Sector Rotation

Understanding Industry Movement Within The Business Cycle

Understanding Industry Movement Within The Business Cycle

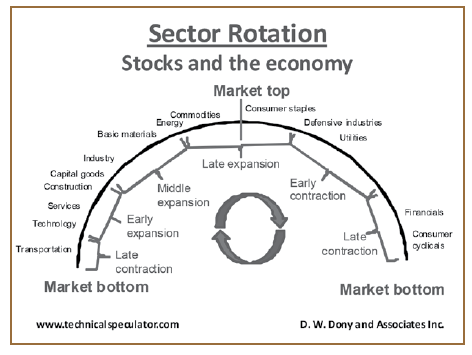

Sector performance can be analyzed through the different phases of economic growth. Different stages of the business cycle are often more beneficial to certain industry groups than to others. Knowing which industry groups usually outperform can be of great benefit to the investor.

This article will outline the normal sector rotation during a standard business cycle, highlighting opportunities at the different stages.

In the first stage (late contraction), the economy is narrowing. Gross domestic product (GDP) is falling, retail sales and consumer confidences are in decline and unemployment claims are rising. Equity indexes are in a bear decline. However, as the stock market is forwardlooking, traders begin to look for those industries that will rebound first.

The financial and consumer discretionary (cyclicals) sectors are typically the first to rise. The transportation sector is also an industry that turns positive as the economy nears the end of the contraction. Products start to move between companies and the transportation sector (trucking, rail and shipping) typically begins to advance on this renewed movement.

As the economy bottoms out, the stock market normally has been climbing for several months. Stock markets usually lead the economy (business cycle) by six to eight months as traders try to anticipate where the economy will be two or three quarters into the future.

In the early expansion phase, technology and basic services sectors are able to turn a profit quickly. Technology, in particular, is often able to create new products and services, and deliver them electronically, as compared to other basic industries which often require more time to establish materials.

With the economy now starting to improve, the construction sector is usually the next industry group to advance. Consumer confidence is picking up and along with it the housing market. New home construction projects and renovations typically begin to rebound slowly at this stage, giving the construction sector a lift.

During the middle expansion phase of the economy, the stock market has generally been advancing for about two to three years. In this phase, capital goods, basic industry and the materials sectors are often good performers. With the rebounding economy now on solid ground, most industry groups are advancing.

In the late expansion stage, economic growth (GDP) is nearing a peak. As the economy is normally moving faster at this stage, there is more demand for natural resources. During this phase, the energy and commodities sectors often outperform. The defensive consumer staples sector also starts to advance. The stock market has been typically rising for several years, and investors begin to hedge their investments.

As the equity markets start to pull back in a bear decline, the economy begins to contract. The economy always lags behind the stock market and reacts several months after the market.

The defensive sectors of utilities, consumer staples and pharmaceuticals are normally the best performing industry groups during a bear decline. These sectors will also fall but usually at a slower pace than many other groups.

Bottom Line:

By understanding which sectors typically perform well during a specific stage of the economy, investors can position portfolios to take advantage of the normal industry rotation.

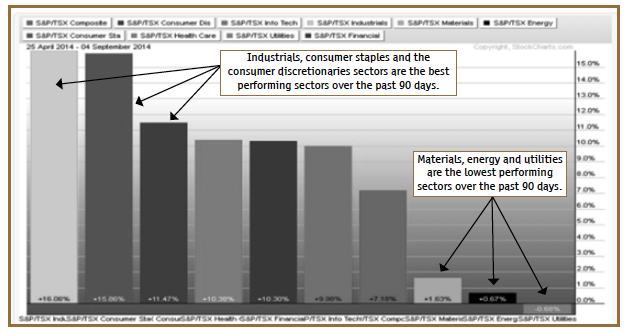

➥Note: The current sector rotation for the TSX suggests that the Canadian economy is in the middle expansion stage.

Donald W. Dony, FCSI, MFTA is an analyst and editor of the Technical Speculator website. Contact: dwdony@shaw.ca, Ph.250-479-9463