Beating the TSX 2022/2023 Update Dividend Durability Prevails Again

So long, 2022. Don’t let the door hit you on the way out.

Many investors feel burned by the past year. Household mega-cap tech stocks like Meta Platforms (Facebook), Amazon, and Netflix crumbled before our eyes. Crypto-currency investors did even worse; at this point, over half of Bitcoin investors are in the red. But the pain was not limited to a few risky sectors. Even balanced portfolios got sucker-punched; never before have stocks and bonds suffered 10%+ declines in the same year. There was no escape.

But as we bid farewell to 2022 and step cautiously into 2023, the chest tightness and sweaty palms are probably still with you. Inflation is battering our bank accounts and undercutting the real value of our long-term savings. Central bankers have all but promised a recession. And COVID just refuses to go away.

What do you do as an investor when surrounded by so much uncertainty?

Very little, I hope.

When “Normal” Doesn’t Feel Good

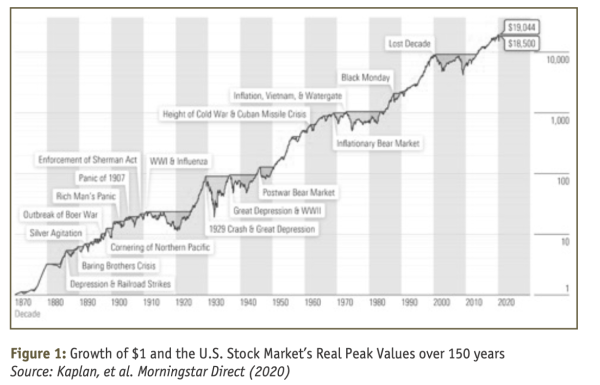

I suggest taking a step back and realizing that 2022 was normal. That’s right. The details differ from year to year, but uncertainty is normal. Periods of high inflation are normal. Bear markets are normal. Political turmoil is normal. They don’t always happen simultaneously but, then again, sometimes they do. Being a stock investor might feel like you’re playing in traffic but, guess what—stocks live and grow through dangerous and uncertain times. Figure 1 is one of my favourite charts showing that they always have and always will.

If you have designed your investment plan with any reasonable amount of historical context in mind, it was made for this. The success of your plan hinges on sticking to it through the hard times even more than reaping benefits in the good times.

One of the greatest advantages of being a dividend investor is focusing on income rather than stock prices. You can reinvest that income or use it to put food on the table, but the point is this: while stock prices change quickly (and, as we’ve seen, bond prices can too), dividends from blue-chip companies have very little volatility, and, in general, they go up.

There is significant evidence that dividend-paying stocks have historically outperformed non-paying stocks in Canada and worldwide. But how can individual Canadians build a portfolio of high-yield dividend-paying stocks?

Enter Beating The TSX

Created by David Stanley in the 1990s, BTSX is a simple method anyone can use to identify Canadian blue-chip dividend-paying stocks that might be worthy additions to your portfolio. I’ve been using the method personally since 2008 and writing about it since 2018. Here is the process:

- 1. List the stocks on the TSX60 by dividend yield.

- 2. Purchase the top ten yielding stocks in equal dollar amounts.

- 3. Hold for a year and repeat.

The method usually results in a portfolio of stocks with several appealing characteristics:

- They are large and usually stable companies with low volatility.

- They have a high dividend yield.

- Most have a long history of stable and growing dividends.

- They are often purchased when their stock prices are depressed.

