Racing To Your Financial Destination... Active Versus Passive

In the pursuit of our financial destinations, we certainly want to get there as soon as possible and at the lowest cost. But do we want to take excessive risks? Do we want to preserve the assets we have accumulated? Are we looking for a smooth ride?

In the pursuit of our financial destinations, we certainly want to get there as soon as possible and at the lowest cost. But do we want to take excessive risks? Do we want to preserve the assets we have accumulated? Are we looking for a smooth ride?

Passive Investments

In today’s world, investors have two distinctly different paths to pursue their financial destinations. There is the traditional active management in which investors rely on professional investment managers to make the critical investment decisions. A new, very popular alternative is passive investments.

Passive investments try to mirror the returns of market indices. These indices include the very popular market results such as the Dow Jones, S&P, NYSE and TSE. These are only a few of the many indices that are used by passive investments. Mirroring these indices means that investors in passive funds earn as much and lose as much as the index does.

The Spin

The boom in popularity of passive investments is in part due to the misleading claim that passive investing encompasses the entire market while traditional active investments are selective and consist only of picking stocks. In fact, active investments offer a wide array of services that guide investors and limit their losses.

This misleading claim is further amplified by the statistics that show passive investments produce higher returns at lower costs than the active counterparts.

With these misleading claims as the foundation, the statistics distort the reality of both the active and passive investments.

The Truth

The foundation begins to crumble with the recognition that indexes used for passive investments are unregulated and can cover as little or as much of the market as the index creator chooses. In other words, index creators are stock pickers. There are over 1,000 indices in existence today so the selection of an unregulated index is an enormous risk.

Limiting active investments to stock picking is disingenuous. This definition of an active investment ignores the core values that attract investors in the first place. These include professional management committed to meeting investors’ goals, preserving investors’ assets during tumultuous markets, managing risks and in some cases providing guarantees.

The statistics of returns and costs take on entirely different meanings in the light of these facts.

Returns are naturally going to be higher with passive investments since the only goal is to mirror an index and no action is taken to preserve assets or to limit risks or to offer any guarantees. The cost of active management is necessarily higher since they oversee the investments instead of simply copying what an index creator has done.

The Costs

There are two critical issues to be considered when faced with the choice of relying on active versus passive investments. What is the cost? And is that cost worth the benefits derived?

Costs take two forms. Expenses that are deducted from investments and lower returns resulting from using more conservative securities.

In the United States, equity fund expenses for passive investments average .11% compared to .84% for active investments. In real dollar terms, that means that an investor with $150,000 would pay $165 annually for a passive investment and $1,260 for active, a difference of $1,095 per year.

The more conservative investing of active management also lowers the returns. Although estimates differ wildly, most are in the range of .55% to .25% annually. Using a mid-point of .40%, we add another $600 to cost for the $150,000 investor for a total annual cost of $1,695.

The second issue is whether the benefits of active investing is worth $1,695 or more if investments are greater than $150,000. There is an economic and an intangible answer and each investor needs to decide on their personal priorities.

The Economics

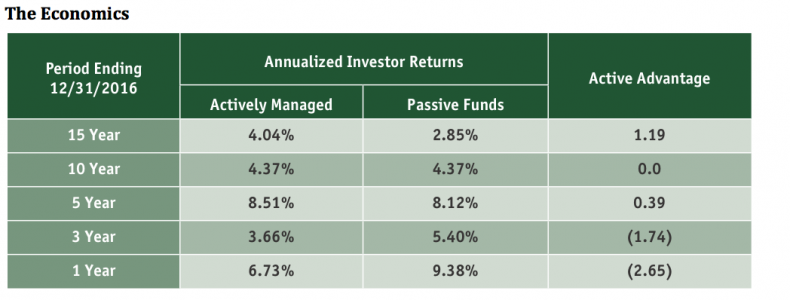

The economic answer actually depends on the time period being considered. Looking back over the last 10 or 15 years, DALBAR found that the costs were worth the benefits. For shorter time periods the cost of active was not worth it.

The reason for this short-term advantage for passive investing but long term disadvantage is the actions of investors! Investors in passive funds tend to panic sooner and more often make the mistake of withdrawing during market declines. The security of the active investment is the suggested cause for the improved retention.

The economics show that short-term investors may do better with passive investments but active investments put long-term investors ahead.

