Your Slow Mover Advantage Over Bay Street - Part 2 - The Better Way

With the smart money completely focused on getting it right 90 days at a time, there’s a huge gap for the rest of us to march through. Let’s spend some time now discussing how we can all walk through this gap.

With the smart money completely focused on getting it right 90 days at a time, there’s a huge gap for the rest of us to march through. Let’s spend some time now discussing how we can all walk through this gap.

One way to do this is to keep things simple. Investing really does not have to be complicated. For example, I spent countless hours studying to achieve the CFA designation. The volume of information that they heap upon those who choose to go down this path is quite significant. Would you like to know how much of it I actually use on a day-to-day basis? Virtually zilch.

As John Reed once said: “When you first start to study a field, it seems like you have to memorize a zillion things. You don't. What you need is to identify the core principles—generally 3 to 12 of them—that govern the field. The million things you thought you had to memorize are simply various combinations of the core principles.”

It’s our thinking that as long as we understand what makes for a successful investment, all that we have to do is go out and find them.

With a simple framework in mind, our CEO and cofounder Tom Gardner is fond of saying that the best way an individual can improve as an investor is simply by doubling their time horizon for an investment.

You see, a longer time horizon allows for a business to develop and the magic of compounding to take effect. Grasping the concept and power that compounding can bring to your portfolio is difficult to begin with— and it’s made infinitely more difficult by the constant bombardment of information we face.

As proof of the power of a longer time horizon, consider that, of Warren Buffet’s approximate $60 billion net worth, $59.7 billion came after his 50th birthday.

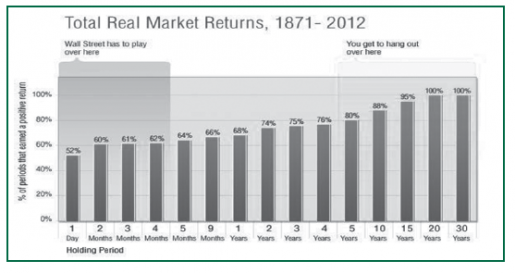

Many find investing to be very difficult. But as my colleague Morgan Housel has found by plotting stock market returns all the way back to 1871 (as illustrated in the chart below), there has never been a 20- or 30-year period where the market (U.S.) has provided a negative return. In contrast, on a one-day basis, the market has booked a positive return just 52% of the time. Day-today,

it’s basically a coin toss as to which way the market might move.

Simply buying, holding and perhaps contributing regularly to something as simple as an index fund has historically been one of the most enriching investment strategies you could follow.

In contrast to this long-term record of positive performance, Morgan also found that on a year-to-year basis, the market (again U.S.) has only achieved a positive return 52% of the time. Again, it’s a virtual coin flip as to what the market is going to do from one year to the next, yet so many try to time it by moving in and out.

Because we know that this is how the market has behaved historically and are comfortable that it will continue to perform in this manner for the foreseeable future, we don’t need to get our heads all in a knot about Dennis Gartman coming on TV and telling us to dump our stocks one day, and buy back the next. Nonsense.

Focus On What’s Knowable

This long-term perspective we maintain is why we don’t forecast or make predictions. We’re terrible at it. Everybody’s terrible at it. We have no idea what tomorrow is going to bring and we don’t even try to guess. What this does is it forces diversification as it makes us plan for or consider a variety of scenarios. And while institutional investors will hold hundreds of stocks and be well diversified as well, they churn those stocks to the point that the average mutual fund tends to turn over by 100% each year.

All of this activity makes it incrementally more difficult to be right. Rather than making just a few well- thoughtout decisions per year, most institutional investors are making literally hundreds if not thousands. Sure they’ll get a few right, but they’re going to get a lot wrong as well. In our mind, though it might sound crazy, doing nothing is a completely viable investment strategy (assuming you’re already invested).

A recent study by Fidelity of all of their accounts found that the ones that had performed the best over the past 20 years were the ones that the owners had completely forgotten about. They were untouched over this period and that’s the strategy that proved to be the most profitable.

Bottom Line

While it’s our opinion that the biggest advantage you and I have over the “pros” is time, the sub-message here is that investing isn’t as complicated as much of the world wants you to believe. Don’t get me wrong, it can be hard—really hard—and I’d say the media storm and the noise it brings only makes it harder…but it’s not complicated.

Let’s finish up with a recap of some of the more pertinent themes that we think, if followed, will hold you in very good stead over the remainder of your investing lives:

- Don’t overthink.

- Don’t try to tactically time the market—dollar cost average or simply wait for the fat pitches to roll in.

- Assume the market return will be an annualized 6-8% over long periods of time. Ignore year-to-year.

- Use the rule of thumb that the worse the market has done over the past 10 years, the better it will do over the next 10.

- Rebalance your mix of stocks and bonds every few years.

- Prefer companies that reward shareholders with dividends and buybacks.

And, Fool on!

Iain Butler, CFA, is the Chief Investment Adviser at Motley Fool Canada. He is also the lead adviser for Stock Advisor Canada. For more information please visit www.fool.ca or email Iain at IButler@fool.ca.

All material has been prepared by Iain Butler, Chief Investment Adviser at Motley Fool Canada. The opinions expressed in this article are the opinions of the author and readers should not assume they reflect the