Go Johnny Go! Part #1

The late Sir John Templeton once said: “To buy when others are despondently selling and to sell when others are avidly buying requires the greatest fortitude.”

Today I’d like to present a bit of an “epiphany” I’ve had recently. It’s regarding where we are in the investment cycle and when we might see a final washout, assuming there is one to come. I believe this two-part series is one of those “important” pieces that I write once in a while. It’s a bit detailed, but the message I present here, in my opinion, is vital stuff for investors to understand!

We’re going to talk about the investment cycle, and how we can identify when the “bottom” of the current period of bearish/volatile market action may occur. For fun, this article will feature that most fearful of investors, “Johnny Dumb”. Johnny is the investor who consistently buys enthusiastically near market tops, and sells despondently near market bottoms. We’re going to examine Johnny’s habits to learn what NOT to do when you invest your money!

In part two of this two-part series, I’ll draw on some market history, and offer my thoughts in what to look for when we identify if the market is at or near a potential bullish reversal. Our job as investors is to find a point of maximum opportunity to invest our cash. I believe that moment is nearing. Let’s get started in our exploration of finding the point of opportunity by examining traditional bear market behavioural patterns, and comparing them to today.

Bear Markets Typically End In Capitulation

To start: True bear markets (as opposed to corrections) typically end in extremes of fear and capitulation. Last October, there were signs of investor capitulation seen in some of the sentiment indicators I watch. However, these indicators were not quite at that deep level of investor despondency often seen at the bottom of significant bear markets – such as the one we’ve witnessed over the past year. It is my view that we may not seen that capitulation and fear phase that might mark the end of the current bear market. Here’s why:

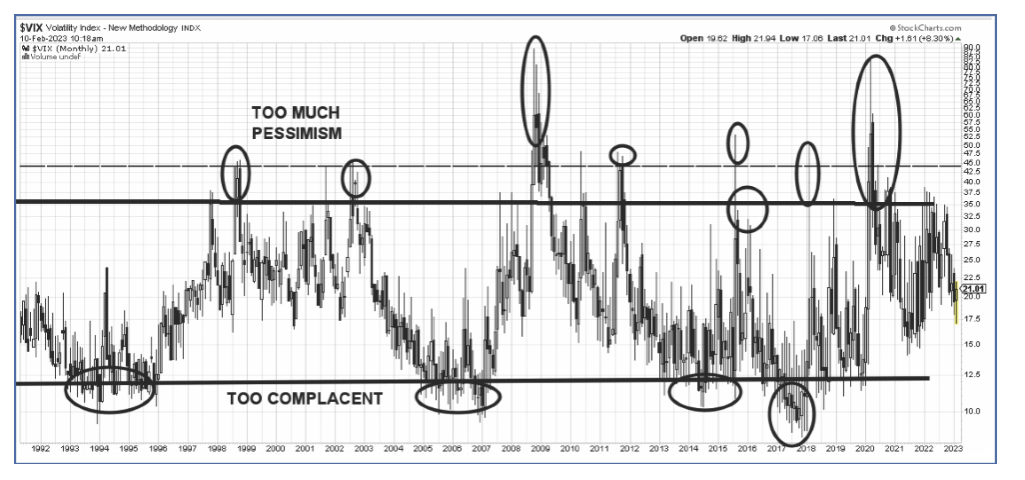

Quantitatively, we can measure sentiment indicators to spot a bear market’s “puke phase”. I covered most of these tools in my book Smart Money, Dumb Money. Two of the best indicators measuring sentiment extremes are the Put/Call ratio, the Smart Money/Dumb Money (sentimentrader.com) indicator, and the VIX. Both are useful in spotting that wonderful moment of fear & loathing in the market. The VIX is a favorite tool to spot those glorious moments of capitulation. It’s quite predictive. The VIX tracks option premiums. Higher market volatility, which typically happens in declining markets, means option writers want more premium. The chart below highlights moments of the VIX levels exceeding 35 as opportunistic. That said, a level of 45 (top black horizontal dashed line) is the more reliable level signifying the bottom of true bear markets.

See my red boxes on the VIX chart highlighting the moments of extreme fear during the major selloffs over the past quarter century. Sometimes, we will see quick tests of that 45 level. That’s typically when the market has seen a short or fast correction. Eg–

- 2015 (summer commodity selloff),

- 2018 (December selloff),

- 2020 (COVID bear market – crash in March, recovery by August.

Now, note the prolonged bear markets of 1999-2003, followed by the 2008-2011 period.

In 1976, sports commentator Ralph Carpenter noted that the baseball game is not over “until the fat lady sings”. Similarly, during significant corrections, or bear market bottoms, we saw single or multiple tests of 45 on the VIX at bottoms. To paraphrase Carpenter, bear markets are often not over until the VIX sings.

In the current bear market, we have barely seen 35 exceeded (see the chart below). Every “true bear” has tested 45. Perhaps we are setting up for the final washout to 45+ on the VIX in the coming months. There’s a decent potential that we have not yet seen the bottom of the current bear, if history is a guide. More on that below. And, by the way…history has been, in the case of the VIX, a darned good guide!

Some Background On The Current Bear Market

In 2022, we at ValueTrend raised a significant amount of cash in our equity models. We did not use that cash at any point to buy back into the market when the market rallied. We were convinced that these rallies were not “the bottom”. In fact, we believed they were typical rallies that would occur during a bear market. In other words, we felt they were “head fakes”. We were right in not getting suckered into these moves.

