Why BMO ETFs Is Leading the Way in Low-Cost Investing

Why BMO ETFs Is Leading the Way in Low-Cost Investing

Because keeping more of your money just makes sense.

When it comes to investing, there’s one simple truth that often gets overlooked: the less you pay in fees, the more you keep in returns. It’s not the most exciting headline—but it’s one of the most important. And BMO Exchange Traded Funds is making sure investors don’t just hear it, but you experience it.

With a track record of competitive pricing, a robust lineup of diversified ETF solutions, and a continued focus on keeping costs low, BMO ETFs aims to help Canadians build wealth more efficiently—and that’s something worth talking about.

A clear commitment to low fees

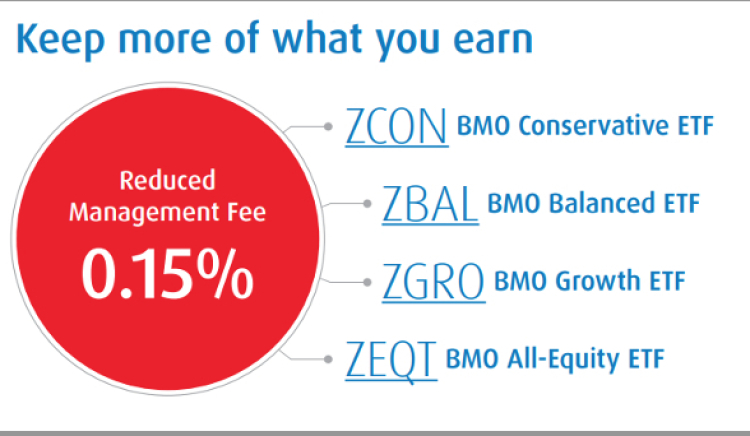

Recently, BMO made a move that speaks volumes: they lowered the management fee on specific Asset Allocation ETFs from 0.18% to 0.15%.

These are the all-in-one portfolios like ZBAL, ZGRO, ZCON, and ZEQT—designed for hands-off, long-term investing. With this change, BMO now offers one of the lowest-cost suites of all-in-one ETFs in Canada.

And here’s the thing: this wasn’t about catching up with the competition—it’s about staying ahead of the curve and continuously delivering better value to investors.

The power of lower fees

Let’s break this down. A 0.03% fee reduction might seem small, but over time, it adds up in a big way.

Imagine you invest $100,000 in an all-in-one ETF and let it grow for 30 years, assuming a 6% annual return:

- With a 0.18% management fee, you’d have approximately $548,741.

- With a 0.15% management fee, that would grow to $552,244.

That’s $3,503 more in your pocket—without lifting a finger. No changes to your investment strategy. No added risk. Just more of your money staying invested and compounding.

Now imagine that same difference across thousands of investors. This is why low-cost investing matters—and why BMO’s leadership here makes such a difference.

Why BMO ETFs stands out

BMO isn’t just cutting fees—they’ve built their entire ETF lineup with value and accessibility in mind:

- Broad product range: From core index funds to factor-based strategies to innovation-focused and ESG ETFs, BMO offers options for every investor type.

- Efficient structures: BMO’s Asset Allocation ETFs are designed for cost-efficiency, liquidity, and automatic rebalancing.

- Built-in diversification: Especially in their asset allocation ETFs, where investors gain exposure to Canadian, U.S., and global markets all in one product.

And perhaps most importantly—they’re focused on the long term. Rather than chasing trends, BMO builds solutions that help investors stay invested, stay diversified, and stay on track.

For today’s investor, cost matters more than ever

Whether you’re a DIY investor using an online brokerage, working with a financial planner, or just starting your investing journey, lower costs help protect your returns. And in an environment where inflation, interest rates, and volatility are all in focus, every basis point saved counts.

That’s what makes BMO’s latest move so significant—it’s not just about offering low fees today. It’s about delivering real value over decades.

Final word

BMO ETFs is showing leadership where it counts: by helping investors keep more of what they earn. The recent fee reduction is a strong signal of their commitment to cost-effective, long-term investing.

So, if you’re looking for a partner that puts your portfolio first—and backs it up with action—BMO ETFs is leading the way.

To learn more visit Asset Allocation ETFs | BMO Global Asset Management

1 As of May 29, 2025 highest priced Asset Allocation ETFs are 0.39%. Source: BMO Global Asset Management, Morningstar.

2 Source: BMO Global Asset Management, Morningstar as of May 29, 2025.

Definitions:

Liquidity: The degree to which an asset or security can be quickly bought or sold in the market without affecting the asset’s price. Cash is considered to be the most liquid asset, while things like fine art or rare books would be relatively illiquid.

Volatility: Measures how much the price of a security, derivative, or index fluctuates. The most commonly used measure of volatility when it comes to investment funds is standard deviation.

Disclaimer

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements. In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent simplified prospectus.

The portfolio holdings are subject to change without notice. They are not recommendations to buy or sell any particular security. Past Performance is not indicative of future results.

This article is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated and professional advice should be obtained with respect to any circumstance.

All investments involve risk. The value of an ETF can go down as well as up and you could lose money. The risk of an ETF is rated based on the volatility of the ETF’s returns using the standardized risk classification methodology mandated by the Canadian Securities Administrators. Historical volatility doesn’t tell you how volatile an ETF will be in the future. An ETF with a risk rating of “low” can still lose money. For more information about the risk rating and specific risks that can affect an ETF’s returns, see the BMO ETFs’ simplified prospectus.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or simplified prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s simplified prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.