The Three Classes Of Indicators

Investors normally use one or two classes of indicators when they are analyzing the markets. These groups of gauges are fundamentals and technicals. However, there is a third group that is also important for investors to remember, and that is economics.

Investors normally use one or two classes of indicators when they are analyzing the markets. These groups of gauges are fundamentals and technicals. However, there is a third group that is also important for investors to remember, and that is economics.

The sensitivity of these classes of indicators to the markets is a key consideration as they tend to forecast or provide information about the markets on different time frames.

Technicals (price action) is the most sensitive to market swings as it plots equity movements in the present time. Technicals are usually the preferred tool for active investors or traders.

Fundamentals are the most recognized and widely used tool for uncovering or predicting value within a stock. There is often a time lag from posted earnings to investor reactions. Economics (i.e. GDP, Yield curve, Unemployment rate, Inflation, etc.) is an element that few private investors review or take into account when making investment decisions. This subset is the least time sensitive, compared to technicals and fundamentals and can be very contradictory. For example, economic elements can be at historically high levels for months or even years without a market correction. Or one economic indicator will point toward one direction (say, unemployment is down) and another will indicate the opposite (low unemployment creates a potential labour shortage).

Nevertheless, all three classes have a place in the retail investor’s toolbox. The key is how to use them effectively.

For more active investors, a stronger leaning toward technical analysis is suggested. This method of analysis leads itself perfectly to an individual with a one to two year investment hold time frame. It is also the most sensitive to any changes in data to the security and can adapt easily adapt to a trader’s own style.

Fundamental analysis is well suited for a mid-to-long term investor. They will highlight changes to a company’s finances.

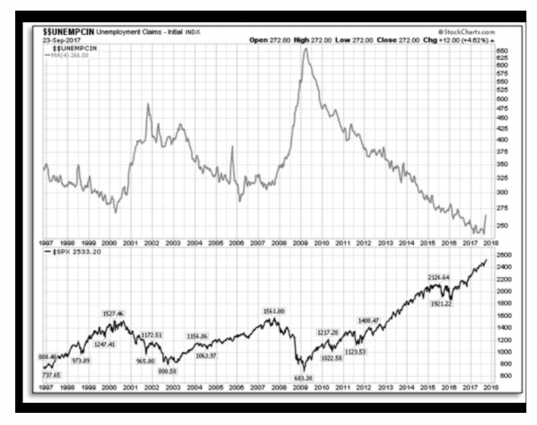

Economic indicators are just another layer of valuable data and can provide clues about changes in the economy that can affect the stock market which in turn, can change the fundamentals of a company. For example, if the US Unemployment rate starts to rise, month over month, this is a negative sign for the S&P 500. It indicates the economy is no longer growing. The stock market has an inverse trading pattern to the US Unemployment rate. As the stock market starts to rollover, companies are usually quick to reduce their overhead costs and keep their stock afloat. Laying off employees is the fastest way to achieve this goal.

Another way to employ economics is to use the consumer. Spending from this group represent the largest component of US GDP and one of the largest piece in Canadian GDP. When this important group feels optimistic, they buy more discretionary items. When they are concerned about the economy they purchase more staples. Consumer buying is a leading indicator to the stock market.

Bottom line: There are three basic methods or tools for stock analysis. Fundamental analysis is by far the most common. Technical analysis is used primarily for trading. Economics is an area that most investors don’t employ, perhaps because of its complex nature or because they don’t feel this area of finance has an impact on stocks. But it does. A great free source for economic data is on the website: www.tradingeconomics.com

Donald W. Dony, FCSI, MFTA. Analyst, past instructor for the Canadian securities institute (CSI), editor for the www.technicalspeculator.com, dwdony@shaw.ca, 250-479-9463