Family Wealth Planning -The Three Stages Of Family Financial And Estate Planning For Disability

Planning to financially support a loved one with a disability is a three-stage process. The first stage gets the most attention but stages two and three are often ignored or delayed unnecessarily.

So, what are these three planning stages;

- Paying day-to-day expenses,

- Accumulating disability capital today that will be needed by your loved one as they get older,

- Estate and Will planning for the transfer of wealth on your death to your loved one with maximum flexibility, tax benefits and control by family caregivers.

It’s a tough act to maximize resources for your loved one and take advantage of all the financial help that is available. And you want to do this in such a way as to get as much flexibility as possible as needs change so funds can be moved to meet new circumstances or to pass to other family members when no longer needed to support disability.

Paying Day-To-Day Expenses

Funds to pay daily living expenses can usually come from four sources:

-

Parental and family support

-

Tax credits and other tax benefits,

-

Social assistance,

-

Community outreach programs.

For some families, parental and family financial support is not an issue, but for many families with lower incomes, it’s a big burden. But you might be surprised how extended family members will pitch in to help.

Tax credits are a great source of financial assistance, starting with the disability tax credit (DTC) of about $2,000 a year. Once you qualify for the DTC, it opens the door to many other short and longer-term benefits, such as the Registered Disability Savings Plan (RDSP), the attendant care tax credit and the availability of certain trusts for your estate planning.

The Income Tax Act provisions can be helpful for two reasons:

-

1-Many tax credits can be shared within families and

-

2-If tax benefits have been overlooked, tax rules allow retroactively claiming those benefits up to previous 10 years.

Social assistance is a significant help in paying current bills and eventually may even give your loved one a feeling of independence as they get older. It’s organized provincially, so the rules vary across the country.

Social assistance benefits are usually constrained by the assets and income of the person with a disability, so it takes some planning to avoid a clawback of the benefits. On the other hand, this limitation perhaps should be put on the back burner if it significantly limits your loved one’s lifestyle through more generous family support.

Social assistance not only provides monthly nontaxable income, but it can also provide drug and other health-related benefits. In Ontario, we also have what is called the Passport program that provides generous financial assistance to allow your loved one to get involved in the community and can provide caregivers financial assistance to pay for an alternate care provider so they can get some respite.

And finally, there is community support both from municipal governments and from not-for-profits that lower the cost of such things as transportation passes, therapies, and social activities to reduce the extra cost of disability.

Accumulating Disability Capital

I use the phrase “disability capital” to describe the funds that you will be setting aside now for the future for your loved one to pay their expenses at mid-life and beyond. The cost of housing and, in some cases, the cost of attendant care will probably be the largest component of these future costs. Other expenses might include therapies, transportation, recreation and so on.

Finding ways to set aside disability capital is complicated, but perhaps the very best way is to have family contribute to an RDSP. In my opinion that funding should be maximized by early contributions to take advantage of tax-free compounding within the plan. Examples that I have worked on indicate that accumulating $500,000 in an RDSP is possible with the right planning.

The government will contribute $90,000 to such plans, but $70,000 of that amount will depend on contributions to the plan. You can contribute up to $200,000. But you only need $30,000 of aggregate annual contributions to get the $70,000, which means that families can contribute up to $130,000 at any time and not affect government support. So, contribute as much as you can afford as soon as you can. Aunts, uncles, and other family may want to participate too, either directly or in their Wills.

The only issue that I see is that after the planholder dies, the RDSP would fall under the control of the Public Guardian if your loved one has an intellectual disability. Then you would be faced with applying for personal guardianship. You should have carefully thought-out, clearly written letter of wishes to provide guidance in decision-making for planholders and other estate managers.

Estate And Will Planning

Estate and will planning that transfers disability capital to a loved one through your Will is perhaps the most important part of the three stages. It certainly is the most complex and misunderstood and consequently gets neglected.

Here are the overarching issues that you need to consider in your estate planning:

-

Avoid loss of control of disability capital to the public guardian.

-

Be financially fair to other beneficiaries of your estate.

-

Use legal structures that can be controlled by family caregivers.

-

Leave guidance to family caregivers about your wishes on the level of financial support you wish for your loved one through a letter of wishes.

-

Use legal structures that allow the eventual transfer of disability capital to other family members when no longer needed to support disability.

-

Minimize tax rates.

The use of trusts and particularly a qualified disability trust, ranks high in meeting the above objectives. Also, the transfer of Registered Retirement Income Fund (RRIF) balances on death can pass to an RDSP or to a Lifetime Benefit trust for an infirm beneficiary that purchase an annuity are great ideas.

The Henson trust to retain social assistance gets a lot of attention, but in my opinion, it’s sometimes overstated. There are other more important uses for trusts that should rank higher such as family asset control and the ability to move trust assets to other family members without a serious tax liability when the trust is no longer needed. The purchase of an annuity for basic income needs can also work well in some situations.

