The Benefits of Tax Loss Selling

How Capital Gains And Capital Loss Taxes Work

Canadian investors that own financial assets outside of a registered account (Tax-Free Savings Account [TFSA], Registered Retirement Savings Plan [RRSP], Registered Education Savings Plan [RESP], etc.) are required to pay income tax on any capital gains that they realize within a tax year.

Capital gains are defined as the increase in value above the cost basis for an investment that has been realized upon the sale. When Canadian investors sell equities that have increased in value above their cost basis in an unregistered account, they must pay income tax on this increase in value.

A capital loss occurs when an investor sells an asset that has decreased below the cost basis of the investment. Realized capital losses can be used to offset any capital gains and thus decrease an investor’s income taxes. One technique that many investors use is to sell an asset that has decreased in value to realize that capital loss and repurchase the stock 30 days later (to avoid the wash sale rule).

In this blog, we are going to analyze the benefits of realizing capital losses to reduce taxable income and buying back 30 days later, compared to the potential missed opportunities of returns in that 30-day period. In other words, at what levels of stock declines are the benefits of a tax loss worth taking the risk that the stock might increase over the next 30 days.

Analysis Assumptions

First, we need to set out a few assumptions for our calculations before diving into the analysis. In the following analysis, we use the 2022 Federal income tax brackets and the 2022 Ontario income tax brackets. Only 50% of capital gains are taxable, and only 50% of capital losses can be used as an “allowable capital loss”.

Part One: Capital Losses And Allowable Capital Losses

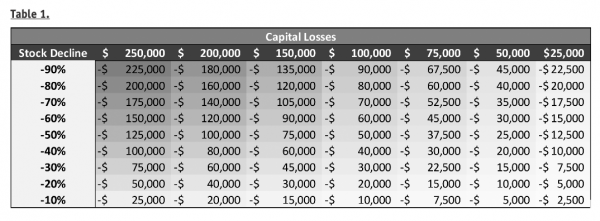

In the table below, we analyze what the capital loss amounts are for an investment in a stock ranging from $25,000 to $250,000 and loss percentages ranging from -10% to -90%. We can see that a -90% decline on a $250,000 investment leads to a -$225,000 capital loss, and a -10% decline on a $25,000 investment leads to a -$2,500 loss.

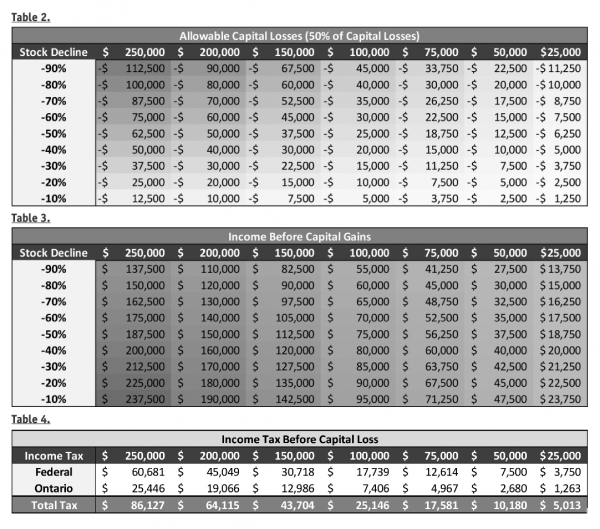

Next, we are going to show the allowable capital loss amounts on these same investments. Allowable capital losses are the amounts that can be used to offset any capital gains on an investor’s taxable income. Below are the amounts for allowable capital losses (50% of the capital loss amounts from table 1).

Part Two: Income Levels And Income Tax

Now we are going to look at the hypothetical income levels of these individuals. For simplicity’s sake, we assume that for every $1 that an individual has in allowable capital losses, they also have an equal $1 in capital gains to be offset. For example, an individual that has invested $150,000 and has seen a -20% decline in price has a capital loss of -$30,000, an allowable capital loss of -$15,000 (50% of capital loss), and therefore has an income level of $135,000 and a taxable capital gain of $15,000, for a total taxable income of $150,000 before applying allowable taxable losses. The table below showcases the relevant taxable income levels for each individual after applying the allowable capital loss.

For each of the above individuals, their incomes are highlighted in yellow/green, but their total taxable incomes, including taxable capital gains but before capital losses, are listed in the top row ($250,000, $200,000, $150,000, etc.). Using the total taxable incomes from the top row and the 2022 Federal and Ontario tax brackets, we have calculated the total income tax amounts listed below (Table 4).

Part Three: Tax Savings And The Required Increase In Stock Prices

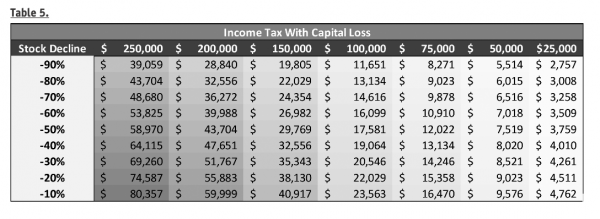

Now we’ve arrived at the fun part. We have calculated the revised total income tax amounts after offsetting taxable capital gains with our allowable capital loss amounts from table 2. The table below highlights what an individual’s revised tax amounts will be after applying the capital loss amounts.

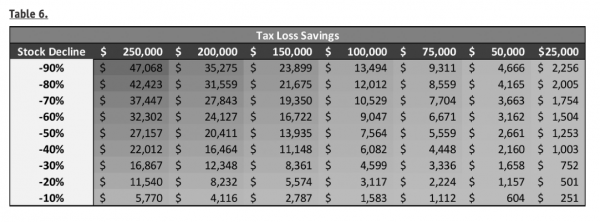

The revised tax amounts from above can then be contrasted against the tax amounts prior to applying a capital loss from Table 4. Below we highlight the tax dollars that an individual might theoretically save by applying the relevant capital losses.

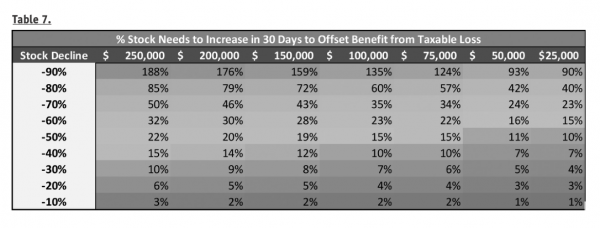

Finally, we look at what percentage a stock will need to increase within a 30-day period to offset the taxable benefits from realizing a capital loss. We see in the table above that if an individual invested $250,000 and witnessed a -90% decline in value and realized and applied the capital loss, they would have saved ~$47,000 in taxes. The table below demonstrates that the stock would need to increase roughly 3X (188%) in order to offset that individual’s decision to sell and wait 30 days to buy back. The math behind this is that after a -90% decline in a $250,000 investment, it is then worth $25,000, and to gain ~$47,000 (amount saved on taxes), the investment would need to increase ~3X from $25,000 to $47,000.

Table 7 demonstrates that at low levels of capital losses (-10% to -30%), the stock only needs to increase between 1% and 10% over the following 30 days to offset the decision to tax-loss sell and repurchase. In today’s environment, a 10% move is becoming increasingly more frequent, as the market is heightening in volatility, and big moves in either direction have been occurring more often. At greater than a -30% decline in stock price, we believe that the decision becomes a bit easier as the stock needs to increase at a faster rate.

We hope that this helps to provide investors with some insight into which levels may be appropriate to conduct a tax-loss sale at. Please note that we are not tax professionals, and some of these values and amounts will differ from province to province and individual to individual.

Chris White, CFA, Analyst for 5i Research Inc.