Dealing With Corrections Big And Small

Our monthly hedge fund comments are followed by many “do-it-yourself” or DIY investors. We encourage such investors to read our newsletter because we think that the ownership of stocks (as opposed to funds) by individual Canadians is important for many reasons. Without wanting to sound overly didactic, we think that individual stock ownership is part of what makes Canada a great place to live. People who are engaged in their economy and own a stake in it, no matter how small, make for better citizens. If our newsletter helps everyday investors make better investment decisions, I am glad to be a part of it.

Our monthly hedge fund comments are followed by many “do-it-yourself” or DIY investors. We encourage such investors to read our newsletter because we think that the ownership of stocks (as opposed to funds) by individual Canadians is important for many reasons. Without wanting to sound overly didactic, we think that individual stock ownership is part of what makes Canada a great place to live. People who are engaged in their economy and own a stake in it, no matter how small, make for better citizens. If our newsletter helps everyday investors make better investment decisions, I am glad to be a part of it.

In this issue, I want to address two issues that DIY investors must always deal with but happen to be particularly challenging when the markets correct. Those two issues are:

- how to avoid letting the price action of the stock market scare you out of the market, and

- why fast-growing but still-unprofitable companies often get beaten up hard when the market corrects.

I won’t pretend I have all the answers on these two topics but hopefully these observations will help.

Share Price Volatility Will Drive You Crazy...If You Let It!

It must be difficult being a DIY investor if one’s only feedback mechanism for how a company is performing is the price action of the stock. If you are going to own individual stocks, you must make an effort to understand the underlying fundamentals of the stocks you own, and to base your buy/sell/hold decisions on the company’s fundamentals rather than on the price action of the stock. But in practical terms, what does this mean?

I often say that if investors were to build a simple spreadsheet or table that showed the seven-year track record of the stocks they were interested in buying, then the obvious “Buys” would simply jump off the page.

This same spreadsheet would also allow them to track investments once they have decided to make them. To create such a spreadsheet is not overly taxing, but once you do so, it will provide you with a very good way to decide between competing investments, and also to understand your investment and track it.

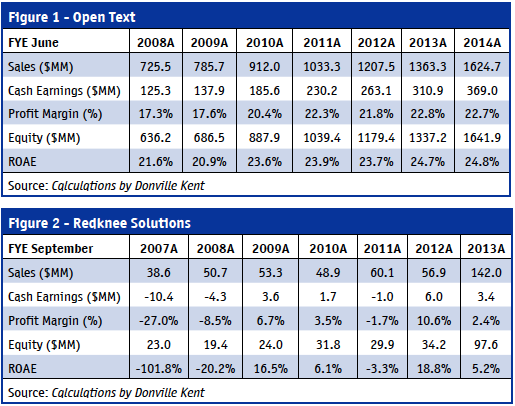

Let me illustrate what I am saying with the examples of two stocks: Open Text (OTC) and Redknee Solutions (RKN), both of which are listed on the TSX. Both are technology companies based in Southern Ontario, and both boast excellent products and strong management teams. Open Text is a stock that we currently own in our portfolio while Redknee is a company we have looked at many times before but never owned.

The basic seven-year historical track record of each company is presented on the next page. In the first table we see that Open Text has experienced steady growth in both sales and cash earnings over the past seven years. It is also worth noting that Open Text’s profit margins (based on cash earnings) have been high and gradually improving. At the bottom line, Open Text looks great with its return on average equity (ROAE) consistently at or above the 20% level in each of the last seven years. Thus, from even this limited statistical vantage point, we see that Open Text is a very attractive company to consider as a potential investment.

Redknee Solution’s numbers are also presented on the next page. Even if I provided the reader with no comments, one would quickly see that Redknee’s seven-year track record is decidedly different than that of Open Text. Until 2013, when the company made a major acquisition, sales growth had been modest and erratic. Similarly, earnings and profit margins have been low and often negative. Redknee’s ROAE has never met the threshold level of 20% that we seek in any one of the last seven years.

We own Open Text but we have no axe to grind with Redknee Solutions. We simply use the basic accounting data of both Redknee and Open Text to illustrate a simple point: that is, when you take the 30 minutes or so to set out and examine the track record of two potential investments side by side, the better investment is usually pretty obvious.

Of course, track record doesn’t tell you everything. Companies with poor track records can sometimes become excellent businesses and vice versa. But spotting turnarounds is difficult, and I, for one, have not been particularly good at spotting them. Open Text is an excellent business that has a very good chance of remaining so for the foreseeable future. Redknee’s financial track record has been mediocre, even if we conclude that its products are excellent. A company with an excellent product does not necessarily make a great investment.

OK, now what?

Let’s assume you are willing to build small spreadsheets on the companies you are considering owning, and in this case you have decided to buy Open Text. How does the table we have built help us on a go-forward basis?

As investors who read our monthly letter are aware, the key metric we look at when evaluating a company is ROAE. Ideally, we want to invest in a company that is capable of generating an ROAE of 20% or better. Thus, assuming I am a DIY investor who owns Open Text, I need to watch as each quarter is reported to see that the company is on track to earn an ROAE of at least 20% in the current fiscal year. In the case of Open Text in FY2015, we calculate that cash earnings of $365MM will equate to an ROAE of 20%. Thus, for FY2015, as long as Open Text is on track to earn cash earnings of $365MM, we are fairly comfortable owning shares in the company. That said, we actually think Open Text will earn more than $485MM in cash earnings in FY15, but as long as it earns at least $365MM we will continue to hold on to our investment. Throughout the year, the company’s share price might bounce around (a lot) but as long as earnings are on track to exceed $365MM for the year, we are happy to continue to hold our investment. That’s how we sleep at night.

