Blindly Heading Towards The Brink

It’s been two years since my last column.1 In that time, there have been some dramatic developments—the plunge in oil prices and the Greek crisis come to mind. We’ll discuss both as illustrations of the concept of market blindness, something that sometimes markets get things badly wrong. Then we’ll move from that to see how market blindness will lead to an imminent reckoning in the Canadian real estate market (and consequently the stock market).

It’s been two years since my last column.1 In that time, there have been some dramatic developments—the plunge in oil prices and the Greek crisis come to mind. We’ll discuss both as illustrations of the concept of market blindness, something that sometimes markets get things badly wrong. Then we’ll move from that to see how market blindness will lead to an imminent reckoning in the Canadian real estate market (and consequently the stock market).

The halving of oil prices is not surprising. The spectre of peak oil (the idea that we will run out of the black stuff ) has turned out to be a false bogeyman. With shale oil extraction, the rise of renewables and greater energy conservation, oil is fundamentally a US$30-$40/barrel commodity, something we mentioned some years ago. The only wildcard in oil prices is geopolitical shocks. A terrorist attack on Saudi Arabian refineries, for example, would send the price shooting back up to US$120/barrel and above.

What is surprising about the drop in oil prices is how long it took for the market to recognize that, absent an upsurge in violence in the Middle East, $120/barrel was not sustainable. In 2013, the International Energy Agency (IEA) released a study predicting the U.S. would become the world’s largest oil producer and would become energy self-sufficient. The story was quietly ignored by the markets. U.S. oil inventories subsequently grew from 320 million barrels in December 2011 to 420 million barrels three years later. It was only when Saudi Arabia declared it would fight for its share of the pie that the oil market suddenly woke up to reality: all hell broke loose and prices swooned to under $50/barrel.

The Greek crisis is another example of market blindness. Greece is a classic case of what we called a “lobster trap economy”, a dire situation where a government’s remedialmeasures makes things worse rather than better. We last wrote about Greece’s predicament in October 2010 and we talked about the likelihood of another crisis within five years. Here we are five years later and as predicted Greece has lit up the headlines once again. The strange part in the tale though is that in 2013 and 2014, Greek bond yields were down to single digits: 5-year bond yields were paying 5%. This, despite the fact that most observers knew that Greece would not be able to make good on its interest payments to the IMF. When the witching hour arrived this past summer, those same 5-year bond yields soared to 30%, a level that reflected the real and continuing threat of Greek default.

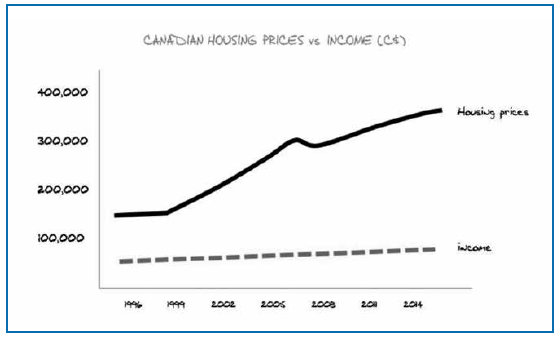

Here in Canada, we have our own case of market blindness: our grossly inflated real estate market. With few exceptions (which we’ll come to soon), most observers believe that real estate prices are either overvalued or in bubble territory. An article in The Globe and Mail in April2 cited Deutsche Bank’s assessment that our housing prices are 60% too high. The Economist has given Canada’s real estate market the dubious honour of being among the world’s most overvalued. Yet the market continues to stubbornly cling to its illusions.

The numbers are easy to grasp. Since 2000, average house prices have risen 150%. How much have incomes grown since then? If you were making $50,000 in 2000, are you making $125,000 now? And the average price level doesn’t even reflect the insanity going on in Toronto and Vancouver. In Toronto, the average home price is $639,0003. To afford it4 you would need an annual income of about $145,000. In Vancouver, the average home price is now $922,000 which would require a homebuyer to have an annual income of $210,000. What’s the average family income in Canada? $77,000.

I’ve been expecting the real estate bubble to pop for a while but it hasn’t. Prices have kept going up. To somethis would seem to be good news, but it isn’t. Higher prices mean more people with bigger mortgages. When the good times end, they will be trying to swim in rough seas weighed down by an anchor of debt. Recall from our "Lessons from the Super Bubbles" article series that the key predictor of how severe an economic downturn is how much debt is in the system. The bad news is that Canadian consumer debt levels are in dangerous territory, at over 160% of personal disposal income. This is higher than the level in the U.S. just before its disastrous housing market collapse. Although Canadian banks have maintained better control of its lending practices (compared to the sub-prime fiasco in the U.S.) this isn’t enough to save us. In a full blown recession, unemployment doubles, and a homeowner without a job won’t be able to make their mortgage payments.

But maybe I’m off base. I mentioned that not all observers agree we’re in the middle of a bubble. Who are the dissenters? The most prominent is Bank of Canada governor Stephen Poloz, who said this April: “We don’t believe we’re in a bubble.” This was a strange claim to make given that the Bank of Canada itself had released a study last December saying that housing was up to 30% overvalued.