Beating The TSX 2022 Results

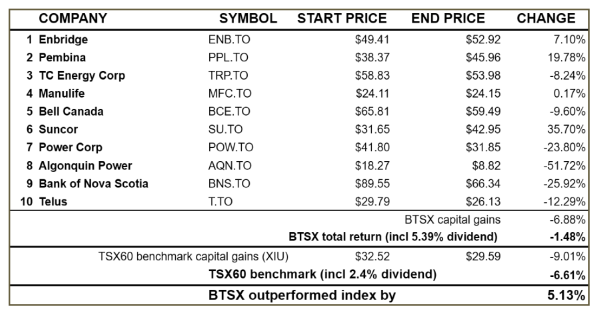

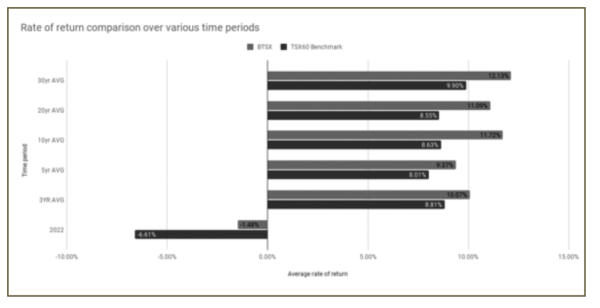

A year ago, I had the pleasure of writing about 2021 which was one of BTSX’s best years, with a total return of 41.7%, beating the index by 13.9%. After a year like that, I was mentally prepared for some reversion-to-the-mean pain, but BTSX has come through again with a total return (price + dividends) of -1.48% vs. -6.61% for the benchmark TSX 60 index, represented by the iShares S&P/TSX 60 Index Exchange-Traded Fund (ETF) (XIU).

Until the last few weeks, BTSX was still in positive territory, but the recent AQN (Algonquin Power and Utilities) debacle narrowed the gap between our portfolio and the index and put BTSX in the red for the year. The result is that BTSX still beat the index by 5.13% even though both are in negative territory.

Variability Among BTSX Stocks

Many of us consider BTSX stocks a homogeneous group, but it’s instructional to see how variable the returns are within the portfolio in any given year. This year the gap between the biggest winner (Suncor) and the biggest loser (Algonquin) is a whopping 88%. As I have been in the past, you might be tempted to try to predict who the winners and losers might be ahead of time and apply some kind of filter. But I have found that, more often than not, my efforts are rewarded with a nice big piece of humble pie rather than superior returns. The simple and perhaps unsurprising truth is that BTSX is better than most mutual fund managers at selecting stocks (net of fees), but it has also done much better than me. Rather than being disappointing, I have found this to be liberating.

Thirty-Five Years Of BTSX Returns

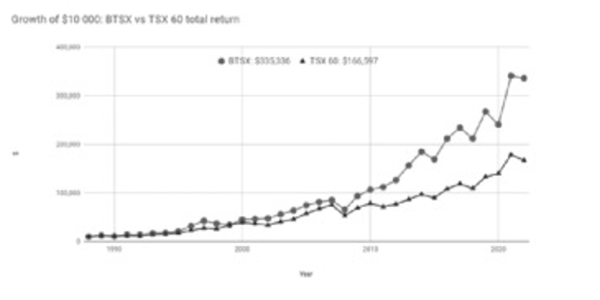

Why liberating? Beating the TSX has had its ups and downs, but the long-term performance of this simple, hands-off approach has been nothing short of spectacular. If you had invested $10,000 in BTSX stocks 35 years ago, you would now have $335,336—over double what a TSX60 index investor would have (in both cases total returns re-invested).

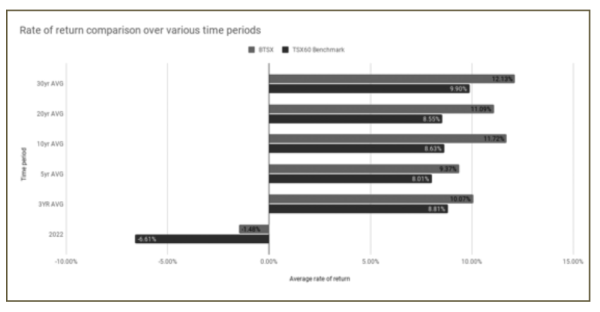

What about periods between one year and 35 years? Beating the TSX has beaten the index over the last 3, 5, 10, 20, and 30-year periods. How many mutual funds do you know with a track record like this?

Realistic Expectations

If Beating the TSX was a mutual fund, the fund company would be plastering those long-term performance numbers all over the place. But I’m not selling a portfolio. My goal is to help other Do-it-Yourself (DIY) investors and the best way to help is to provide balanced information. If you’re considering using BTSX, you’ll be more effective if you understand a few challenges and limitations:

- It can be hard to hold BTSX stocks. The overall long-term results have been great, but, as you can see from 2022, some stocks are going to fall in price, sometimes by a lot.

- Some stocks may cut their dividends. This didn’t happen in 2022, but it does happen on occasion and investors should have a plan for this.

- BTSX stocks tend to be concentrated around a few sectors, so further diversification is warranted.

- BTSX stocks don’t always beat the benchmark.

