Do Risky Assets Belong In A TFSA?

Do risky assets belong in a TFSA? This is a simple question with a complex answer. In order to explore this question we will consider an individual with $5,500 to invest in their TFSA for 2014. The individual has the following two investment options. The first option is a GIC paying a guaranteed 2% per year. The second choice is an ETF tracking the TSX with an expected return of return of 6%, with the possibility of returns ranging from -15% to 20%. The purpose of this article is to explore some of pros and cons of holding risky assets in a TFSA.

The Stream Of Future Returns

The GIC investment is the risk-free investment in that it will generate a 2% return with no variation. Therefore, after three years, the $5,500 investment will grow to $5,837, generating a tax-free return of $337 over the three-year period.

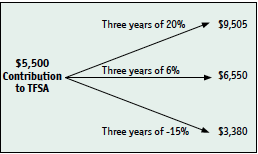

The ETF is the risky investment in that it is expected to generate a return of 6% but there is a degree of variance in the actual returns realized. For example, in any given year, the ETF could result in returns ranging from a loss of 15% to a gain of 20%; however, the most likely outcome in any given year is a 6% return. A summary of the most likely outcome and the two most extreme outcomes is presented in the figure below:

This figure reveals that the investment can grow to $9,505 after three years (returning $4,005) or decline to $3,380 (losing $2,120). The most likely scenario is that the investment could grow to $6,550 based on the expected 6% return, generating a return of $1,050.

The Risk-free Investment

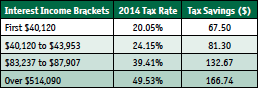

The GIC investment generates a risk-free return of $337 over the three-year period. The main benefits of holding this investment in the TFSA is that the individual will save taxes on the investment return. The table below shows the tax savings at various marginal tax rates in Ontario:

The Risky Investment

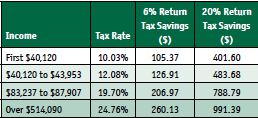

The risky investment has the potential to generate much larger returns, and therefore the TFSA can potentially save the investor a larger amount of tax. However, the ETF will generate capital gains returns (dividend income is ignored for simplicity) which are taxed more favourably than interest. The following table reveals the tax savings for the two positive return scenarios:

Even with the reduced tax rate on capital gains income (50% inclusion), the tax savings from the ETF exceed the tax savings from the GIC. The additional tax savings on the risky investment during periods of positive ETF returns are one of the main benefits of holding riskyinvestments in the TFSA.

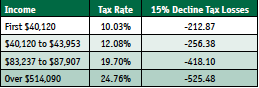

However, if the ETF generates negative returns, when the investor withdraws the funds from the ETF, there is no tax savings. Furthermore, the capital loss will not be deductible against other capital gains. Therefore, the TFSA will generate a loss of tax savings as follows:

The tax losses on not being able to uses the capital losses in the TFSA against capital gains outside of the TFSA is one of the main drawbacks of holding risky investments inside the TFSA.

Impact On Future Contribution Room

Aside from the tax savings (or loss) consideration, it isimportant to understand the impact of withdrawals on future contributions to the TFSA. Under the risk-free GIC investment option, if the investor withdraws the $5,837 from the TFSA, he/she can re-contribute the $5,837 starting in the next calendar year. The return of $337, along with the original investment of $5,500, can be reinvested.

Under the risky investment option, if the investor withdraws the $6,550 ($9,505), they can re-contribute this much larger amount in the future. This will lead to a larger amount of tax-free compounding in the TFSA relative to the risk-free asset. Therefore, another benefit of the risky investment is that it leads to more room for future compounding and re-contributions of withdrawals.

However, this benefit comes with a significant risk. If the TFSA generates a loss and the investor withdraws the $3,380, the investor can only re-contribute the $3,380 and not the original $5,500. In this case, the investor has essentially lost the re-contribution room of $2,120. This is a significant drawback of investing in risky assets in the TFSA.

Summary

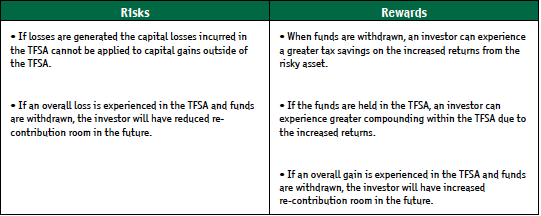

The following table summarizes the risks and rewards of holding risky investments in a TFSA:

Camillo Lento, PhD, CPA, CA, CFE, Faculty of Business Administration, Lakehead University, Thunder Bay, ON (807) 343-8387, clento@lakeheadu.ca