How To Use RRSP Contributions To Maximize Child Tax Benefit

Many people receive the Canadian Child Tax Benefit (CCTB), but few people know how this important benefit works. If a family with three or more children is able to change their income, they can dramatically increase (or decrease) this tax-free benefit.

Many people receive the Canadian Child Tax Benefit (CCTB), but few people know how this important benefit works. If a family with three or more children is able to change their income, they can dramatically increase (or decrease) this tax-free benefit.

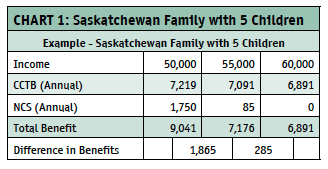

Let’s start with an example. We live in Saskatchewan and have five children. Saskatchewan has no provincial program related to the CCTB, so we only receive a federal benefit.

An increase of income from $50,000 to $55,000 ($5,000 increase) decreases our CCTB benefit by $1,865 or 37%. Another increase from $55,000 to $60,000 (still $5,000) decreases it by only $285 or 6%.

$1,865 or 37%. Another increase from $55,000 to $60,000 (still $5,000) decreases it by only $285 or 6%.

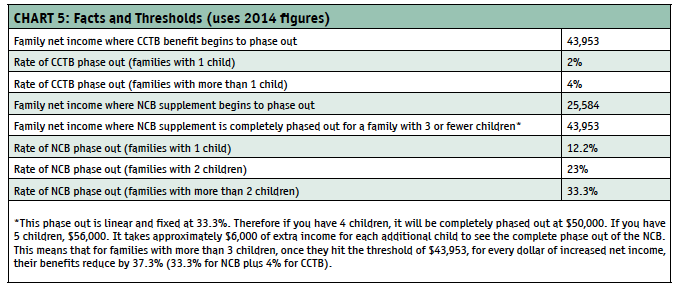

The reason for this dramatic difference is that the National Child Supplement or NCS (for low-income families) totally phases out for a family with 5 children at $55,256. This benefit phases out at a rate of 33.3%.

These benefits can be generous for modest income families. But there is a way for even higher income families to take advantage of this program (at least in some years). The key is to find ways to reduce net income.

A primer in taxes: taxes are calculated using credits and deductions. Deductions are better. Credits are always calculated at the lowest marginal rate (15% federally) and have no effect on your net income and therefore no effect on your means-tested benefits.1 Deductions not only reduce your income at your highest marginal rate, but also increase your eligibility for all meanstested programs (CCTB, GST/HST rebate, and related provincial programs—see next page).

The main deductions are: childcare expenses, business investment loss, moving expenses and alimony/spousal support. In all of these cases, it is difficult to increase or decrease these payments.

The main deductions are: childcare expenses, business investment loss, moving expenses and alimony/spousal support. In all of these cases, it is difficult to increase or decrease these payments.

Good thing RRSP contributions are a deduction.

RRSP is the most valuable deduction at tax time. RRSP contributions can also be carried forward from year to year, meaning that even though you contribute throughout the year to your RRSP (without going over your limit), you do not have to claim it for that year.

Where RRSP contributions become really valuable is in enabling you to double dip with the tax include the income tax saved at this rate (22% federally and in Saskatchewan 11% for income over $44,000) for a total of 70% back in savings or benefits.

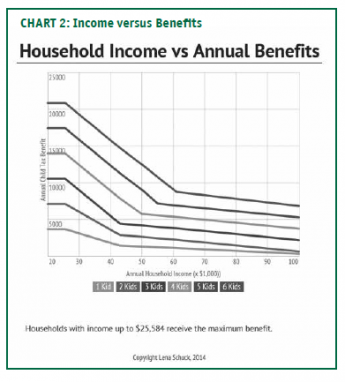

In the graph, you will see there is a dramatic change in the slope/steepness of the line. If you can have your income pass over this threshold (downwards) by using RRSP deductions, you will see a generous increase in your monthly benefits. Changing your income on the right side of the graph will only give you a change of 4% in benefits (for more than two children). But changing your income downward on the left side will give you a benefit of 33 – 37%! This doesn’t

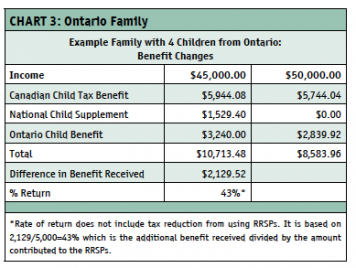

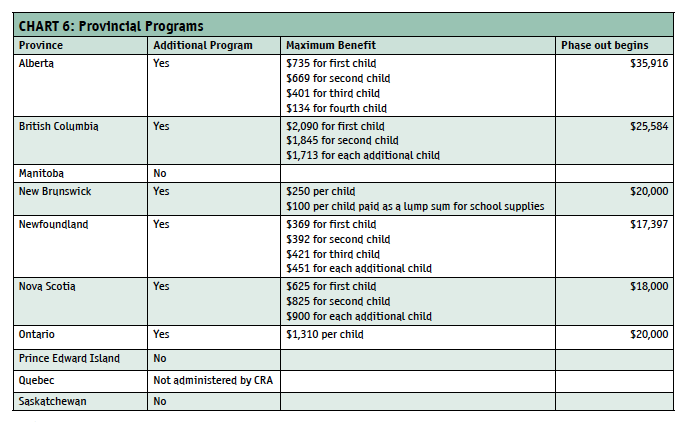

In Ontario, the results are even more pronounced with the Ontario Child Benefit. This is a benefit paid to families who already receive the NCS. For lower-income families, the additional benefit for reducing income from $50,000 to $45,000 is a whopping 43%! This is before the tax reduction at this rate (22% federally and 9.15% provincially equals 31.15%). This is, combined, almost a 75% return on the $5,000 contributed to your own RRSPs! A much better bet than the stock market.

