Borrowing 101

Borrowing 101

Basic Terminology

- Amortization Period – Length of time required to pay off a loan.

- Balloon Payment – A large payment that is required at the end of a loan which offsets reduced payments throughout the life of the loan.

- Beneficiary – The debt lender.

- Borrower – The individual receiving the proceeds from a loan.

- Bridge Loan – A temporary loan (less than 12 months) intended to be paid off with proceeds from a sale of an asset.

- Co-Borrower – An individual who applies for a loan with another individual. Both individuals owning the loan.

- Collaterilzation – Using a tangible or intangible asset to back a loan.

- Co-Signer – An individual who agrees to pay back the loan if the primary borrower cannot. The co-signer is not a borrower of the loan.

- Credit Score – A numeric value that is assigned to an individual to rate their creditworthiness.

- Default – The inability or failure of a borrower to repay a loan.

- Downpayment – A payment that is made to reduce the amount of a required loan.

- Equity – The different in amounts between the market value of an asset and the current debt on that asset.

- Interest Rate: Two primary types of interest rates – fixed or variable.

Fixed Interest – A pre-determined and set interest rate that does not change.

Variable Interest – Changes throughout the life of the loan.

- Interest-Only Payment Loan – The loan has no set maturity date, interest payments are made throughout the life, and the principal is paid as a lump sum.

- Loan-To-Value (LTV) Ratio – The balance of the loan divided by the value of the asset.

- Non-Revolving Loan – The loan has a maturity date and the amount does not reset once paid.

- Pre-approval – Authenticiation of income and assets to determine eligiblity of loan amount.

- Principal – Payment towards the loan that reduces the balance.

- Refinancing – Paying off an existing loan and obtaining a new loan.

- Revolving Loan – No maturity date and the credit amount is available once paid off.

- Secured Loan – The loan is backed by a tangible or intangible asset.

- Term – Period for which interest rate is set for.

- Unsecured Loan – The loan is not backed by a tangible or intangible asset, but rather relies solely on the cash flow of the borrower.

Reasons for Borrowing Money

There are several reasons for an individual to borrow money:

- To purchase a new home.

- To purchase a car.

- To purchase a boat or other vehicle.

- Home renovations.

- Furniture or other large expenses for a home.

- College/University/other education.

- Starting a business.

- Buy an investment property.

- To purchase an equity or other investment.

The Different Types of Loans

For each unique purchase of asset or reason for borrowing, there are different types of loans available to an individual:

- Personal Loan (Line of Credit):

An unsecured loan backed only by the income of an individual. They are revolving loans, meaning that as the balance is paid off, that amount is made available for borrowing again. They can be used to purchase most items such as buying a TV, furniture, home renovations, or paying a bill.

- Mortgage Loan:

A non-revolving loan secured by the house that is to be purchased. The amortization period is usually 25 years, the term is usually 5 years, and the interest rate is fixed or variable.

- Business Loan:

Business loans can vary from a non-revolving loan to a revolving loan that is either secured or unsecured.

- Credit Card:

Similar to a line of credit, it is also unsecured and revolving. Credit cards can be used for everyday purchases such as food, bills, etc.

- Car Loan:

A non-revolving loan secured by the car that is to be purchased. The amortization and term are usually 5 years.

- Education Loan:

Education loans or student loans are available to pay for tuition or other educational needs. They are typically non-revolving and can offer subsidized options.

The Different Types of Lenders and Items Required for Qualification

- Banks

- Credit Unions

- Private Lenders

- Federal/Provincial Government

Items Required for Qualification

Note: Not all of these items will be required for each type of loan, but these are some key items that may be required on certain types of loans.

- Proof of stable income.

- Adequate savings or investments.

- Good credit history.

- Proof of any physical asset as collateral against the loan.

- Proof of bank balance history to show recent purchases.

