Where Are the Bubbles In Today’s Markets?

We seem to live in an era of financial bubbles. In the last 15 years, the world has experienced, among other episodes, a massive run-up in technology stocks (think Nortel), a huge increase in the value of U.S. residential real estate, and two epic spikes in the price of crude oil. In every case, devastating crashes followed these remarkable booms.

We seem to live in an era of financial bubbles. In the last 15 years, the world has experienced, among other episodes, a massive run-up in technology stocks (think Nortel), a huge increase in the value of U.S. residential real estate, and two epic spikes in the price of crude oil. In every case, devastating crashes followed these remarkable booms.

What, exactly, are bubbles? There isn’t one definition, but generally speaking they are instances where the price of an asset rises significantly above what can be justified by its actual value. Bubbles are characterized by large amounts of speculative buying as people attempt to profit from a seemingly never-ending climb. This drives the price of the asset ever higher. At some point, every bubble peaks. Fear sets in among those left holding the bag and panic selling often ensues. The boom turns to bust.

From this (admittedly brief) description of bubbles, two things should be clear: a lot of money is made while a bubble inflates, and a lot of money is lost when it ends. For nimble traders, buying into a nascent bubble may prove to be a profitable strategy, so long as you can sell before the crash.

Yet for long-term investors, the more crucial imperative is not getting accidentally trapped in a bubble. By ‘accidentally’, I mean buying something you believe is a sound investment, only to find out later it was mostly hot air. Nothing is more hazardous to long-term capital growth than seeing a part of your portfolio decimated. Imagine owning U.S. bank stocks at the height of the American housing bubble, or oil sands companies here in Canada before crude prices collapsed.

With all this in mind, what stocks and sectors look bubbly these days?

Perhaps the most important one for readers of this magazine is Canadian housing. This probably won’t come as a huge shock. After all, warnings about a housing bubble in Canada have been sounded repeatedly for the last number of years by a variety of experts. Through it all, prices have continued their ascent, which may convince some people that there never will be a crash.

This is wishful thinking. On a nationwide basis, house prices in Canada are now approximately five times household income, versus a historical range of 2.5-3 times. Just to return to the long term average would require a drop of 40-50%. This suggests that house prices are severely overvalued. Of course, being a national figure, it doesn’t account for regional disparities. So, for example, Vancouver house prices have risen spectacularly, whereas values in Windsor have only risen modestly. (Naturally, I’m not saying everyone should sell his or her house. Houses are more than assets, and so long as you aren’t over-leveraged to real estate, you may be able to withstand a crash).

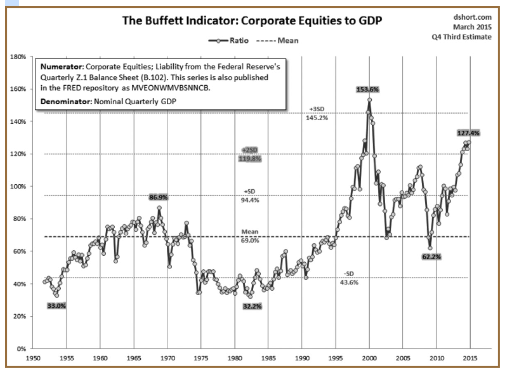

Putting real estate aside, what about potential bubbles in the stock market? Increasingly, I think investors should be wary of valuations for U.S. equities. One such measure (reported to be Warren Buffet’s favourite) looks at the total value of stocks relative to the size of the economy (i.e. the market capitalization to Gross Domestic Product ratio). According to U.S. fund manager Doug Short, as of March, U.S. stocks were worth 127.4% of GDP. This compares to a long-run average of closer to 62%.

It’s not the only sign that the market is overheated. Robert Shiller, the Yale professor who predicted the bursting of both the tech and U.S. housing bubbles, has noted that his Cyclically Adjusted Price Earnings ratio (CAPE) suggests investors be cautious. The CAPE divides the S&P 500 by 10 years of earnings data to smooth over economic volatility.

At nearly 28, the Shiller CAPE is substantially above its long-term average of 17. Of course, it could go higher still. At the top of the 2000 stock market bubble, the ratio hit nearly 45. But that market was the greatest equity bubble in U.S. history, so no one should assume it will necessarily return to that level again.

How about individual stocks and industries within the equity market? As for specific companies, one that stands out as particularly frothy is Alibaba, the online commerce site from China. Alibaba had a high-profile initial public offering in the fall, and currently sports a market capitalization of over $200 billion. To put this in perspective, this is almost 18 times Alibaba’s revenues. To say this is pricey is a dramatic understatement.

In addition, those buying the stock are making a huge bet on the Chinese consumer. What they should be aware of is that, according to China expert Anne Stephenson-Yang of J Capital Research, sales of retail-oriented companies on the Shanghai and Shenzen stock markets are actually declining year-over- year. Alibaba may well be, as more than one person has suggested, a giant Alibubble.

Last but certainly not least, U.S. biotech stocks have all the hallmarks of a bubble. The sector has risen dramatically in the last few years. The NASDAQ biotech index, which traded at around 970 in September 2011, now stands at over 3500. While some large companies do have profitable drugs, the vast majority lose money and are still in the development stage. Brokerage analysts are using what appear to be increasingly stretched reasons to justify the lofty price levels, with Credit Suisse most recently suggesting that the biotech sector had entered a “new era” where higher values were justified. This kind of language should raise red flags, as it is awfully close to the four most dangerous words in investing: “This time it’s different”.

And yet, despite these warning signs, biotech can seem compelling because there’s always the possibility that a company will find the cure to a horrible disease and make billions in the process. I would make the analogy to mining exploration companies here. While it’s possible that one or more may hit the motherlode, you really must assume that the vast majority will not. As a result, grossly overpaying for what amounts to lottery tickets is not a sound investment strategy. The time to buy them is when pessimism abounds in the sector, not when everyone is beyond exuberant.

Let me end by cautioning that just because something has gone up does not mean it is a bubble. However, when the price of something becomes totally divorced from reality, it is time for investors to step aside. You may be early in selling, but it sure beats being late.

Andrew Hepburn is a freelance writer based in Toronto. He specializes in economic and financial issues. From 2006 to 2009 Andrew was a Research Associate with Sprott Asset Management in Toronto focusing on commodity markets. He is a graduate of Queen's University. ahepburn20@hotmail.com