The Power of Index Investing

By: Danielle Neziol, VP Online Distribution, BMO ETFs

This educational article is sponsored by BMO ETFs.

Index investing took Exchange Traded Funds (ETFs) mainstream over a decade ago when investors were looking for an efficient way to add an entire index to their investment portfolios. The ETF was the perfect structure to accomplish this; it provides access to a basket of stocks in a liquid, transparent and cost-effective way. ETFs eliminate the need for investors to make thousands of trades a year for index exposure - a costly, time consuming and often impossible task for most.

Over 10 years later, index investing has remained a sought-after investing strategy. ETF investors are continuing to add indexes to their portfolios as a core exposure mostly because it takes the guess work out of investing. Rather than picking several different stocks (a difficult task for even seasoned investors with access to institutional level information), index investing provides instant diversification and access to an entire market. Index investors prefer to have full market exposure year after year, rather than making bets on beating the market. And now with over a decade of analysis, there is powerful data to support this investing thesis is not just used for its simplicity and “set it and forget it” tagline, but for its strong long-term performance as well.

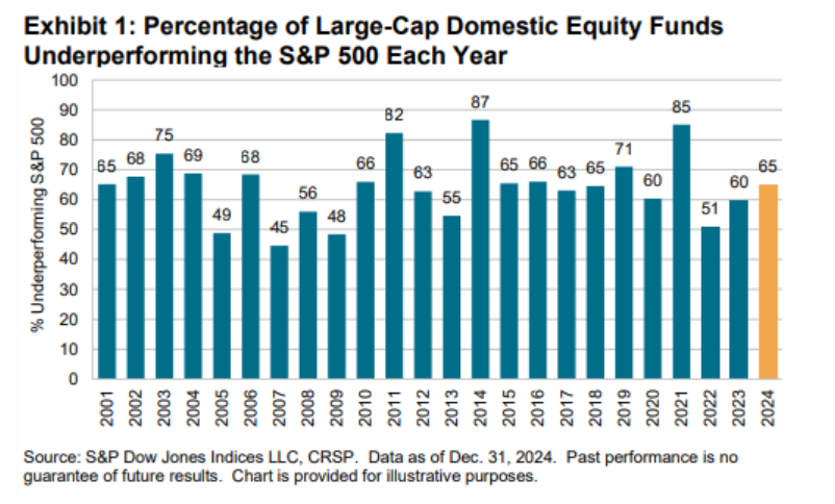

The S&P 500 Index has returned an annualized 12.6% over the last 10 years (SPDJI, Aug 29 2025), a return number which has been hard to beat (see Exhibit 1).

For years, S&P Dow Jones Indices has tracked the performance of actively managed funds compared with indexes through its indices versus active (SPIVA) scorecards. Consistently, they have displayed that only as many as a third of the active, stock-picking managers in any particular market can beat the index over one or two years. And the active managers’ ability to outperform their reference index decreases as time goes on. For example, over 15 years the number of active managers (managing large cap U.S. equity mandates) that outperform the S&P 500 Index falls to 10%(SPDJI, December 31, 2024). This data shows that the longer you’re invested, the harder it is for active managers to beat the broad market. That happens for several reasons. Different sectors and investing styles will generate outsized returns for a while, then give ground to other corners of the market. So for buy-and-hold investors, investing in an ETF that tracks an index such as the S&P 500 makes a very compelling case.

Another benefit of index investing is that they are generally low-fee products. Active mandates are typically more expensive because of the extra work involved in managing them, in addition to their mandates to investors to beat the broad index - a mandate which is not always an achievable task, as the data supports.

Still, investors face the question of which index funds to buy. Several S&P 500 funds are trading on Canadian stock exchanges, for example. Trusted providers with large, liquid ETFs, have gathered the most assets, supported by investors’ preferences for asset managers with proven track records and operational stability.

One of the largest and most liquid S&P 500 ETFs in Canada is the BMO S&P 500 Index ETF (ticker: ZSP) with over $19.5 billion in assets (BMO GAM, Aug 2025). This ETF showcases the index investing trend isn’t going anywhere. Institutions, advisors and direct investors use this ETF for instant S&P 500 exposure.

ZSP has been listed on the Toronto Stock Exchange for over 12 years and sees half a million units change hands daily, on average (BMO GAM, Aug 2025). While ZSP is the unhedged version of the fund, investors can find a Canadian dollar-hedged version (ZUE) and a U.S. dollar-denominated iteration (ZSP.U).

With equity investors facing a lot of uncertainty in 2025 (Will the AI trade still win? Will trade policy continue to disrupt markets? Will the economy enter stagflation?), a diversified ETF offering market exposure can make a lot of sense. Timing the market is almost impossible to do, but time in the market, and staying invested over the long run, has proven itself year after year.

Disclaimer:

This article has been sponsored by BMO Global Asset Management (BMO GAM).

This material is for information purposes only. The information contained herein is not, and should not be construed as investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated, and professional advice should be obtained with respect to any circumstance.

The viewpoints expressed by the author represent their assessment of the markets at the time of publication. Those views are subject to change without notice at any time. The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results. This communication is intended for informational purposes only.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by the Manager. S&P®, S&P500®, US 500, The 500, iBoxx®, iTraxx® and CDX® are trademarks of S&P Global, Inc. or its affiliates (“S&P”) and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”), and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by the Manager. The ETF is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the Index.

The S&P 500 Index is an unmanaged index of 500 common stocks that is generally considered representative of the U.S. stock market. The Index is heavily weighted toward stocks with large market capitalizations and represents approximately two-thirds of the total market value of all domestic common stocks.

The S&P 500 Index figures do not reflect any fees, expenses or taxes. An investor should consider investment objectives, risks, fees and expenses before investing.

You cannot invest directly in an index.

Any statement that necessarily depends on future events may be a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Although such statements are based on assumptions that are believed to be reasonable, there can be no assurance that actual results will not differ materially from expectations. Investors are cautioned not to rely unduly on any forward-looking statements.In connection with any forward-looking statements, investors should carefully consider the areas of risk described in the most recent prospectus.

Commissions, management fees and expenses all may be associated with investments in exchange-traded funds. Please read the ETF facts or prospectus of the relevant BMO ETF before investing. The indicated rates of return are the historical annual compounded total returns including changes in unit value and reinvestment of all distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. Exchange-traded funds are not guaranteed, their values change frequently and past performance may not be repeated.

For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination.

BMO ETFs are managed and administered by BMO Asset Management Inc., an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

BMO Global Asset Management is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.