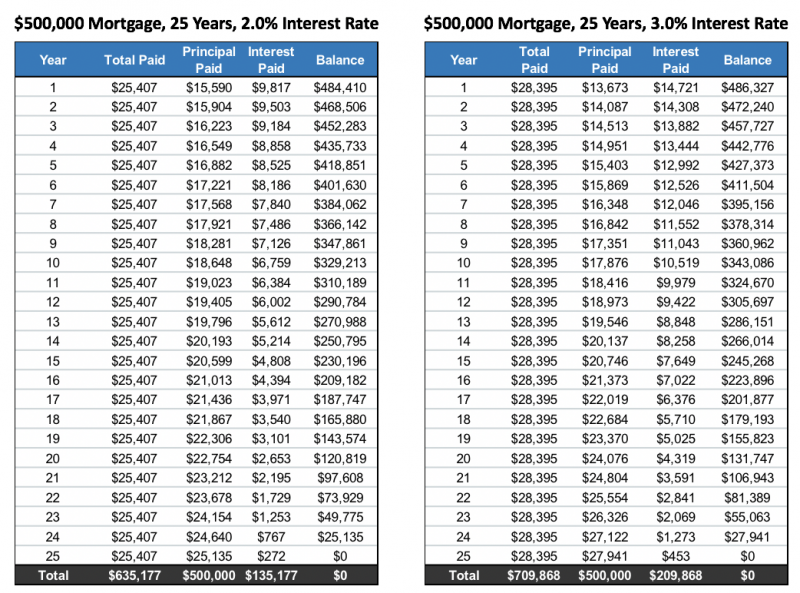

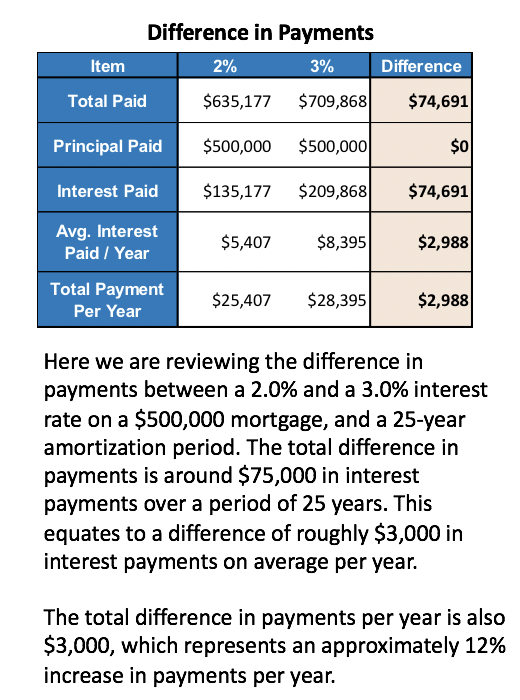

Interest Rate Sensitivity on a Mortgage

Now that we have reviewed the different types of loans and lenders, we can review some of the structural forces between interest rates, mortgage payments, and the loan balance

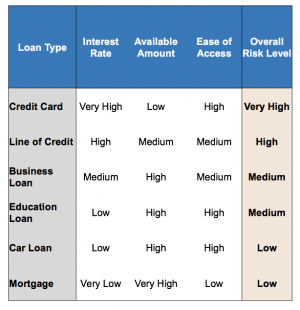

Lowest to Highest Cost Types of Loans

Below we will analyze which types of loans are the riskiest and pose the most financial harm to a consumer if used incorrectly. These rankings are based mostly off of ease of access and highest interest rates:

Credit cards are the easiest to access as most financial institutions will provide an individual that is 18 years or older with a credit card. There are very few requirements to obtaining a credit card, and the interest rates are very high.

Credit cards are the easiest to access as most financial institutions will provide an individual that is 18 years or older with a credit card. There are very few requirements to obtaining a credit card, and the interest rates are very high.

Lines of credit are fairly easy to access, although a good credit score and source of employment are typically required. Interest rates are much lower than a credit card, but are still high as it is an unsecured form of credit.

- Business loans are more difficult to obtain and require a business license and the interest rates are better as they are usually secured.

- Education loans are easy to access for most students and have a low interest rate.

- Car loans are easy to access as they are secured by the car, and interest rates tend to be low.

- Mortgages usually have some of the lowest interest rates and this is because the loan is backed by the house. House values have typically trended up, and so this gives the financial institutions more comfort in providing loans at a low interest rate.

Basic Guidelines and Principals to Borrowing

General Guidelines and Principals to Successful Borrowing:

- Do not borrow more money than one can reasonably afford.

- Ensure to make required interest (and principal payments if applicable) on time each month.

- If the loan re-payments are becoming too difficult to make, review personal budget and assess which expenses can be reduced or removed.

- Speak with the lender to assess if there are any options for reducing the interest rate or if debt consolidation is an option.

- Before taking on debt, review and assess if the debt is “good” or “bad”.

- “Good” debt can be considered anything that further enhances one’s financial situation (purchasing a house, renovations to improve the quality of one’s house, tuition for better education).

- “Bad” debt can be considered as anything that will have a detrimental impact on one’s finances and will not improve their overall financial situation. Examples can include short-term consumption (dining out too frequently, vacations that one cannot afford, electronics that are outside of one’s financial reach).

- Keep in mind interest costs and the relationship between interest expenses and debt balances. As interest payments are missed, they are added to the loan balance, and interest expenses will begin to increase.

Comments

Login to post a comment.