ETFs With a Focus on Women

Women in leadership

Time and again, studies have shown that female-driven companies or companies with more female employees have the tendency to outperform the market. In a 2019 study by S&P Global Market Intelligence, it was noted that firms with female CFOs are more profitable and generated excess profits of $1.8T over the study horizon[1]. More specifically, female CEOs drove more value appreciation and improved stock price momentum for their firms while female CFOs drove more value appreciation, better defended profitability moats, and delivered excess risk-adjusted returns for their firms (Sandberg, 2019).

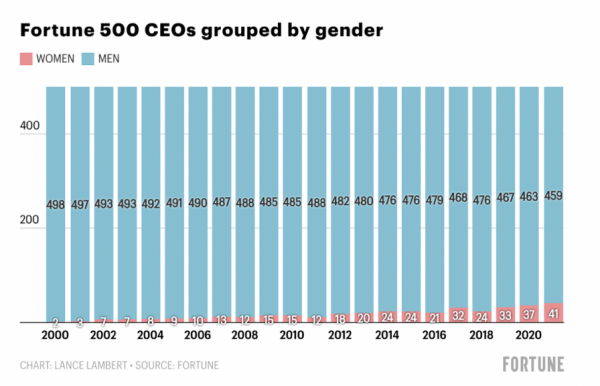

In the recent years, many high-profile women have taken leadership roles in several of the Fortune 500 companies such as General Motors, Citigroup, Best Buy, and Oracle. In fact, in 2021, the number of female CEO’s on 2021 Fortune 500 hit an all-time high at 41.

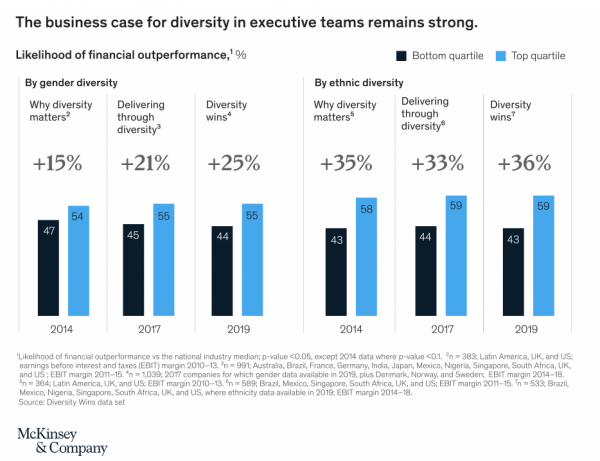

A 2019 study by McKinsey reported that companies in the top quartile for gender diversity on executive teams were 25 percent more likely to have above-average profitability than companies in the fourth quartile – up from 21 percent in 2017 and 15 percent in 2014[2]. Furthermore, companies with greater diversity in leadership have experienced lower volatility in earnings, return on equity, dividends, and higher employee retention.

Women as investors

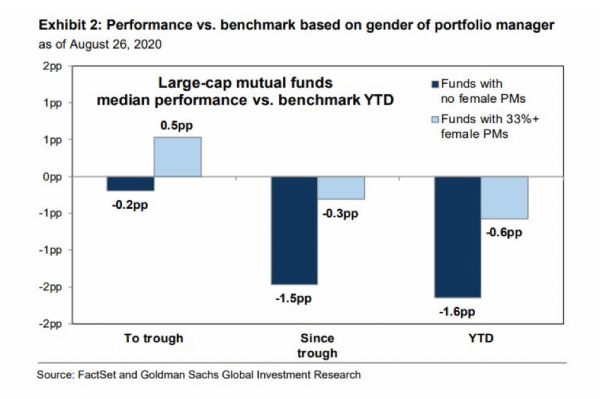

Several behavioral economic studies have shown that female investors spend more time researching and evaluating their investment decisions compared to males. They tend to focus more on appropriate risk-return relationship, preventing them from being influenced by hot bubbles, get rich quick schemes or hot tips leading to outperformance in the long-run. Research has shown that men are more overconfident than women and often trade more excessively than women[3]. Ideally, a rational investor makes periodic contributions to their portfolios, trade in ways that are tax efficient, invest for long-term capital gains to reduce trading fees and commission, rebalance portfolio, and diversify in an appropriate manner. The following chart shows how funds with female portfolio managers have performed against other funds and benchmark.

Female power

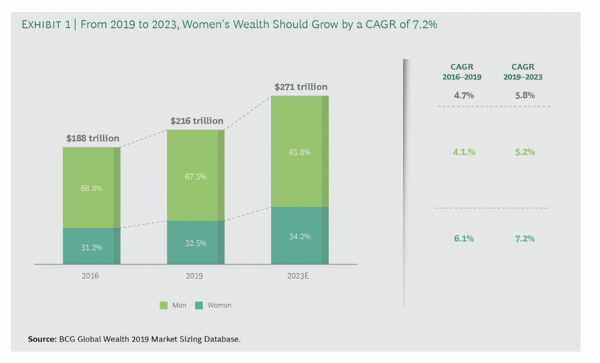

With a third of the world’s wealth under females and future growth, an analysis done by BCG finds that women are adding $5 trillion to the wealth pool globally each year[4]. Females share of regional wealth in increasing in all parts of the world and will account for a significant portion of global wealth growth over the next several years. Women are increasingly taking control of their finances, giving back to their communities (investing in ESG), and are investing based on sustainable and durable investment strategies.

