Factors to Consider in a Mortgage

The largest amount of debt that most individuals will have in their lifetime is probably a mortgage. A mortgage is a term loan that allows an individual to purchase and own a home, using a fraction of the purchase price as the down payment. Financial institutions lend out mortgages to individuals and will use the physical house as collateral against the loan. This means that if the individual purchasing the home suddenly cannot make the mortgage payments or defaults on the loan, then the bank can repossess the property. Therefore, mortgage loans are most likely the largest amount of debt that most consumers will have, because they are backed by the physical property, and it is one of the largest ticket items in society.

Basic Dynamics of a Mortgage

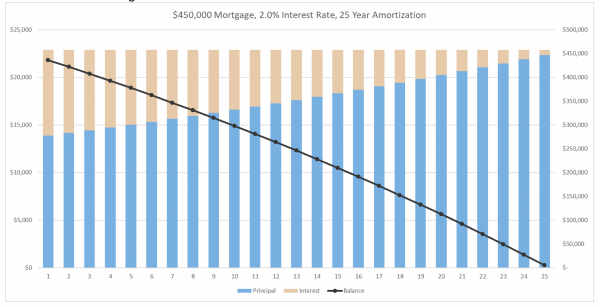

A mortgage loan has a similar structure to a bond in that it has both principal and interest payments. Principal payments reduce the total amount of the loan, and the interest payments are necessary to be paid to the lender. The sum of the principal and interest payments combined are the total mortgage payments. Mortgage payments are typically a fixed dollar amount, and at the early stages of a mortgage loan, the interest payments are high as the loan balance is also high, but as principal payments are made and the loan balance is paid down, the interest payments decline. As the interest payments become a smaller portion of the total mortgage payment, the principal payments increase. Below we can see an example of a $450,000 mortgage with a 2.0% interest rate, a 5-year term, and a 25-year amortization period. As the years progress, interest payments decrease and principal payments increase, all while the loan balance is decreasing.

Main Properties of a Mortgage

The following are several key elements that make up a mortgage loan:

- Purchase price of the house

- Amortization period (typically twenty to thirty years)

- Term period (typically five years)

- Interest Rate (fixed or variable)

- Down payment amount (minimum is 5% and higher)

- Payment frequency (monthly, bi-weekly, accelerated, other)

Let us examine further each of these properties of a mortgage, some of the main options available, and how the different options can affect the pricing and longevity of the loan.

Purchase Price of the House

Purchase price is quite straightforward, simply being the amount to be paid to the seller to purchase the house. The listing price of the house often differs from the purchase price, and so this is one key consideration to keep in mind.

Amortization Period

The amortization period typically ranges from twenty to thirty years, and it is the total length of the loan being offered. In the case of a twenty-five-year mortgage, the loan will expire in twenty-five years and at that time the entire loan will have been paid in full.

Term Period

The term is the timeframe with which the agreed upon interest rate is set for. Terms typically range from one to five years and once the term has expired, the borrower will be required to be re-approved for the mortgage and receive a new term with a different interest rate.

Interest Rate

The interest rates on mortgages are offered as either being fixed or variable. A fixed interest rate is simply a set percentage that the borrower will need to pay for the term period. Once the term period matures, the borrower will need to be re-approved for another term at a different interest rate. Fixed mortgage interest rates are mostly dependent on the central bank interest rates as well as 5-year Treasury Bond rates. With a fixed interest rate, the interest rate does not change throughout the term and the borrower can be assured of their payment amounts for the length of the term.

A variable interest rate is typically the prime rate plus or minus a fixed percentage. For example, if the prime rate is 2.45%, a variable rate offered to a borrower may be prime minus 1.0%, meaning the variable rate is 1.45%. The caveat is that as the prime rate fluctuates based on decisions made by the central bank, the variable rate of 1.45% can change month-over-month. Using a variable rate can be beneficial to a borrower if the central bank begins to decrease interest rates as the mortgage payment will also decrease, however, it can also work against a borrower if the prime rate begins to increase.