Perhaps Poloz’s opinion would carry more weight if it weren’t for an uncomfortable fact: during the U.S. housing bubble, Poloz’ fellow central banker, Alan Greenspan, Chairman of the Federal Reserve, didn’t see any hint of an impending housing crisis. Neither did his successor Ben Bernanke. But at least you could argue that they had no direct historical experience to inform their statements. Poloz has no such excuse.

The needle’s been in the red zone for a while now. The pressure’s been building and when the blow-up comes, the damage will be horrible. The trouble of course is the timing. In the past few years I’ve been reducing my exposure to the stock market in anticipation of a serious downdraft. In 2010, when the TSX was at 12,000, I said the upside for the market was limited. What happened instead was that the index kept going up and it hit 15,500 last year. Does this bother me? No. Profits are very nice, but I’d rather forego them than expose myself to higher levels of risk. When markets decline, you need to have cash if you want to bargain hunt.

I’ll be a bit more comfortable buying stocks when the index is back down to 10,000. I’d be enthusiastic if it sinks to 5000.

Stock Market Buys and Sells

There is one sector that I consider an exception to an overpriced and vulnerable stock market: gold miners. I recommended some a few years ago, I thought they were cheap then but they are very cheap now.

The Market Vectors Junior Gold ETF (GDXJ) is at a record low of US$19.49 and is a good vehicle for exposure to the sector. Some junior miners with low debt are also worth taking a look at: Alamos Gold (AGI, $3.32), Alacer Gold Corp (ALIAF, $2.00) and Eldorado Gold (EGO, $3.30). Then there’s IAMGold (IMG, C$1.81) selling for a price-to-book of 0.20 at an almost two-decade low. All prices are as of market close, July 24.

The reasons for having some exposure to gold are numerous. It is a bulwark against the chaos which would arise from a Eurozone breakup. (For the record I see roughly a 60% chance of this happening within ten years). It is insurance in the case of a crisis of confidence as central bankers continue to print money, and governments keep running unsustainable deficits. It is an effective hedge against both deflationary and inflationary spirals. It anticipates the actions of the huge number of newly middle-class investors in China when faced with the uncertainty of markets that are not transparent.

Here in rising order of risk and reward (from lowest to highest) are the available gold investment vehicles: gold bullion ETFs (e.g. iShares Gold Bullion ETF), global gold mining ETFs (e.g. iShares Global Gold Index), junior gold mining ETFs (e.g. the Market Vectors ETF above), senior gold mining stocks(e.g. Goldcorp) and finally junior gold mining stocks (see list above).

On the other hand there are some companies that I think are particularly vulnerable and I would stay away from, starting with the banks. Their dividends are certainly attractive, but banks are like tea bags—you don’t know what they are like until they’re in hot water. Canada has never had a housing bubble of this magnitude. It would be nice if they’ve learned from the experience of our southern neighbours, but human nature being what it is, I’m not that confident. A few years ago, the banks were lining up to give out thirty-five- and forty-year mortgages—a testament to greed over prudence. They’ve been canny enough to offload some of the mortgage risk onto the CMHC (i.e. you and me) but a sizeable portionof consumer loans remain on their books. How strong will

the banks be when the storm breaks? I don’t know but I prefer to learn the answer from a safe distance.

Another sector that’s ripe for a fall is biotech. Over the past year some biotech companies have brought back memories of the dot-com bubble. Valeant Pharmaceuticals (VRX, C$326.70) is Canada’s entry in this dubious pantheon. It sports a P/E ratio of 97, a market capitalization of $111 billion. High P/E’s and high market caps are usually danger signs. Why? Large companies, with very few exceptions cannot sustain high growth rates. The company has been on a tear, but its business model is one that is heavily driven by debt-fuelled acquisitions. It owes US$30 billion. (Ironicallythey bought Bausch and Lomb, the eyecare specialist, a company which we recommended way back in 2006.)

As always, you should consider what I say in these columns through your own personal financial perspective. Everyone has different objectives, risk tolerances and timeframes. My main objective is to make you aware of risks that perhaps you hadn’t considered. And to have you think about downside scenarios so that you aren’t caught off-guard. “Plans are useless”, Dwight Eisenhower once said, “but planning is essential.”

WynnQuon is Chief Investment Analyst at Legado Associates (www.legadoassociates.com). I welcome your comments at wynn_quon@hotmail.com

1 I’ve been busy with some personal interests; writing and doing volunteer work on the Board of a community health centre. Finding the right balance of time is an ongoing challenge. Time management and financial management are tied together in interesting ways. Perhaps a subject for a future article.

2Globe and Mail, April 29, 2015. p. A10.

3 http://crea.ca/content/national-average-price-map gives average prices for provinces and cities across Canada

4 Assuming a 10% downpayment, 3% 25 year mortgage, 1% for annual property taxes and $500/mon for utilities, maintenance and other expenses. See http://m.mortgageweb.ca/adrianwilliams/calcs/ purchase_financing/ for the nifty calculator. See http://www.statcan. gc.ca/tables-tableaux/sum-som/l01/cst01/famil108a-eng.html for median family incomes.