You Gotta Know When To Hold 'Em, And Know When To Fold 'Em

Kenny Rogers once sang “You got to know when to hold 'em, know when to fold 'em, know when to walk away and know when to run.”

Kenny Rogers once sang “You got to know when to hold 'em, know when to fold 'em, know when to walk away and know when to run.”

The hardest question I’m asked on BNN and at my speaking engagements is “How do you know when to sell?” The answer is hard to give because of the many different circumstances that might merit selling a position. Stocks tend to fall much quicker than when they are climbing in an uptrend. The Wall Street adage “Stocks take the stairs up, and the elevator down” illustrates this tendency to decline at a faster pace than they ascend.

Here’s how ValueTrend utilizes a sell discipline to limit risk. Below, I use specific examples that were triggered in the ValueTrend Equity Model to illustrate six scenarios.

Situation #1:

Selling When The Trend Changes

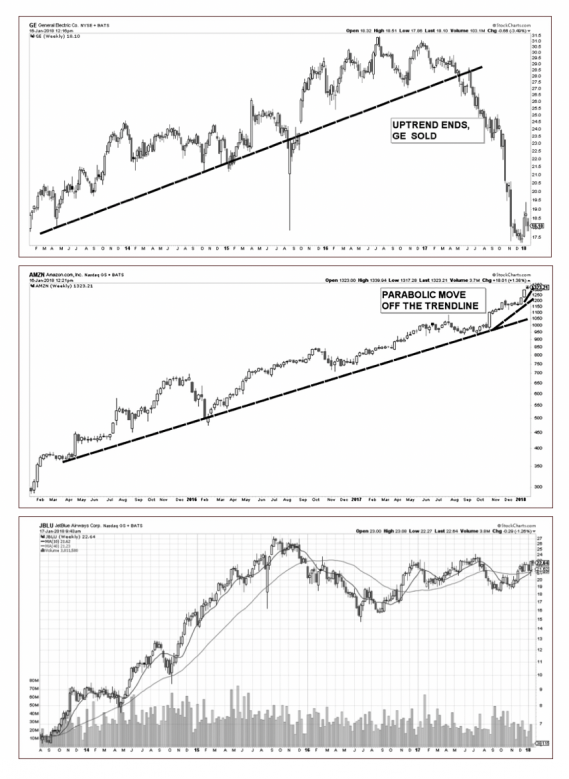

The ideal scenario to sell a stock is when we can identify the end of a trend. There are often signs that a trend has changed from “up” to “down” on a stock, sector or even the broader market. As a stock or sector moves from a series of higher highs and higher lows to lower highs and lows, we will sell that position. We look for a few confirmations of this trend change before acting – lest we experience a “whipsaw” and watch the stock rally right back up again. For example, in addition to a lower low, we look to see if the 200-day moving average has been penetrated by the stock price. Good recent examples of selling into a trend reversal are our exits from General Electric, Johnson Controls and AltaGas.

Situation #2:

Reducing Exposure To An Overbought Market Despite A Rising Trend

Sometimes the market, or individual stocks become overbought. Despite their uptrends, they illustrate a parabolic (rapidly rising) price pattern that suggests a significant potential for a rapid decline. Recently, the extreme advances of the FANG (Facebook, Amazon, Netflix and Google (now Alphabet) & technology stocks inspired us to reduce our exposure to the sector from three stocks to one stock (Microsoft). In hindsight, the two stocks we sold (AMZN and GOOGL) went higher after we sold. Despite that move, it was the prudent thing to do. Historically, Investors have lost more money by sharp reversals in technology and biotechnology stocks than in any other sectors. Think of the 2001 tech bubble. Stocks like Nortel or even high quality stocks like Intel or Motorola rapidly imploded. Think of the implosion by Valeant pharmaceuticals and the entire biotech index in 2015. We felt our exposure was too high to this risky group of stocks that was (and is) aggressively overbought.

Situation #3:

Selling To Reduce Exposure

The ValueTrend system dictates a price position between 2% to 7% per stock, and a maximum position of 10% in an index or sector ETF. It is rare to see us hold 7% of our models in one stock. In fact, we typically peel back (sell) some of a stock if it has risen enough to reach 7%. MasterCard is a recent example of a stock that started at a 5% weighting. It outperformed in such a rapid manner that it began to approach our 7% ceiling. We sold enough to bring the stock back to 5%. Another example of selling to reduce exposure was our decision to sell about half of our U.S. stock holdings in the spring of 2017. While our remaining U.S. stocks were negatively affected by the rise of the loonie, our exposure to this currency drawdown was reduced.