How ValueTrend “knew” the rallies in 2022 were head-fakes:

Truthfully: Nobody can “know” future market moves! However…ValueTrend uses studies, like the VIX noted above, to guide us. We utilize PROBABILITY analysis. I’ve often told investors, we cannot time the markets. But we ABSOLUTELY CAN quantitatively measure the approximate risk/reward trade-offs using our proven three-factor probability model. This is not market timing, or sure-thing fortune telling. This is about understanding the risk vs reward potentials. We use a quantitative probability model – which incorporates Trend rules, Risk/reward rules, and Fundamental factors to make assessments. If you go to the ValueTrend website (www.valuetrend.ca), you will see a link to an Online Technical Analysis course. It will teach you how to incorporate those risk analysis tools into your own system.

ValueTrend also incorporates qualitative “observational” analysis. For example:

Many investors speculated that the bottom had been seen during the two 2022 bear market rallies – first in July, then in October. Again…Bear markets end in fear, loathing, all hope lost, capitulation puke phases. Did you get that vibe before these two rallies? We didn’t. The media didn’t:

Bad News Is Good News

So, the media and market “experts” were telling us to be optimistic about a return to the bull market back in August, 2022. Time to get back in! Buy, buy, buy! This, well before the bear market was anywhere near over!

So, how are these “experts” feeling now?

Now that the market has declined, and struggles to gain a footing, the previous attitude of hope by market experts and participants seems to be changing. They are becoming more pessimistic, more despondent. Now, they feel that the end of the bull is farther away than previously hoped. Such bad news. So sad. So depressing. Why stay invested, they ask?

That’s good news!!

We need some good, wholesome fear, loathing and despondency to mark the bottom! Case in point: Open your favorite investment news site now, and read the headlines quoting the experts. Almost everyone is calling for a continuation of the bear market (now that we’ve been in one for an entire year). And that’s good news! History shows that a crowded trade, where everyone agrees, is soon to end.

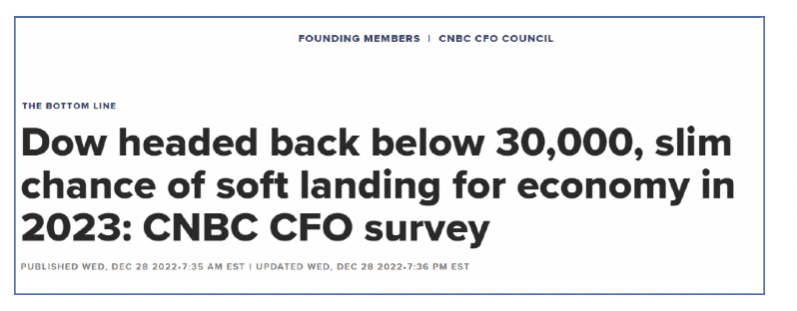

A couple of months ago, we were reading the traditional “Yearly outlook” writeups. Predictions for 2023 were coming out suggesting a weak or declining market in 2023 -Like this one:

Another example: Most of the first half of last year saw market pundits suggest that:

- inflation would be transitory,

- recession would be unlikely or mild,

- the afore mentioned trough & rallies were the bottom.

Lesson: Most experts aren’t experts, except at getting paid a lot to waste your time. They are reactionaries with track records that leave much to be desired.

The Bullish Setup For 2023:

- The headlines are gloomy. Experts are predicting flat, or lousy market returns- even negative returns for 2023.

- The “transitory inflation” cult has lost its voice. Now, we are seeing acceptance of entrenched inflation. Something that I have been preaching for almost three years. Old news for me.

- We’re also seeing Canadian and US governments, you know–the ones who were vehemently denying the likelihood of recession for the past 12 months (while I was suggesting it was almost impossible to avoid one..) are now saying “well, of course we are about to have a recession…”. Again: Old news for me.

Dr. Doom has entered people’s headspaces, and he’s just getting started messing with their minds. Fear is in the air, and its growing. Rejoice! That negative headspace is necessary for the bullish follow-up. Fear will continue to grow. “Get me out!”, says Johnny Dumb. Now he wants out, a year after the top (when he was bullish). Go, Johnny, go! We need him, and other Dumb-money investors, to panic and sell. This creates the final washout. Run, Johnny Dumb, run! You too, Forest.

This panic will drive sentiment indicators like the VIX to uber-high levels – like 45, or more. And therein lies the opportunity.

If you are not excited now, you are not paying attention. The puke phase is coming! Rejoice, those of you who continue to hold cash and defensive positions! With your cash, and Johnny’s panic selling, soon your greatest opportunity to earn profits will arrive. I’ll be back in the next issue with thoughts on what you need to look for in your quest to trade the current investment cycle profitably.

Keith Richards is Chief Portfolio Manager & President of ValueTrend Wealth Mgmt. He can be contacted at info@valuetrend.ca.

Keith Richards may hold positions in the securities mentioned. The information provided is general in nature and does not represent investment advice. It is subject to change without notice and is based on the perspectives and opinions of the writer only. It may also contain projections or other “forward-looking statements”. There is significant risk that forward looking statements will not prove to be accurate and actual results, performance, or achievements could differ materially from any future results, performance, or achievements that may be expressed or implied by such forward-looking statements and you will not unduly rely on such forward-looking statements. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness. Before acting on any of the above, please consult an appropriate professional regarding your particular circumstances.