The Intangibles

The rationale for the cost of active versus passive investments includes the investor’s willingness and ability to make prudent investment decisions, take risks and perform the necessary monitoring. In the absence of such willingness or ability, the investor must either find a professional to take on these responsibilities and pay the cost or suffer the consequences of poor decisions and excessive risk.

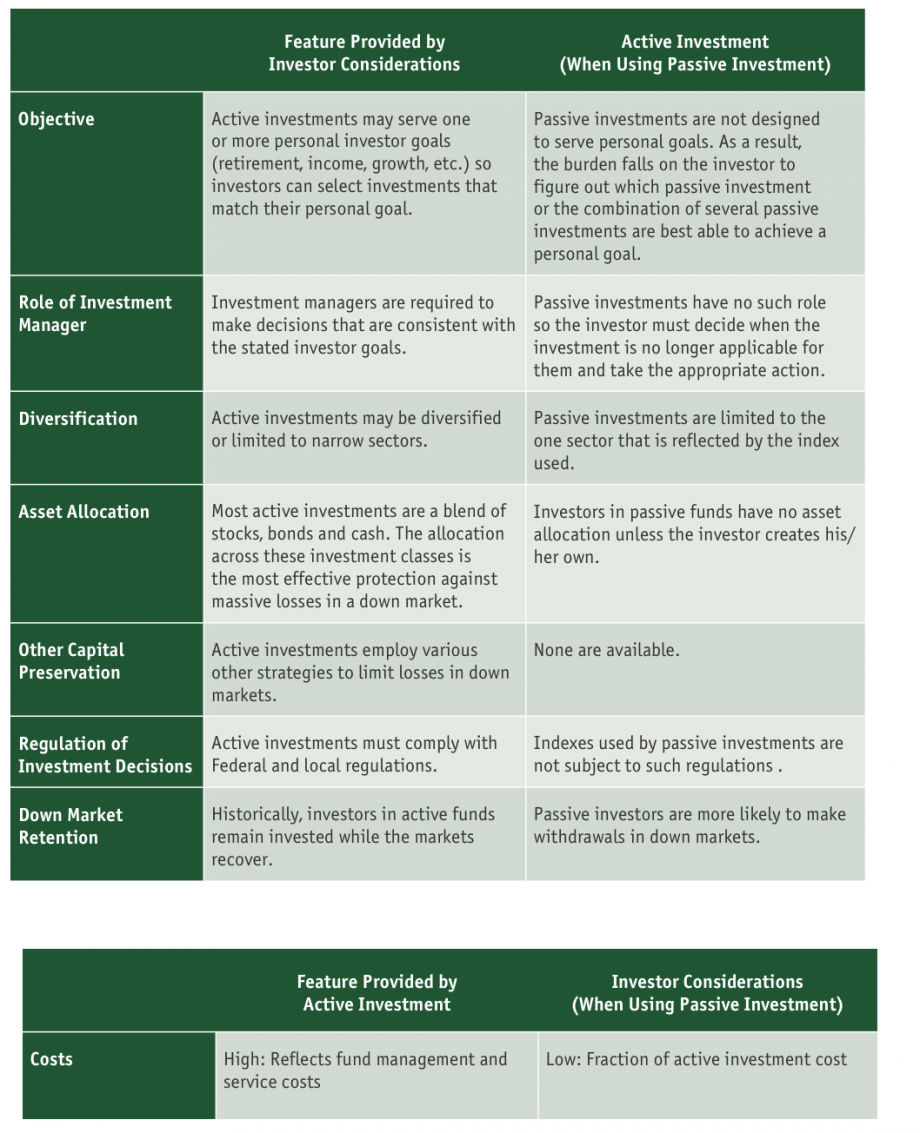

The checklist on the following page reflects the factors that a typical investor should consider when replacing an active investment with a passive one.

As this analysis shows, there a number of factors to be considered in choosing between an active and passive investment. The single issue investor (“all I care about is the return”) is advised to take careful note of the fact that past returns are no reflection of future results and that important services and protections may outweigh the cost savings if these features are discarded.

Louis S. Harvey, President & CEO, Founder and leader of DALBAR. Lou Harvey is relentless in the search for the forces that are shaping the world of financial services today, tomorrow and for years hence. Using DALBAR’s research capabilities, Lou Harvey seeks insights from inside and outside the industry to understand and anticipate changes in customers’ needs and the ways products are distributed.