The Devil Is In The Taxable Details: Understanding Different Types Of Investment Distributions So You Can Make Your Money Go Further

When the rubber hits the road, what really matters when you sell your investments or get paid along the way, it is what is left in your back pocket after you’ve paid all fees, expenses and taxes. Although making investment decisions purely for tax reasons can be an invitation to disaster, failing to take tax into account when making investment decisions or deciding the right person or account to hold that investment can also be like driving with your eyes closed. More specifically, it can mean paying our friends in Ottawa more than their fair share, as it prevents you from taking steps to minimize your tax pain in advance or making different investment choices.

When the rubber hits the road, what really matters when you sell your investments or get paid along the way, it is what is left in your back pocket after you’ve paid all fees, expenses and taxes. Although making investment decisions purely for tax reasons can be an invitation to disaster, failing to take tax into account when making investment decisions or deciding the right person or account to hold that investment can also be like driving with your eyes closed. More specifically, it can mean paying our friends in Ottawa more than their fair share, as it prevents you from taking steps to minimize your tax pain in advance or making different investment choices.

Just as importantly, it can also wreak havoc for budgeting and retirement planning purposes, particularly if you’re receiving Old Age Security (OAS) or Guaranteed Income Supplement (GIS) payments that are affected by your taxable income. Although retirement projections are largely educated guesses at the best of times due to the number of different variables thrown together in your retirement blender, failing to properly consider how your non-registered investments are taxed can mean the difference between making an educated guess and picking random numbers out of the air.

The Basics

I won’t say much about interest income and other types of investment income that get taxed in largely the same way, such as pension income, Registered Retirement Savings Plan (RRSP) or Registered Retirement Income Fund (RRIF) withdrawals and rental income. In a nutshell, it is 100% taxable, net of any expenses you incur to earn that income, such as interest paid on your rental’s mortgage. You might get a small tax credit for earning income from a work pension or also from a RRIF after age 65. Likewise, you might get credit on tax paid on foreign income, but the bottom line remains you pay the most tax per dollar on these sources of income as compared to capital gains, return of capital and eligible dividends.

On the other extreme, for many Canadians in lower tax brackets, eligible dividends are the most tax efficient way of receiving investment dollars. “Eligible dividends” are those paid from Canadian public companies or funds that own such companies. In order to make them more appealing to investors, our government provides a tax credit to recipients that can actually make them better than tax-free money for some Canadians since the credit can exceed the amount of tax owing!

Let’s say the company paying the dividend originally earned $100. It would have to pay perhaps $27 in tax on this money and would only have $73 left to pay out in eligible dividends. The government wants the shareholders earning these dividends to be approximately in the same position as if they’d earned the original $100 made by the corporation and had the money taxed in their hands like interest or business income. To make this happen, the $73 in actual dividends received by the investor is multiplied by 1.38 for tax purposes, which equals $100.74, and the shareholder is taxed on this amount as investment income. This amount is fully taxed just like interest.

Sound like a bad deal rather than a good one? Well, this is where the enhanced dividend tax credit comes in. To balance the scales, the shareholder who receives only $73 but was taxed on $100 also gets a credit that essentially credits him for paying the $27 dollars paid by the company in the first place, which is deducted from their taxable income.

So how is this better than tax-free money, you might ask? Clients in lower tax brackets would have paid less than $27 on $100 in interest earnings. For example, if Bob in Vernon (I use B.C. tax rates throughout this article) had $35,000 in other income before receiving his $73 in dividends, he is in the 20.06% tax bracket. Since the company paying the dividend had already paid 27% tax, the government has received more in tax dollars than would have been paid if Bob received $100 directly. Accordingly, lucky Bob can now claim a tax credit of seven dollars (or 9.6% of $73). The only catch is that if someone doesn’t owe any additional taxes that year or their dividend tax credit exceeds their tax bill, then the rest of the credit is wasted in most circumstances. In other words, you can use the dividend tax credit to reduce your taxable income to zero but not to a negative amount.

The other major source of investment loot is from capital gains, or from growth in the value of an investment rather than from payouts along the way. Although taxpayers in the lower tax brackets would usually want eligible dividends for the reasons just discussed, capital gains are still a lot better than interest income, as only 50% of the total increase in value, net of costs is included as income. In other words, for every dollar in gains, 50 cents are always free and the other is taxed as income like interest. Moreover, if you sell investments at a loss, you can apply 50% of the loss against current and future capital gains. If you’re so inclined, you can even go back in time up to three years and apply the losses against past gains, which might be really helpful if you were in a much higher tax bracket during those years past.

As I’ll discuss below, capital gains become more and more appealing the higher your taxable income. In B.C., if your taxable income exceeds about $148,000, capital gains are taxed at a lower rate than eligible dividends for your next dollar of earnings. Moreover, for seniors earning OAS pensions, you are probably better off making your last dollar a capital gain rather than a dividend once your taxable income exceeds about $95,000. If you’re receiving other means-tested benefits, like the GIS, be careful about earning eligible dividends as well—the 138% gross up for income tax purposes can reduce these income-related benefits far more quickly that capital gains. If in this situation, then eligible dividends might become more of a foe than a friend.

The other thing that is so wonderful about capital gains is that you only pay when you sell your investment or there is a sale inside your mutual or segregated fund. That means you can control when you trigger your tax bill and that there is more money left to compound along the way. I’ll have a lot more to say about capital gains and savings strategies in my next article.