In Ontario, the results are even more pronounced with the Ontario Child Benefit. This is a benefit paid to families who already receive the NCS. For lower-income families, the additional benefit for reducing income from $50,000 to $45,000 is a whopping 43%! This is before the tax reduction at this rate (22% federally and 9.15% provincially equals 31.15%). This is, combined, almost a 75% return on the $5,000 contributed to your own RRSPs! A much better bet than the stock market.

How can families use this information to maximize their tax savings and CCTB payments? Can a more affluent family use this information for tax planning? There are a few strategies: reduction and benefit increase. It’s like using a great coupon on a sale item! There are three ways to do this.

Save Up Your Contribution Room From Year To Year.

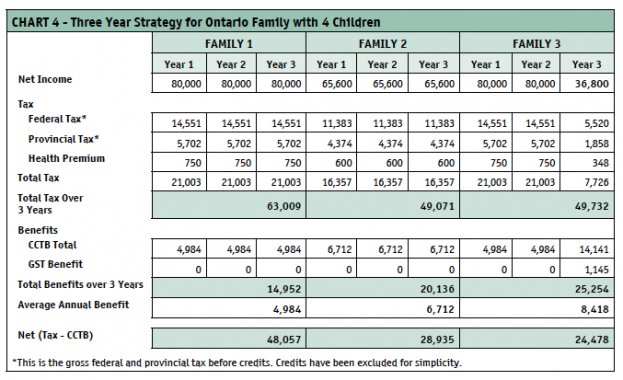

An Ontario family with four children and a moderate family income—say $80,000 annually—is entitled to contribute 18% to an RRSP (assuming they don’t have another pension plan2). This is approximately$14,400 per year. If a family saved their contribution space for three years and then used it all, they would quickly find themselves in that sweet spot where benefits increase quickly and tax rates decrease slowly. This example is illustrated in the chart on the next page.

Family 1 shows a family who do not use their RRSP contribution space at all (the control).

Family 2 shows a family who contribute the maximum ($14,400) to RRSPs each year and claim those contributions each year.

Family 3 shows a family who contribute the maximum but also save their contributions for three years and then claim $43,200 as a lump sum in Year 3.

As the example shows, using a 3-year strategy increases the annual return on the $14,400 invested by 15%! The 3-year return after using the maximum RRSP contributions each year (Family 2) is 40% (1- 28,935/48,057=0.40). In contrast, the 3-year return after carrying forward the contributions to the third year (Family 3) is 49% (1- 24,478/48,057=0.49). Over Family 2, Family 3 averages an extra $1,485 per year or $3 per day! ((28,935-24,478)/(3 years)=1,485) <CHART 4>

Take An RRSP Loan In A Year With Employment Interruption.

Some families might want to enjoy an extended vacation or have the main breadwinner take parental leave. This can be the perfect year to take a loan to increase RRSP contributions and then pay the bulk of the loan back with your tax refund and monthly CCTB payments.

Use Up All That RRSP Contribution Space You Haven’t Touched In The Last Few Years.

Maybe this isn’t for you, but many folks have unused RRSP contribution space from previous years. If you have tens of thousands of dollars of unused RRSP contributions from previous years and more than three children, examine the line graph. A loan might make sense. The benefits almost pay the costs—and you’ll be much richer in retirement because of it.

Notes:

All income figures include the amount for UCCB. Therefore, the actual earned income is less than what is depicted here. Federal tax is from 2014 forms. Provincial tax is from 2013 forms (the latest available at time of writing).

All figures are estimates based on information available from the CRA forms and website, but should be checked again if using any strategy outlined here.

In October 2014, the government announced a family-income-splitting credit worth up to $2,000. Reducing your income through RRSPs will reduce the value of this credit. If all of your income is in the lowest tax bracket, then transferring income to your spouse will have a more limited benefit. Using the outlined 3-year, save-your-contributions strategy for a family with a single breadwinner will produce poorer results because of this credit. However, for a family with more equal incomes, the results will stay largely the same.

The details of this new program were not available at the time of writing.

Lena Schuck is an educational writer and amateur tax-prep enthusiast. She lives with her husband and their five children in Regina, Saskatchewan.

1Means-tested is a fancy way of saying “based on your net income (line 236).” The CCTB is means-tested, meaning that it varies with more or less income. The Universal Child Care Benefit, on the other hand, is not means-tested. It is the same payout to every family regardless of income.

2For families with a pension plan, income going to the pension acts exactly like an RRSP contribution in the sense that it reduces taxable income. But it is unavailable to carry forward from year to year. For an earner with a company pension, often there is surplus contribution space. A common amount of pension income is 6% matched 6% by the employer. This means that there will still be approximately 6% left as RRSP contribution space that can be used and carried forward (6% + 6% + 6% = 18%).

Click Here to subscribe to the Print edition of Canadian MoneySaver Magazine

for $26.95(+tx)per year.