Is It Time To Buy Commodities?

If you’ve been following financial markets, you know that commodities have suffered very steep declines since last year. Oil, which traded at $105 (U.S.) a barrel in June 2014, now trades around the $40 mark. Copper is hovering just above $2 per pound, down over 50% from its peak in 2011. These are just two examples: almost without exception, prices for commodities have collapsed.

If you’ve been following financial markets, you know that commodities have suffered very steep declines since last year. Oil, which traded at $105 (U.S.) a barrel in June 2014, now trades around the $40 mark. Copper is hovering just above $2 per pound, down over 50% from its peak in 2011. These are just two examples: almost without exception, prices for commodities have collapsed.

Perhaps not surprisingly, many commentators are putting on their contrarian hats and suggesting that now is a good time to start buying beaten-up commodities. So, is this a good idea? Before I give my answer to this question, I think it’s worthwhile to go back in time and provide some perspective on how we got to where we are.

I think the story begins around 1998-2000. At this stage, commodities had been in a long bear market (oil was $10) and started a bull market based primarily on two factors: underinvestment in new supply due to low prices, and strong demand, notably from resource-intensive growth in the Chinese economy.

Then around 2004-2005 or so, Wall Street became enamoured with commodities and entered the fray. Everyone from pension funds to hedge funds and investment banks started buying commodities in order to profit from the bull market.

Much of the rationale for these bets was the presumed ascendancy of emerging markets and a belief that they had an insatiable appetite for raw materials. This, coupled with widespread conviction that supplies for many commodities were seriously constrained (think peak oil), caused prices for energy, metal and agricultural resources to soar. A declining U.S. dollar, as the U.S. mortgage market started faltering, added another boost as investors sought a safe haven. By July of 2008, commodity prices had gone parabolic, with oil touching $147.

And then it all came unglued: the financial crisis and great recession led to an implosion in resource prices. In early 2009, oil was under $40 and it seemed like the great commodity bubble was over for good.

And then it all came unglued: the financial crisis and great recession led to an implosion in resource prices. In early 2009, oil was under $40 and it seemed like the great commodity bubble was over for good.

In hindsight, it had merely taken a sharp and dramatic pause. All the rescue efforts by governments and central banks reignited the resources mania. Investors feared high rates of inflation as a result of the Federal Reserve’s quantitative easing and thus bought commodities as a hedge. Prices soared anew, peaking in 2011.

Why have prices fallen? For one thing, the inflation that investors sought refuge from never appeared. This has caused some investors to abandon commodities. In addition, high prices encouraged the supply of commodities to expand. The rapid increase of U.S. oil production exemplifies this trend, but it’s also apparent in many other raw materials markets. Another factor weighing on prices is the marked slowdown of the Chinese economy. In part, China’s deceleration has resulted in a real reduction in demand, but it’s also spurred speculators to sell commodities. Finally, the U.S. dollar has been on a tear against rival currencies, which has further pressured prices.

With commodities having crashed, many investors are probably wondering if this is a tremendous buying opportunity. I would advise caution in this regard. There will of course be rallies, but for investors with a longer term time horizon, I think a sustainable commodity bottom is years off.

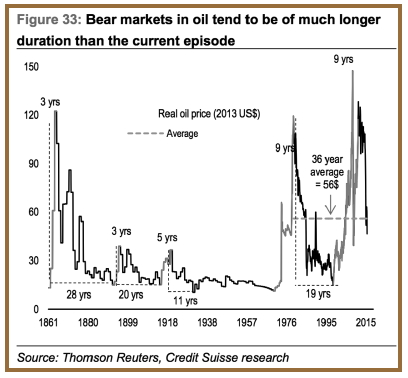

Part of my caution is due to the nature of commodity price cycles. Generally speaking, bull markets in commodities tend to be shorter than the bear markets that follow. For example, Credit Suisse recently published the following chart illustrating this phenomenon in oil. As you can see, real oil prices (i.e. adjusted for inflation) tend to have brief, sharp upswings after which prolonged periods of low prices ensue. I would add that a good case can be made that we are really only a year and a half into oil’s bear phase, given that prices were still in the triple digits last June.

A second reason for my reluctance to call a bottom in commodities is the state of the Chinese economy. While I believe China’s actual consumption of raw materials has been overstated in recent times, there is no doubt that its real estate and industrial sectors do consume a significant share of the world’s resources. China is slowing, likely more than its government admits, and the country is beset with massive unprofitable overcapacity in many sectors. Further, there has been a rapid expansion in both corporate and local government debt since the financial crisis. Taken together, China’s economy should continue to falter, with negative implications for commodity demand.

Third, across many different commodity markets, low prices have not yet triggered a meaningful reduction in supply. Until this happens, the world will be awash with heightened inventories of raw materials.

There’s one final reason to believe we haven’t seen the lows in commodity prices. As I’ve discussed, investors became enchanted with commodities in the last decade. In essence, resources became just another asset to own, much like stocks or bonds. Numerous exchange traded funds were created that allowed retail investors to get in on the game alongside the largest financial players in the world.

Undoubtedly, many investors have reduced or eliminated their commodity holdings. Some have gone short. Nevertheless, speculators are still long (i.e. bullish) over 200 million barrels of crude oil futures on the New York Mercantile Exchange. To my mind, this sort of bullishness is not what we will see when prices have truly bottomed out. Rather, we need the kind of utter capitulation where virtually no one wants to own commodities. That should be a telltale sign that the market is ready for its next bull market.

My concern isn’t simply that financial players are still exposed in the paper futures market. As I’ve mentioned in previous articles, some traders and investors now buy and store physical commodities. You can probably chalk some of this activity up to pure speculation, and in part to attempts to create artificial shortages of some commodities.

Along these lines, Dow Jones Newswires reported in 2008 that hedge funds and others were storing as much as 800,000 tonnes of copper in Chinese warehouses in a bid to create the illusion of a tight market. More recently, The Wall Street Journal reported in late 2013 that banks, hedge funds and commodity traders owned tens of millions of tonnes of base metals that were being stored in warehouses around the world.

Before commodities have bottomed, I expect much of these excess inventories held by investors to be liquidated, thereby pressuring prices even lower. The fact that this does not seem to have occurred yet makes me very wary of calling an end to the current malaise in resources.

There will be opportunities for nimble traders to make money-buying commodities for short periods of time before prices reach their ultimate low. Moreover, it’s always possible for some individual commodities to rise even though most are stagnant or falling. But for investors looking to buy the sector at the bottom, I think that time is still a ways off.

There’s an adage in markets that you shouldn’t try to catch a falling knife. When it comes to commodities, I think the knife has yet to hit the floor.

Andrew Hepburn is a freelance writer in Toronto. He specializes in economic and financial issues and a former Research Associate with Sprott Asset Management in Toronto focusing on commodity markets. He is a graduate of Queen's University ahepburn20@hotmail.com