Insights From ETFs: ETFs That Didnít Work Last Year

Not all that glitters is gold, so the saying goes. What was gold-hot and a “no-brainer” for many between 2019 and 2021 became a curse in 2022. These ETFs delivered outstanding returns before rising interest rates became a headline. It is no surprise that 2022 brought high inflation and steeply rising interest rates, marking a shift from a decade of low-interest rates. The shift triggered new lower valuation boundaries under which the market sold off sharply. Higher-risk, higher-growth sectors such as Technology and Consumer Discretionary saw sharp cuts in valuation and stock prices, while Energy, Defence and Consumer Staples have held relatively steady positions.

Before 2022, it was all about the best performers and stars of the stock market, and unfortunately, for 2022, the list of losers was longer than the list of winners. In this article, we look at the five worst ETF performers of 2022. As always, the list excludes leveraged and inverse ETFs.

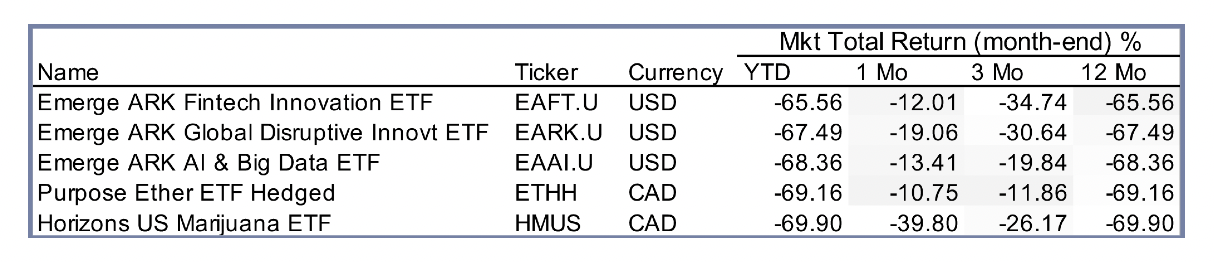

Emerge ARK Fintech Innovation ETF (EAFT): 1-year total return as of Dec 29th: -65.56%

It is no surprise that the top three of the five worst-performing ETFs are funds run by the infamous Catherine Wood, who became a sensational name in 2020 and 2021, delivering triple-digit returns in some years. The results were strong across ETFs managed by Ms. Wood. EAFT, in particular, focused on financial technology innovation, including changing payment infrastructure platforms and web-based intermediaries. The thematic exposure offered exposure to fintech innovations, including mobile payments, digital wallets, and peer-to-peer lending. The fund manages some 43 holdings, including many with operations focused on cryptocurrencies and blockchain. A significant number of companies held in the fund were pre-profit, meaning negative profitability and were/are years before they reached breakeven. While this premise seemed promising when debt was cheap, and growth was overvalued, this is not the case a year later. The top three holdings include Square Inc, Sea Limited, and Shopify Inc.

Emerge ARK Global Disruptive Innovation ETF (EARK): 1-year total return as of Dec 29th: -67.49%

Focused on innovation, EARK aims to offer disruptive, technologically-enabled new products and services that could potentially change the way things normally happen. As is the trend in thematic ETFs such as these, many companies are pre-earnings. As interest rates rose, interest in such “long-duration” investments (long-duration investments, refer to investments wherein an investor pays for earnings that will be earned by the company more than five years in future, if so.) diminished in favour of relatively safer sectors and asset classes. These are riskier bets considering the companies have no track record to speak of and can be considered a gamble on advancement. We are not against taking such bets, but we do emphasize the need for diversification in a portfolio rather than an overweight exposure to a certain theme. The top three holdings in the fund are Zoom Video Communications, Exact Sciences Corp, and Tesla Inc. Each of the three names gained over 100% after the 2020 March dip.

Emerge ARK AI & Big Data ETF (EAAI): 1-year total return as of Dec 29th: -68.36%

It might feel redundant to talk about yet another Emerge ETF that flunked in 2022; however, the trend is important to note. It is not always the trends that continue as expected, and with a shift in investors’ approaches toward investments, the decline in trading prices was sharper than expected.

Thematic ETFs have been hit particularly hard as boring safer holdings regained popularity during the market turbulence shown in 2022. The shift in approach toward investments came from abandoning riskier assets to preserve capital and lock gains over the cost base. While artificial intelligence (AI), big data, and cloud services are still hot topics today, investors are less willing to pay a premium considering the long-dated nature of benefits and shrinking capital expenditures across sectors.

Many of the top ten companies held in the fund overlap other ETFs mentioned in this list. The top three holdings in EAAI include Zoom Video Communications, Block Inc, and Roku Inc. All holdings exhibit high beta, which explains the high volatility shown in 2022.

Purpose Ether ETF Hedged (ETHH): 1-year total return as of Dec 29th: -69.16%

2019 to 2021 gave birth to numerous crypto-related products and avenues to invest in the sector. Many products thrived in the growing “bubble”, and it was a topic of discussion in many gatherings.

When it comes to cryptocurrencies, many have polarized views, with one segment extremely “pro-crypto” and the other ignoring the asset altogether. The frenzy has been hard to ignore across developed and developing countries alike. In 2022, however, it was not the best year for cryptocurrencies. There was no shortage of continuous negative headlines (almost every month) for the industry, including high-profile bankruptcies, exposure of extremely high leverage, and erroneous currency-pegging-revaluation (Luna).

While there is no shortage of ETFs involved in crypto-servicing, such as mining, transactions, digital wallets, and such, ETHH is a commodity ETF that allows investors to hold physically settled Ethereum units after a transaction. This was a first of its kind and allowed retail investors to easily invest in the currency without the hassle of external coin brokers, which may have included a fair bit of scam. The ETF allows investors to skip the hassle of managing the currency within a digital wallet and protect against crypto thieves.

Along with the ability to hold the currency directly, the ETF was also TFSA/RRSP eligible, making it more tax-friendly and boosting its popularity. As is frequently said in the cryptocurrency world, it is likely that currencies are experiencing a crypto winter, but there is no doubt that these riskier assets are an alternative but not equivalent to fiat currencies .

Horizons US Marijuana ETF (HMUS): 1-year total return as of Dec 29th: -69.90%

Following the legalization of cannabis in Canada in late 2018, the demand and popularity of marijuana-related stocks skyrocketed. The hoarding of permits, real estate for cannabis, and supplier contracts sent many investors paying high premiums for the industry as a whole, looking south of the border as cannabis legalization began taking place state-by-state rather than on a federal level.

This gave birth to the world’s first U.S.-focused marijuana index ETF, HMUS. The fund is comprised primarily of marijuana or hemp production and distribution companies and provides exposure to over 30 American companies within the industry. However, since 2021, hard facts about the industry began to surface, including low margins, demand not as high as expected, stalled production and a thriving illegal market. The short-lived bull run has been seeing a decline since 2021, and 2022 was no exception.

The point of this is not to deter anyone from investing in thematic or niche ETFs but rather to emphasize the importance of diversification and discipline in investing. When all is good and glorious, it is easy to get caught up in the hype and difficult to find a realistic standing. Sometimes storms pop up when you least expect them, and after the storm has passed, many trees are uprooted, exposing their roots.

Barkha Rani, CFA, Analyst for 5i Research

Disclosure: Authors, directors, partners and/or officers of 5i Research have a financial or other interest in XIT and ZRE.