Situation #4:

Greener Grass

There may be nothing wrong with a stock. We may simply foresee less upside going forward on than we have experienced until now. Sometimes we will continue to hold a high dividend stock in the Income Model but sell it in the Equity Model. We’d rather put the capital to work in higher growth stocks within the Equity Model, or hold the cash if markets appear risky. Good examples of sold stocks that looked less growth orientated than the Equity Model demands include past sells of CP Rail, and JetBlue. These are good companies that we made a bit of money on—and we would indeed re-enter the positions within the Equity Model should their growth outlook improve. The chart of JetBlue below illustrates a wandering sideways pattern that has offered little capital gains to investors.

Situation #5:

Cyclical Or Trading Range Patterns

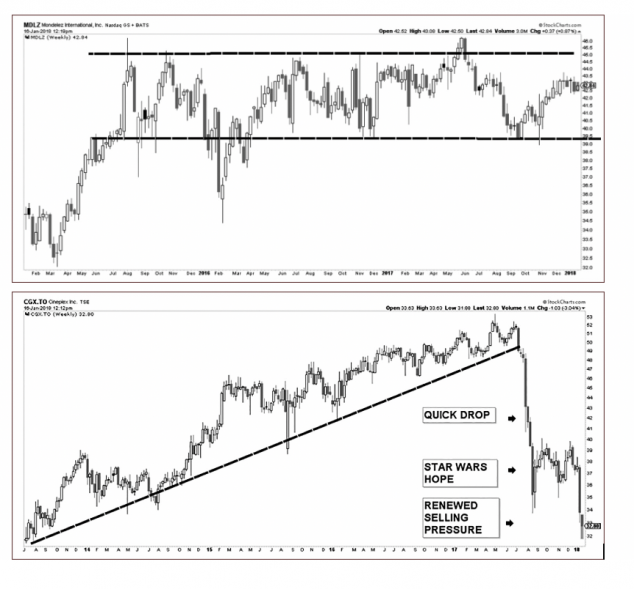

Sometimes we buy stocks or sector ETF’s that trade in a range. For example, BCE has recently been moving between $57 to $62, and we have traded it twice within that range (bought near the bottom, sold near the top). Take note that we have not reentered BCE lately despite its move to the bottom of its trading channel. We are less convinced of its ability to move quickly back to the $62 top given the challenges all telecoms will face in a rising rate environment. Mondelez is another stock that seems to be stuck in a range. It’s been floating between $40 – $46 since 2015. We owned it and recently sold it as it moved above $46. We would consider rebuying it if it reaches the bottom of its trading range — again around $40.

Sometimes, seasonal tendencies tend to dictate that certain sectors do better at one point of the year than others. For example, consumer staples tend to be stronger over the summer months. Consumer discretionary stocks tend to be stronger during the winter. While this rotation in strength isn’t always the case, it happens often enough to inspire us to seasonally trade the respective sector ETF’s that represent those sectors. Same goes with energy stocks, which tend to have their greatest strength from early in the New Year until the spring.

Scenario # 6:

Yikes away!

There are times where a company will issue a surprise financial report or negative news of some sort. Traders react quickly and aggressively to dump the stock, which in turn causes a landslide stock price movement. A recent example of this is Cineplex – a stock where we had initiated a smaller 3% position in the ValueTrend Equity Model. The company announced lower-than-expected earnings and guidance in the late summer, and traders punished the stock by marking the share price down by 20% within a few days, breaking well below technical support. After such a selloff, one has to decide whether the market has over reacted and an oversold rebound is likely – or if it is best just to sell with the crowd. In such situations, there are no hard and fast rules. In Cineplex’s case, we held out with the expectation that the winter’s movie lineup (including the new Star Wars, and others) might rally the stock. This has not taken place in the manner we anticipated. The company continues to be a well-run business however, the stock is trading with significant skepticism surrounding future box office revenue. By the time you read this, we won’t have a position in the stock.

Keith Richards, Portfolio Manager, can be contacted at krichards@valuetrend.ca.

Keith Richards may hold positions in the securities mentioned. Worldsource Securities Inc., sponsoring investment dealer of Keith Richards and member of the Canadian Investor Protection Fund and of the Investment Industry Regulatory Organization of Canada. The information provided is general in nature and does not represent investment, accounting, or tax advice. It is subject to change without notice and is based on the perspectives and opinions of the writer only and not necessarily those of Worldsource Securities Inc. It may also contain projections or other “forward-looking statements.” There is significant risk that forward-looking statements will not prove to be accurate and actual results, performance, or achievements could differ materially from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements and you will not unduly rely on such forward-looking statements. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. As we are not engaged in rendering tax or accounting services please consult an appropriate professional regarding your particular circumstances before acting on any of the above.