But despite these tax benefits of trusts, tax credits and others, I am concerned that many of them are not available for loved ones with an intellectual disability because they can’t legally sign the documents. Then, an expensive guardianship application may be required.

You are not going to accomplish all of this without some hard work and professional advice. Don’t get overly involved in the shiny techniques but focus on the bigger picture to guide you to where you want to go. You will need to draw on help from a myriad of sources to help you through this.

The complexity of these difficult financial and estate planning issues is why I wrote The Family Guide to Disability and Personal Finances.

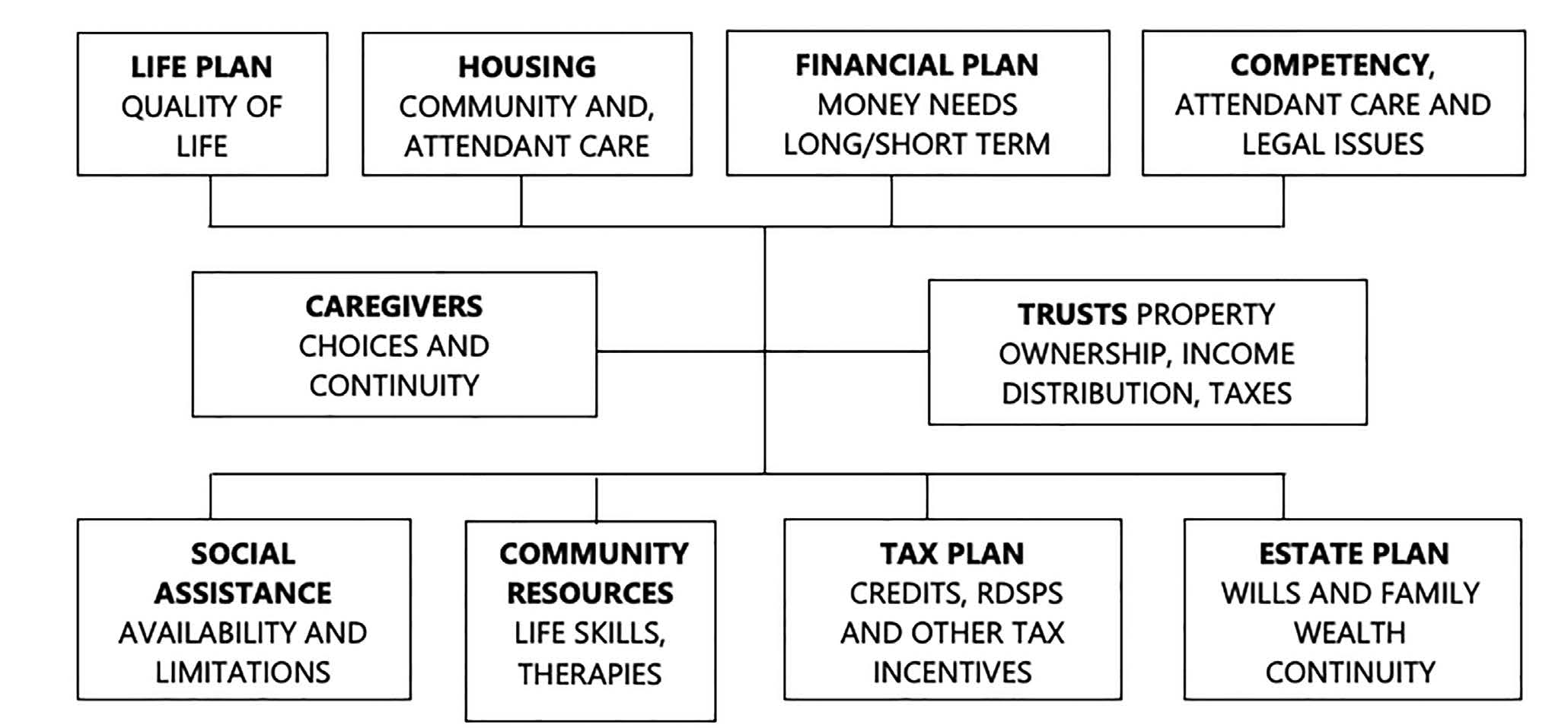

The chart below from chapter 10 of my book might give you a helpful overview of the major components of financial planning for disability.

Figure 1.10 Disability - The Ten Most Important Components of Financial Planning

Ed Arbuckle is a Chartered Accountant who has taken a special interest in helping clients plan their finances to support the cost of disability for a loved one. He recently wrote a book covering the many aspects of such planning called The Family Guide to disability and Personal Finances. Ed has extensive involvement in personal taxation and vast experience in community involvement in healthcare. - jea@personalwealthstrategies.net

Comments

Login to post a comment.