file this form automatically for individuals who are Canadian residents and who provided photo identification when creating their account. I called two investment brokerages of Canadian banks to confirm that this is the case. As always, this article does not guarantee that your situation may differ.

There is an exemption in the tax treaty for dividends paid to a Canadian trust to provide pension, retirement, or employee benefits (Article XXI paragraph 2(a)). An RRSP is captured under this exemption, and therefore no withholding tax is payable on US dividends received in RRSP accounts. However, the TFSA or RESP are not captured under this exemption.

Withholding Tax Across Accounts

As discussed above, the US withholding tax on dividends can be avoided if the US stocks are held in an RRSP. It is important to note that withholding tax may be charged on dividends paid by some non-US foreign companies even when held in an RRSP. These withholding taxes are not recoverable. Therefore, the conclusion that RRSP can be used as a vehicle to avoid withholding tax applies to US dividend payers only in this article.

If US stocks are held in a non-registered account then withholding tax is levied at a rate of 30% or 15% as discussed above. US dividends do not qualify for the dividend tax credit; therefore, an individual will pay tax on the full amount of the dividend at their marginal tax rate. However, in a non-registered account, the withholding tax can be partially or fully recovered through a foreign tax credit. The result for most Canadians is that US dividends in non-registered accounts will be taxed at a similar marginal tax rate to interest income.

When US stocks are held in a TFSA or RESP, the tax treatment varies. US withholding tax will be charged on dividends from US companies; however neither of these accounts qualify as a pension or retirement vehicle under the tax treaty exemption. Furthermore, because both accounts are tax-free accounts the foreign tax credit is not available. Therefore, the withholding tax is not recoverable when received in a TFSA or RESP.

What About Capital Gains?

Capital gains on shares of US public companies are treated in the same manner as capital gains on shares of Canadian companies. Therefore, the preferential 50% inclusion rate applies to capital gains on shares of US companies.

Impact On Returns

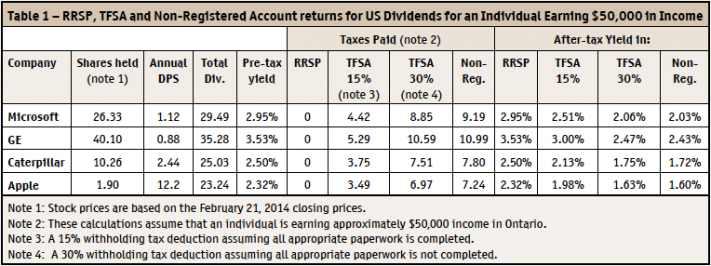

Table 1 provides a general overview of the after-tax dividends received for holding $1,000 worth of shares of various US stocks across the three investment vehicles. (Note that the RESP would result in the same as the TFSA.)

Table 1 reveals that the RRSP does lead to the highest after-tax dividend yield on US stocks, followed by the TFSA, and then the non-registered account for individuals with around $50,000 in income.

Table 1 also reveals that for individuals with $50,000 in income, the TFSA is superior to the non-registered accounts in terms of after-tax dividend yield. This is especially true for an individual with a 15% withholding tax rate.

Although withholding taxes is a complex area of taxation, and results can vary depending on an individual’s specific circumstances, the general conclusion that RRSPs are ideal for US dividend paying stocks is generally accepted by most financial advisors.

Income Level And The General Conclusion

The above table was based on the marginal tax rate for individuals with $50,000 in income in Ontario. However, the conclusion between the TFSA and Non-Registered Account can vary based on an individual’s marginal tax rate.

Table 2 below presents the taxes paid on US Dividends inside the TFSA versus non-registered accounts for various income levels.

Table 2 reveals that when U.S. Internal Revenue Service Form W-8BEN is completed, the TFSA outperforms the non-registered account for an individual of all income levels (assuming their income is over $12,000) in Ontario.

However, if an individual has a withholding tax rate of 30%, then the TFSA outperforms the non-registered account only for individuals with $43,953 or more of income in Ontario. The benefit of using the TFSA as opposed to the non-registered account becomes more significant for individuals with higher income levels.

| Table 2 – TFSA versus Non-Registered Account for US Dividend Stocks | |||||

| Income Level | TFSA 15% | TFSA 30% |

Non Registered Marginal Tax Rate |

||

| Approx. $12000 to $40120 | 15% | 30% |

20.05% |

||

|

over $40,120 up to $43,953 |

15% | 30% |

24.15% |

||

|

over $43,953 up to $70,651 |

15% | 30% |

31.15% |

||

|

over $70,651 up to $80,242 |

15% | 30% |

32.98% |

||

|

over $80,242 up to $83,237 |

15% | 30% |

35.39% |

||

|

over $83,237 up to $87,907 |

15% | 30% |

39.41% |

||

A Note On Investment Type

As discussed, withholding tax is very complicated. It is important to point out that certain securities will result in differing taxation. American Depository Receipts (ADRs), which trade on US Exchange and proxy for large foreign companies, are not protected by the tax treaty and may be subject to a withholding tax of up to 35%. In addition, Limited Partnerships are another investment that have implications that vary from the general conclusions in this article.

Summary And Conclusion

Many articles that discuss US withholding tax tend to focus only on the negative aspect of the TFSA (i.e., no recovery or credit for US withholding tax) and comment on the positive aspect of non-registered accounts (i.e., the foreign tax credit). This may give readers the appearance that US dividend paying stocks should not be held in a TFSA or RESP.

However, this article provides emphasis on the fact that when the appropriate forms are completed, the TFSA can still outperform the non-registered account even though the TFSA does not allow for any relief from the US withholding tax. This is especially true for individuals with higher income levels.

This conclusion is significant for individuals who would like to hold US stocks in more than just their RRSP and/or individuals who do not make use of RRSPs.

Camillo Lento, PhD, CPA, CA, CFE, Faculty of Business

Administration, Lakehead University, Thunder Bay, ON

(807) 343-8387, clento@lakeheadu.ca