Given the data, many investors are now actively seeking to invest in companies run by females. While the list of such public companies is small, investors are not shying away from gender diversity and female investors are stepping up as well. We have highlighted some ETFs below which highlight female-run companies.

SPDR SSGA Gender Diversity Index ETF (SHE)

The ETF SHE manages nearly $280 million in assets and offers exposure to US companies that have greater gender diversity within senior leadership compared to other companies in their respective sectors. The fund tracks the SSGA Gender Diversity Index and holds 193 securities. SHE charges 0.20% in annual fees and offers a yield of 0.95%. The fund’s strategy focuses on large-cap growth companies with a high weighting to the technology (32%), healthcare (12%), and communication (12%) sectors. The fund has returned 14.5% year-to-date, and 31.8% over the past year. The top ten holdings are as follows:

|

Name |

Weight |

|

Salesforce.com Inc |

5.05% |

|

Walt Disney Company |

4.96% |

|

Netflix Inc |

4.79% |

|

Visa Inc |

4.76% |

|

PayPal Holdings |

4.49% |

|

UnitedHealth Group Incorporated |

4.35% |

|

Intuit Inc |

2.95% |

|

NIKE Inc |

2.76% |

|

Merck & Co |

2.43% |

|

Square Inc |

2.20% |

Mackenzie Global Women’s Leadership ETF (MWMN)

Launched in Dec 2017, MWMN follows an actively managed portfolio of 417 securities globally. The top geographic exposure consists of US (69%), France (8.5%), and Canada (4.9%). Sector-wise, the fund is more diversified with the top three sectors including financial (18%), technology (18%), and consumer discretionary (16%). MWMN manages just under $29 million in assets and trades on the NEO exchange. The annual MER fee sits at 0.61% with a distribution yield similar to SHE at 0.96%. As of Sept 30, 2021, the fund has returned 10.5% year-to-date, and 19.3% over the past year. MWMN holds the Mackenzie US large cap equity index ETF QUU, Mackenzie International ETF QDX, among large-cap names such as Microsoft, Amazon, and Estee Lauder.

|

Name |

Weight |

|

Mackenzie US Large Cap ETF QUU |

6.20% |

|

Microsoft Corp |

4.80% |

|

Amazon.com Inc |

3.90% |

|

Mackenzie International Equity ETF QDX |

3.10% |

|

American Water Works |

2.00% |

|

Lululemon Athletica Inc |

2.00% |

|

L’oreal |

1.90% |

|

Starbucks |

1.80% |

|

Principal Financial Group |

1.70% |

|

Ulta Beauty |

1.70% |

RBC Vision Women’s Leadership MSCI Canada Index ETF (RLDR)

This fund is the smallest of all with just under $15 million in assets. RLDR offers exposure to and tracks the MSCI Canada IMI Women’s Leadership Select Index focusing on Canadian companies that pursue leadership in gender diversity. RLDR charges an MER of 0.29% and has a low trading volume of just under 700 units. While we typically suggest avoiding such small funds, but RLDR holds large-cap stable Canadian companies, which almost mirror the TSX Composite and TSX 60. RLDR manages 144 securities and the top ten holdings account for nearly 50% of total exposure meaning a very concentrated exposure. The fund offers a higher than peers distribution yield of 2.89% which is understandable given that RLDR holds several Canadian banks and energy companies that pay high distribution yields. 32.8% of total assets come from the financial sector, 12.8% technology, and 12.6% from materials and energy, each. RLDR has returned 17.2% year-to-date and 30.5% over the past year. The top holdings look like:

|

Name |

Weight |

|

Shopify Inc |

8.80% |

|

Royal Bank of Canada |

7.30% |

|

Enbridge Inc |

6.40% |

|

Toronto-Dominion Bank |

6.30% |

|

Canadian National Railway |

5.00% |

|

Bank of Nova Scotia |

3.80% |

|

Brookfield Asset Management |

3.60% |

|

Bank of Montreal |

3.40% |

|

Nutrien Ltd |

3.30% |

|

Canadian Pacific Railway |

2.70% |

Investing in a gender diversity focused ETF is not the only way to get exposure to or advance female-oriented leadership. The funds above not only offer a way for this niche but can also search as a stock screener offering stock ideas in different regions, sectors, and niches. There is no guarantee that such a strategy will result in outperformance compared to the market, but given the undeniable data about female leadership, we would rather be on the side where the odds are with us.

Happy Investing!

Barkha Rani, Analyst for 5i Research Inc.

Barkha Rani, Analyst for 5i Research Inc.

Disclosures: Authors, directors, partners and/or officers of 5i Research have financial or other interest in AMZN, INTU, MSFT, NFLX, SBUX, SQ, and ULTA.

1] https://www.spglobal.com/en/research-insights/featured/when-women-lead-firms-win

[4] https://www.bcg.com/publications/2020/managing-next-decade-women-wealth

Comments

Login to post a comment.