On The Uses And Abuses Of Price-To-Sales Ratios

I am pretty sure the first time I heard of the price-tosales ratio was sometime in the late 1990s when I joined CSFB in Singapore. This was during the heyday of the 1990s tech cycle when Frank Quattrone was the eminence grise of technology banking at CSFB and the world was just beginning to understand the Internet and its subsequent bubble. At that time I was a Singapore-based industrial analyst and I had really no idea why anyone would care about a company’s price-to-sales ratio, let alone use it to value a company.

Then somebody at CSFB recommended that I read a book called Super Stocks by Ken Fisher. I had never heard of Ken Fisher, but when it was pointed out that he was the son of Phillip Fisher, the author of Common Stocks and Uncommon Profits, I raced to the bookstore to buy it. For those not familiar with Phillip Fisher, he was one of the first people to write about investing in growth companies in a systematic and logical way. Warren Buffett has on occasion described himself as “85% Graham and 15% Fisher.”

What I discovered once I had the book in hand was that Ken Fisher, like his father, was both an astute investor and a good teacher and writer. Super Stocks is about investing in technology companies, and a significant part of the book is focused on buying into cyclical technology stocks and how to use price-to-sales ratios to assess the value of a company when profits had temporarily been reduced or had disappeared. Fisher was therefore usinglow price-to-sales ratios to identify bargains. His book had nothing positive to say about buying companies on the extremely high price-to-sales ratios that were being pushed by tech analysts and bankers in the late 1990s (and now).

Notwithstanding Fisher’s excellent work, we rarely look at the price-to-sales metric from the long side. Indeed, these days we don’t see that many companies with skyhigh price-to-sales ratios. What we more commonly see these days are technology stocks with no profits but impressive sales growth. These stocks are often described as being underpriced because they trade at price-to-sales ratios that are lower than their profitable peers or lower than industry price-to-sales averages.

The issues with such companies can best be understood by looking at an example. Imagine that you are looking at two companies, each operating on an equity base of $100MM with 30%+ sales growth. One of the companies is profitable with an ROAE of 30% while the other has been, and continues to operate, at the break-even level. The profitable company trades at 3.0x sales, and the break-even company trades at 2.0x sales. On a price-to sales basis, the break-even company appears to be significantly cheaper. We see at least three significant issues, however, that an investor contemplating investing in the break-even company must first consider.

The first issue is the existence or lack of profits. At the end of year one, the break-even company still has its $100MM, but it has no new capital to support growing sales, expand its product offering, buy back shares, pay a dividend, etc. The second company now has $30MM more than it started with to do all of those wonderful things that the first company could not do without raising equity and therefore issuing more shares. Thus, the profitable company has significantly more options in terms of allocation and deployment of capital than the break-even company.

Key In On The Competitive Advantage

The second issue is competitive advantage. The breakeven company may have many wonderful products, but on average, its products sell for the cost of making them. As such, if an economic moat exists, it’s not apparent, even though the market is buying its product at a rapid pace. The other company, however, is selling its products at an equally rapid pace and, given its 30% ROAE, probably enjoys a very wide profit margin. That profit margin is your best evidence that the company has a significant economic moat and its expansion or contraction over time will give you a good idea of whether its moat is stable, improving, or weakening.

The third issue is cultural. The CEO who is praised for sales growth without regards to profitability will pursue more of the same. Indeed, all of the reward mechanisms in that corporation will be focused on more sales without regard to profitability. Of course, capital at some point will become scarce and the corporation will suddenly need to focus on profitability. By this point, the organization’s skill-set will be based on chasing sales, not profits. When the goals of the company suddenly change towards profits rather than sales growth, as they always do, this company will struggle to respond given that it doesn’t have that skill set. Meanwhile, the other company will actually turn down sales that don’t have a healthy profit margin and the company will have a war chest to create new products. This cultural focus on profitability lies at the heart of the great “moat” businesses. Competitive products alone don’t make for great companies. A management team’s focus on profitable growth and the ability to allocate capital are critical to long-term success.

Fast-growing but unprofitable companies can perform well during times of optimism. When markets correct, however, investors begin to realize that companies lacking in profits are vulnerable. Such companies often get hit hard during corrections, and many don’t bounce back. Once again, we know that all companies are unprofitable on day one and only gradually move towards profitability. But, companies that have impressive sales growth and are perennially unprofitable should be viewed with a great deal of skepticism.

Final Thoughts

The markets are correcting but I don’t think we are on the cusp of something bigger. Most economic cycles come to an end because central banks raise interest rates to stave off inflation. Inflation in this context is usually accompanied by higher energy costs. The problem we face in most parts of the world today is in fact a lack of growth. Inflation has virtually disappeared and oil prices are falling.

My best guess for the next 12 months is more of the same: low inflation, tepid GDP growth, and a generally sane environment for investing in stocks.

Reprinted and edited with permission from Jason Donville, Donville Kent Asset Management.