Portfolio Strategy

Portfolio Strategy

Portfolio strategy is a blueprint which investors use to create their optimal portfolios to achieve their financial goals. The strategy can take various forms for different investors. Some investors might be passive investors, tracking indices and markets, while others might take on a more active approach selecting and picking funds or stocks that match their view. A strategy, ideally, must also define when and how often would an investor rebalance their portfolio, time horizon, liquidity needs, and risk tolerance.

Asset Allocation

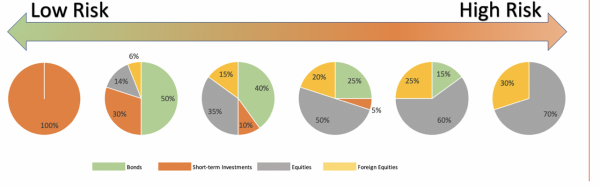

Asset allocation is typically the most important consideration in a portfolio, and then comes sector allocation. In simple words, asset allocation is the way you divide your portfolio by asset classes. Your asset allocation has the biggest impact on how your portfolio will behave in different economic cycles, business cycles, and market rotations. Given that different asset classes behave and react in different ways and might have little to no correlation with each other, by allocating weightings to asset classes, you can control how you want the overall picture to look like. There is no ‘perfect’ asset allocation guaranteeing financial success or capital growth, and it all depends on individual needs, financial goals, and risk profile. Below is a broad overview of how asset allocations are perceived by investors:

Factors to consider for asset allocation to fit your needs and requirements include:

- Investment time horizon

- Risk tolerance

- Liquidity needs

- Diversification within and among asset classes

- Rebalancing

Time Horizon: As a general point to note, your investments and portfolio goals need to match the liquidity needs, costs and capital requirement. As an example, if one has a long-time horizon (20+ years), this will allow for more flexibility and opportunities to invest in growth equities that might otherwise be considered ‘risky’. A short-term horizon typically means investments in more stable and liquid investments forgoing any growth opportunities for capital preservation.

Risk tolerance: Investments have real risks wherein there is a possibility of losing your invested capital. You want to define your risk tolerance as if there is an x% swing in the market tomorrow, how much are you willing to see your portfolio decline by? Willingness to take risks can be very different from ability to take risks. A single income family with monthly costs and kids approaching college might be willing to take risks expecting high returns, but the ability to take risk is low given the liquidity and cost needs. On the other hand, a high-income single individual might be risk averse, but can take on risks given the cash flow, liquidity needs and time horizon. An aggressive investor, one who is willing to take risks, is the one who would risk losing capital to get potential higher results. A conservative investor would tend to favor capital preservation options which are liquid, stable, and do not cost much. A conservative investor might also take an approach synonymous with the idiom, ‘a bird in the hand is worth two in the bush’, wherein the investor would prefer dividends, income-generating and stable investments.

Liquidity needs: Needs depend on any upcoming or unexpected cash need, annual expenses, and/or lifestyle (such as retirement). Depending on the liquidity needs, an investor can decide whether dividends are going to be the focus, or interest income, or whether to invest in low-‘risk’ or stable investments. This would go hand in hand with time horizon.

Diversification: Before deciding on asset weightings, an investor must consider diversification among asset classes such as bonds, equities, cash, real estate, and such. Secondly, diversification between asset classes would need to be considered within the context of geography (such as global vs domestic), growth vs value, dividends, and sectors. When considering diversification, investors must be mindful of overdiversification, and diversification just for the sake of diversification with no risk-reward benefit. Overall, diversification can be summed up as ‘do not put all your eggs in one basket’. Spreading investments across classes and segments should mean that if one investment loses money, other investments can help to offset the losses to compensate and maintain some form of consistency in portfolio returns.

Rebalancing: After an investor has decided on diversification and time horizon after considering your portfolio goals, it is important not to get carried away with winners and letting them become a larger percentage of the portfolio than expected. This is not to say that it is best to take profit out of winners, but investors should strive to maintain a balanced portfolio rather than making a portfolio a ‘bet’ on a single investment.

For added diversification, investors can seek market cap diversity, sector diversification, geographic diversity and a balance between growth/value.

The factors mentioned in this article should help to provide a good foundation for building a portfolio strategy and a plan through, or in the least, offer some food for thought when talking about one’s investment plan with an advisor.

Invest and Diversify!

Barkha Rani, Analyst

5i Research Inc.

Comments

Login to post a comment.