What exactly happened in Europe and what does it mean for the markets?

There is a lot we can touch on with this question, but first let’s remind ourselves of what’s been going on in Europe for the past few years. With sovereign debt problems in many countries the ECB was forced to make financial stability its number one priority by providing liquidity to the financial system so that banks could get back on their feet and repair the damage done to capital levels. The ECB did so by cutting interest rates and providing lending facilities to financial institutions. Eventually, conditions improved to a point that banks actually started to pay back those loans. You could view what was happening in Europe in two ways – either it was positive because banks were actually healthy enough to pay back the central bank or it was negative because banks were returning excess liquidity to the ECB instead of using it to lend and potentially grow the economy. Needless to say it’s been a tough slog for the Eurozone as economic growth has only recently returned to the Continent and the rate of that growth has been marginal at best.

So what is the ECB doing now that the "stability” issues of the past have been resolved for the time being? Considering what happened this week and what is likely to happen in the coming months, it would appear that the focus of the ECB has now turned from stability to growth.Therefore, what policy decisions can the ECB make that will encourage lending and hopefully result in economic growth? Let’s review what the central bank actually did on Thursday:

1. The main refinancing rate was cut from 0.25% to 0.15% while the marginal lending facility was cut from 0.75% to 0.4%. While we can give them fancy names, these are rates at which financial institutions can borrow money from the central bank. The logic is that the lower the rate, the more incented a bank might be to borrow and then lend that money to consumers and businesses. The more money in the hands of consumers and businesses, the higher the likelihood they will spend it and generate economic activity.Admittedly, the rates were already so low to start off with that the cuts may not really stimulate growth as much as we’d like. We may look back on these cuts as being more symbolic, but the ECB will take any growth it can get by lowering borrowing costs.

2. The ECB also cut its deposit facility rate from 0% to -0.1%. Let me provide some background. Regulators dictate that banks have to have a certain level of capital on their balance sheet, basically like a minimum balance requirement that you might have in your own personal bank account. Any capital the banks have that exceeds the regulatory minimum can be placed in a deposit facility with the central bank. Historically, banks would earn interest on this money, but in Europe they were receiving no interest before Thursday. Now, as an incentive to keep excess capital out of the central bank and hopefully back into the economy, the ECB has a negative deposit rate which means that they will actually charge banks to keep money on deposit. The logic is that the ECB needs money/liquidity in the economy and not in a facility where it will do nothing for economic growth. If I were to charge you a deposit interest rate at your local bank, would you keep all you money in that account? Probably not. In all honesty, this change won’t have a profound impact on the European financial system, but the ECB wants to send the message that they’re trying to encourage economic growth with the policy tools at their disposal.

3. Central banks love acronyms, so here’s another one for you…the TLTRO or Targeted Long Term Refinancing Operation. The ECB has launched a TLTRO. The purpose behind this operation is to allow banks to borrow at low rates and then lend that money to non-financial businesses. We note "non-financial” businesses because this differs from what the Federal Reserve has done in the past where they’ve lent money to banks only to see the banks hold on to it for themselves instead of lending it to the private sector.

4. There were other measures announced such as an end to the ECB market securities sterilization program and discussion about an asset backed securities market, but we won’t go into too much detail on those other than to say that these are measures whereby the ECB is trying to improve market liquidity and stimulate economic expansion.

Will all these policy decisions really turn around the European economy? Not necessarily, but each policy decision helps the European economy take a step in the right direction. The market was expecting these announcements, so the reaction was positive. But the better news for investors from a sentiment perspective is that the ECB has indicated they may not be done yet and could introduce other policies in the future such as larger scale asset purchase programs if required. So, not only did the market get what it wanted, it also got reassurances that there are more tools at the ECB’s disposal that it is willing to use to stimulate economic growth and prevent deflation.

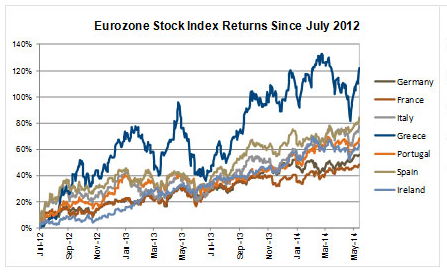

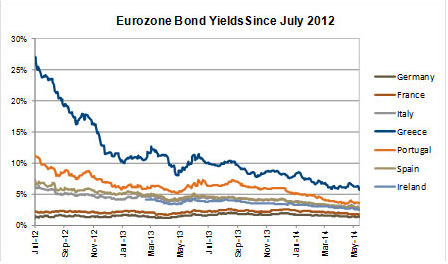

Investors have been rewarded in the Eurozone equity markets ever since Mario Draghi said he would do whatever it takes to get Europe back on track in July 2012.Admittedly, it was fair to question his commitment lately, but this week’s announcements and the expectation of policy changes to come should continue to provide some level of support for equity markets going forward, especially if these policies result in a weaker euro and improved corporate profitability. In addition, fixed income investors should expect continued downward pressure on Eurozone sovereign bond yields (rising bond prices) in the near term, especially if larger scale asset purchases are required in the future.

By The RM Group at Richardson GMP Limited. Our Group can help you.

We invite you to subscribe to our free bi-weekly newsletter and visit our website: www.thermgroup.ca

Source: Richardson GMP Limited

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson GMP Limited or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trade-mark of James Richardson & Sons, Limited. GMP is a registered trade-mark of GMP Securities L.P.

Both used under license by Richardson GMP Limited