The Olympics of Investing

The Olympics have been at the top of many peoples mind as athletes from around the world congregate in Sochi to compete in events that they have been preparing their whole lives for. It is an exciting time that instils pride in ones country and an opportunity for the host country to showcase all of its accomplishments. It is also a period that requires a large amount of planning, as host countries need to be able to handle an influx of visitors who will for the most part all be concentrated in a relatively small geographic region. With this in mind, it would make some wonder if there is an investment opportunity related to countries that host Olympic events.

The Olympics have been at the top of many peoples mind as athletes from around the world congregate in Sochi to compete in events that they have been preparing their whole lives for. It is an exciting time that instils pride in ones country and an opportunity for the host country to showcase all of its accomplishments. It is also a period that requires a large amount of planning, as host countries need to be able to handle an influx of visitors who will for the most part all be concentrated in a relatively small geographic region. With this in mind, it would make some wonder if there is an investment opportunity related to countries that host Olympic events.

The investment case for allocating capital toward Olympic host countries around the time of the Olympics seems fairly straightforward. The areas generally will be required to upgrade or build brand new infrastructure, areas are modernized and made more appealing to tourists, stadiums are built and the host country gets a lot of ‘airtime’ on the world stage. Further, outsider countries often apply pressure on host countries to change or adjust certain policies that may be due for ‘updating’. All of these factors, in theory, should have economic benefits leading up to the Olympic event and following it. Things like an infrastructure build-out is an aspect that should help improve a countries quality of life while providing an opportunity for existing businesses to grow and new businesses to form. It seems pretty simple on paper but before investing in an idea it should be confirmed that there is some sort of relationship between the variables being examined.

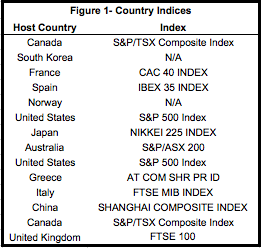

In order to confirm some sort of relationship, we will look at 12 of the past winter and summer Olympics. Starting with the Canadian winter Olympics in 1988, we have arbitrarily decided to look at monthly market returns for the host country for a period of 2 years prior to the Olympic event and 1 year after. We will also examine the aggregate three-year period. Figure 1 shows the host countries included along with the market index being used to measure the returns. The South Korean 1988 summer Olympics and 1994 winter Olympics in Norway have been excluded from the analysis due to insufficient market data. It was decided to look at returns 2 years before the Olympics in the hopes that economic benefits would be seen as the country in question ramps up activity in order to prepare for the event. Using data a year after the Olympic event was chosen due to the expectation that the benefits of the Olympics (infrastructure, tourism, reform, etc) would have a lingering effect, helping to boost returns the year after. While a longer time period could have been used, it seemed that any direct effect from an Olympic event would be lost amongst any one of the many macroeconomic factors that can affect a country from year to year.

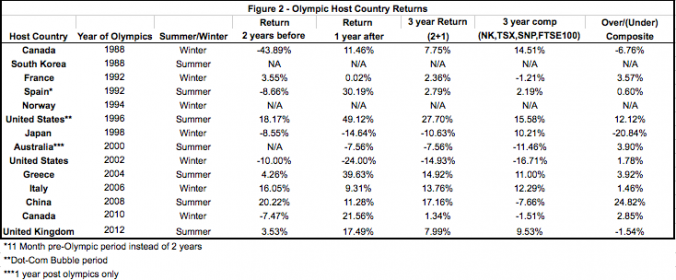

Figure 2 shows the market returns of host countries over a 2-year period before and 1-year period after the Olympics as well as the combined returns over a 3-year period. A ‘composite’ was also created which involves a 25% weight for the returns of the S&P 500, S&P/TSX, Nikkei 225 and FTSE 100 over the same periods. Admittedly, this is not a perfect benchmark for comparison purposes but should help to provide a point of reference in comparing the returns through the ‘Over/Under’ column.

Examining Figure 2 yields some interesting information. Of the 12 Olympic events included, 9 of them outperformed the ‘composite’ created (See Over/Under Column) and nearly all of the 9 outperformers’ yielded results that most investors would probably consider material. It is important to note that investing around the Olympics does not necessarily mean positive absolute returns but a case could be made for relative outperformance of world markets. While it is not apparent in the data, one would think a country that has a smaller geographic area and higher population concentration would benefit more than larger, less concentrated ones. The Olympics in Canada, for instance, are likely to have less of a countrywide effect than the same event being held in Greece, Italy or Spain. As an anecdotal example, let’s imagine a subway being built for an Olympic event in British Columbia and Greece. For Greece, a subway has potential to connect a whole country allowing people to work and travel nearly anywhere within the country. For the subway in B.C., only that province would have the potential to benefit, leaving the rest of the country no better or worse. So, at least logically, there could be substance to stronger returns from host countries that are smaller geographically.

With an understanding that a statistician could likely poke various holes in the above analysis (sample size, composite choice, correlation vs. causation, etc.), there may be some truth to the idea that Olympic host countries outperform world markets around their Olympic event. While there could be the greatest potential in concentrating on geographically smaller countries that host the Olympics, one should not blindly allocate capital based on the idea.

As always, an investors own due diligence and research is required before making any investment decisions. For inquiring minds, it could be interesting to drill down deeper into the host country markets and look at specific industries or companies involved in areas such as infrastructure, construction and tourism. One would expect to see these areas perform better than the general country index. Unfortunately this sort of data is difficult to obtain for an analysis. It seems that the Olympics may provide investors a chance to ‘bring home the gold’ alongside the Olympians but similar to what those competing understand, don’t expect to win without the proper patience, diligence and research before starting your own Olympic journey.

Ryan Modesto

5iResearch.ca