Finally, don’t forget about return of capital. Some investments, like Real Estate Income Trusts (REITs) and corporate class mutual funds (depending on how they are affected by the new corporate class rules) can pay you tax-free dollars every year regardless of your tax bracket. For tax purposes, it’s treated like you’re receiving some of your original investment dollars back rather than any of the three other types of distributions just discussed. That means you have more money to reinvest or to spend on that new set of golf clubs since no tax is deducted from these payments along the way. There is a catch, however, as every dollar you receive in return of capital is subtracted from your original purchase price for the purpose of calculating your eventual capital gain on sale. Thus, as they say, save now and pay later. Although it could mean a spike in your taxable income in the year of sale, it can often still be worth the later pain if it means years of savings until that day of reckoning finally comes, particularly if you are able to do some of the tax planning I’ll discuss next time.

Dividends, Capital Gains And The OAS Clawback

In general terms, your OAS pension is reduced by 15 cents for every dollar in which your taxable income exceeds a set amount, which is currently around $75,000. On the other hand, as discussed earlier, 138% of the eligible dividends you actually receive are included as income while only 50% of capital gains are added to the mix. Although you still get that wonderful dividend tax credit to apply against your tax bill when earning dividend income, this credit isn’t considered for clawback purposes.

Thus, every eligible dividend dollar you receive reduces your pension by 20.7 cents (15 cents x 138%) while every capital gain dollar you get when you’re in the clawback zone only reduces your pension by 7.5 cents (50% of 15 cents). This 13.2 cent spread isn’t as significant as it first appears, since you would have lost some of those 13 cents to tax anyway, so you might have been out of pocket only between perhaps seven to ten cents depending on your tax rate. All the same, this can mean that capital gains become more tax efficient for some retirees as soon as their taxable income reaches about $95,000 in B.C. for as long as they’re in the clawback zone.

The Benefits Of Only Including 50% Of Your Capital Gains

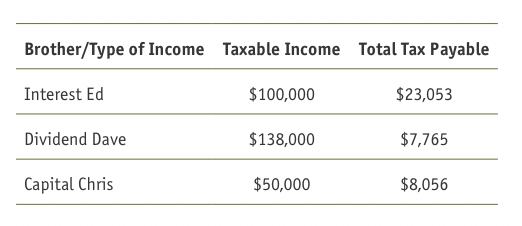

Another huge and often overlooked benefit to capital gains is that, since only 50% of your gain is included income, you can earn a lot more of them than other types of income before having to pay tax in a higher tax bracket. For example, assume 50-year-old triplet brothers in Terrace, B.C. each earned exactly $100,000 in 2019 from all sources, one entirely in interest, one just in capital gains and the third got paid exclusively in eligible dividends. Their results would be as follows, after grossing up the eligible dividends by 138% and including the dividend tax credit, and only including 50% of the total capital gain of $100,000:

Here are some key takeaway points from this comparison:

- Ed paid almost three times as much tax as Chris since Ed was forced into the higher tax brackets sooner. Thus, although it is commonly thought that investors earning interest will pay only twice as much tax as those earning capital gains, this is only true if the extra taxable interest income doesn’t push poor souls like Ed into higher tax brackets. In this case, most of Chris’ income was taxed at the lowest rate while Ed was at a level where tax rates start to get really depressing. To make matters even worse, if Ed was earning his OAS pension, he would have been well into the clawback zone, thus increasing his total tax hit, while Chris would still be cashing his full OAS pension cheques.

- Although Dave would still pay less tax than Chris until they were both earning around $160,000 in their different forms of income, after that point Dave would fall behind quickly, as Chris would still be in the lower tax brackets while Dave would be inhabiting high tax country. Plus, over about $154,000, dividends are taxed at a higher rate than capital gains anyway. Thus, even if the brothers both had taxable incomes of $154,000, capital gains are taxed at a lower rate from that point onward anyway. Dave would pay 25.92 cents on his last dividend dollar if his taxable income was $154,000 and Chris would be out 22.9 cents on his last dollar of capital gain if his taxable income was the same.

- Dave only paid slightly less tax than Chris even though eligible dividends are extremely tax efficient for lower income earners. If both Dave and Chris received the maximum yearly OAS pension of $7,217.40 as of June 2019 on top of their other income, Dave would have actually paid a lot more tax than Chris. Dave’s total tax hit, including the clawback, increases to $14,982 while Chris’ tax bill would only increase to $10,091. This also ignores that Chris would often have control about how much and when he realized his capital gains in order to get the best possible tax result while Dave doesn’t have that flexibility.

- It’s important to crunch the numbers for each case. I love to use the taxtips.ca website for their tax calculators, such as the following investment income calculator that also calculates the OAS clawback: https://www.taxtips.ca/calculators/invest/investment-income-tax-calculator.htm.

Conclusion

At the end of the day, it’s not what you make, but what you keep that matters. Taking the time to first understand how different types of income are taxed and then applying these general rules to your specific situation can go a long way to making more informed investment decisions, reducing your tax bill and more accurately budgeting for retirement. Next time, I’ll talk about strategies you can use to when investing for capital gains to stretch those hard-won investment dollars even further.

Colin S. Ritchie, BA.H. LL.B., CFP, CLU, TEP and FMA is a Vancouver-based fee-for-service lawyer and financial planner who does not sell investment or insurance, just advice. To find out more, visit his website at www.colinsritchie.com.