The last point is particularly important: Beating the TSX is not a sure thing. I talk to many investors keen to use the BTSX method based on the long-term outperformance. But some haven’t appreciated that BTSX, like any investment strategy, has, and will continue to have, periods of underperformance. The following chart shows how BTSX has performed relative to the TSX60 index year by year; 2022 is at the top and 1987 is at the bottom.

Just like any stock investor should be prepared for prolonged downturns in equity markets, BTSX investors should be prepared for periods of underperformance, particularly in the short term. But as Charlie Munger has said, “It's waiting that helps you as an investor and a lot of people just can't stand to wait.” Those who have waited out the rough patches have been rewarded.

The good news is that, when it comes to volatility, dividend investors have a secret weapon. OK, it’s not much of a secret: our dividends protect us. How? When you’re investing for dividends, those payments are what matter, not the stock price. And the only way to keep those payments coming is to buy and hold. This is a powerful behavioural aid helping us to stay the course when times get tough which, as we all know, is one of the biggest factors in successful investing.

BTSX Dividend Income

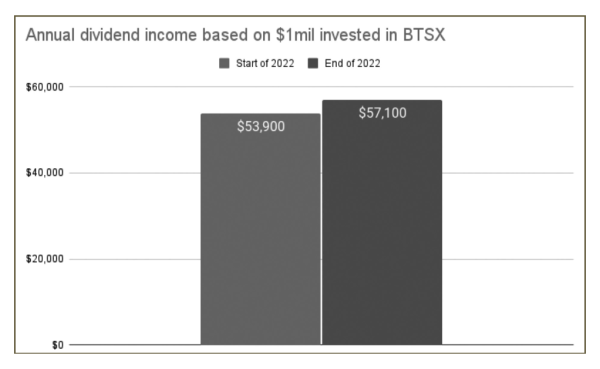

2022 was another good year for BTSX dividend income. Eight out of the ten stocks raised their dividends during the year, with average dividend growth for the portfolio of 6%. If you were lucky enough to have $1 million invested in our 2022 BTSX portfolio, your anticipated dividend income at the beginning of the year would have been $53,900. By the end of the year, thanks to dividend-growth, that income rose to $57,100. How’s that for inflation protection?

Beating The TSX 2023

The media will keep feeding us reasons to be fearful: COVID, inflation, recession, etc.—that is how they keep our attention and, therefore, their advertising revenue. But when has there ever been a period without uncertainty? The only certain thing is uncertainty.

But decisions made under stress are almost always worse than those made with a clear head. So, take a step back, and ask yourself two simple questions:

- 1. Do I have a clear investment plan? and,

- 2. Is it designed to carry me through the uncertainty?

The best thing about Beating the TSX is this: it is simple, rules-based, and transparent. No special skill is required, no paywall, and no need to adjust the plan based on world events or business cycles.

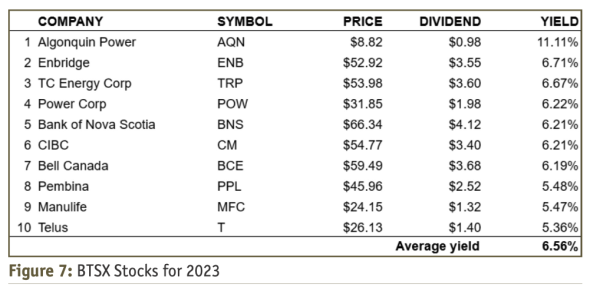

Whether you’re already using BTSX or new to the game, this year’s list of stocks is generated based on closing prices and yields on December 31, 2022.

2023: Enter With Caution

I’ll end this update with a word of caution. AQN sits at the top of this year’s list with a yield of 11%. The yield is so high because AQN’s stock price has been cut in half in recent months. As I write this on 1 January 2023, the board has not announced a dividend cut, but that seems to be what the market is expecting and, I wouldn’t be surprised by one at all.

So, when constructing your portfolio for 2023, remember that dividend yields are not a promise of future income. Rather, they are simply a reflection of the latest dividend announcement from the company’s board. BTSX is a tool to identify potential investments, not an instruction manual.

If you are not comfortable owning AQN or other stocks on the BTSX list, that’s okay. You can simply leave them out, go to #11 from the TSX 60 list (currently EMA), or perhaps seek a good dividend-growth stock from another sector to improve your diversification. Whatever your choice, it is important to build the portfolio you will be able to stick with through the inevitable uncertainty we will all encounter.

I wish you all the best in 2023!

Matt Poyner is a DIY investor, flat-fee financial mentor, and blogs at DividendStrategy.ca.