Down Payment Amount

A down payment amount is required to purchase a house with the use of a mortgage. The minimum down payment is roughly 5%, although this varies based on the house price and province. If the down payment is less than 20%, the Canada Mortgage and Housing Corporation (CMHC) will require the borrower to pay for mortgage insurance throughout the life of the term. Mortgage insurance ranges from 0.6% to 4.5% of the amount of one’s mortgage. If one does not yet have the funds to put down 20% on a home to avoid paying for mortgage insurance, the trade off is to either wait until funds are available for a 20% down payment or to use a lower down payment and pay for the mortgage insurance. We feel that paying for mortgage insurance is not necessarily a bad thing as it allows an individual to own a home sooner and to begin making payments towards the loan, therefore building up equity.

The CMHC is offering a first-time home buyers’ incentive which is like a loan but specifically for the down payment. It is offered as either a 5% or 10% incentive toward the down payment of a home. The loan must be paid back with the corresponding home appreciation or depreciation percentage. As an example, if an individual is buying a $500,000 home, the CMHC will provide them with a 5% loan, being $25,000, towards the down payment on the house. When the borrower either sells the home or the term expires, they must pay back the $25,000 plus the corresponding percentage that the home appreciated or depreciated by. If the home appreciated by 10%, then the borrower will need to pay back $27,500 ($25,000 loan + $2,500 appreciation). If the home decreased in price by 10%, then the borrower will need to pay back $22,500 ($25,000 - $2,500 decrease).

Payment Frequency

There are many different types of payment frequencies that are available to a borrower, and most of them are simply a matter of preference for one’s cash flow. There is an ‘accelerated’ option for borrowers, however, that allows for a slightly faster payback period of the mortgage and saves the borrower money in interest payments. Below we examine the main types of payment frequencies available:

- Monthly: Payments are made monthly – 12 payments a year

- Semi-Monthly: Payments are made twice in a month – 24 payments a year

- Bi-Weekly: Payments are made every two weeks – 26 payments a year

- Accelerated Bi-Weekly: Payments are equal to half of the monthly payments but are made every two weeks. This means that an additional month of mortgage payments are made each year – 26 payments a year.

- Lump Sum Payments: Lump sum payments are in addition to one’s typical mortgage payments and go directly to the principal amount of one’s mortgage. This can help to reduce the lifespan of the loan and future interest payments.

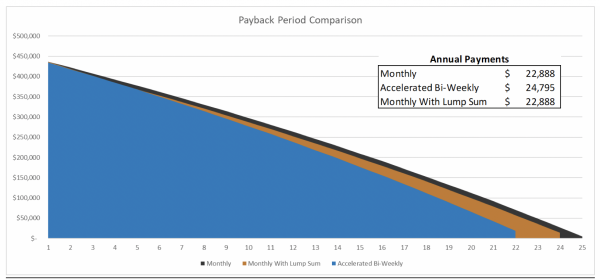

Below we examine the benefits and expected payback periods for a traditional monthly mortgage payment, an accelerated bi-weekly mortgage payment, and a monthly option with three lump sum payments. The mortgage amount is $450,000, the amortization period is 25 years, the interest rate is 2.0%, and the term is 5 years. The lump sum payments made are $3,000 made in years 2, 3, and 4 for the monthly option with three lump sum payments. What we can see is that for an accelerated bi-weekly payment option, the mortgage is paid off three years earlier than the traditional monthly payment option. The borrower would also save roughly $10,000 in interest payments by paying almost $2,000 more in total mortgage payments each year. The individual that selected a monthly payment option but decided to make three lump sum payments of $3,000 each in years 2, 3, and 4 saved almost $5,000 in interest payments and paid off the loan in full one year early.

Conclusion

When considering the various options of a mortgage or all the considerations involved in a mortgage, it is important to know of the benefits available to a borrower and what makes the most sense for each individual. Knowing the potential benefits and downfalls of a fixed or a variable rate, or the long-term benefits of using an accelerated payment schedule can all help to increase one’s financial position. Lastly, understanding the dynamics between interest payments and principal payments and how the balance of a mortgage loan is paid off can better one’s financial position in the long run.

Research for today, invest for tomorrow

Research for today, invest for tomorrow

Chris White, CFA

Analyst for 5i Research Inc.

Comments

Login to post a comment.