Bond ETFs Versus GICs

At 5i Research we often get questions from subscribers on whether they should invest in bond exchange-traded funds (ETFs) or Guaranteed Investment Certificates (GICs) and the degree of safety bonds have compared to GICs, timing the bond market and getting the right equity/ bond/GIC mix. In this piece we hope to clear up some of the recurring misconceptions and answer some overarching questions investors have. Let’s start with the basics.

At 5i Research we often get questions from subscribers on whether they should invest in bond exchange-traded funds (ETFs) or Guaranteed Investment Certificates (GICs) and the degree of safety bonds have compared to GICs, timing the bond market and getting the right equity/ bond/GIC mix. In this piece we hope to clear up some of the recurring misconceptions and answer some overarching questions investors have. Let’s start with the basics.

Basic Differences

Purchasing a bond essentially means you are lending a sum of money (principal) to a bond issuer (borrower) in exchange for a coupon payment until a specified maturity date, at which point you will receive your principal back. However, it is difficult for the average investor to invest in a single bond issue due to demanding sums of money required, so individual investors need to resort to the arguably better option of a diversified basket of bonds through ETFs (or mutual funds). GICs on the other hand are much simpler. Your funds are guaranteed not to fall below your principal amount and increases in value at a predetermined rate. However, funds are typically not accessible during a locked-in period. GICs also come in fewer types than bonds (i.e. redeemable, nonredeemable and market-linked) and all have a principal risk level of zero. GIC investors are typically interested in non-redeemable types as they tend to pay the highest guaranteed rates. Bond ETFs, on the other hand, come in all sorts of varieties (fixed or floating rate, government, corporate, high yield, different geographies, inflation-linked etc.). Bond ETFs also have more considerations than GICs do, such as duration (interest-risk) and credit quality (credit risk) resulting in varying risk levels among bond funds.

The Case For GICs

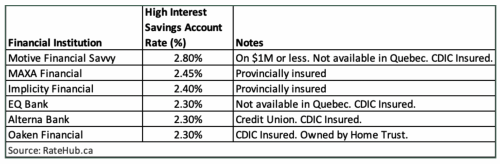

Now that interest rates have less room to fall (assuming a floor of 0%), bond prices have less room to rise. This is a pretty sound argument for owning GICs since they do not experience any capital appreciation or depreciation as a result of changes in interest rates. The other case that can be made for GICs is related to duration. Bonds with higher duration have higher interest rate risk so they are subject to more fluctuations if interest rates change. For example, when interest rates were hiked four times in 2018; Vanguard Canadian Short-term Bond Index ETF (VSB). Vanguard Canadian Aggregate Bond Index ETF (VAB) and Vanguard Canadian Long-term Bond Index ETF (VLB) with durations of roughly 3, 8, 15 years returned 1.65%, 1.13% and -0.39% respectively. Bond investors who can barely stand the idea of bonds having a negative year are likely better off with bonds with shorter durations, but this also translates into lower coupon rates. One of the more common questions we get about bonds and GICs is: what are the closest bond funds to GICs in terms of principal safety? For this we often suggest short duration North American government bonds like iShares 1-5 Year Laddered Government Bond Index ETF (CLF) or iShares 1-3 Year Treasury Bond ETF (SHY), which have the highest credit quality available in the bond market and lowest duration (usually 3 or less). Of course, investors should come to terms with the fact that more safety and lower risk means lower yield as these funds yield around 2.00-2.25%. Another ETF we often suggest to our members at 5i is the Purpose High Interest Savings ETF (PSA) which gives the same safety as a savings account, but without CDIC deposit insurance. In terms of safety, this is about as close as you can get to a GIC and as far rate is concerned, PSA has an effective yield of 2.15%. Not bad when comparing to current rates on deposit accounts and that the fund is fully liquid. For GICs, durations are much shorter and generally do not exceed 5-years. However, shorter duration for GICs serves as an advantage not because it reduces interest rate risk (since GICs do not fluctuate), but because it reduces its inherent liquidity risk. This is assuming investors are as likely to hold a bond fund for 3-5 years as they are a GIC with a similar duration. If holding periods are truly the same, a GIC might have benefits in both safety and yield but as we all know, “life happens” and holding periods might be different than individuals expect. You can also find very attractive (often better) savings accounts rates at many of these smaller financial institutions (see table 1 for a list of competitive savings account rates), which have the added advantage of liquidity. However what needs to be kept in mind is that deposit account rates can change at any given moment, unlike GICs which guarantee a rate for a specified term.

Table 1.

Rates

When it comes to rates, GICs are also straight forward. Your rate is spelled out clearly and does not change, so you know what your return is going to be in advance. The best way to gauge the expected total return received from a bond fund is its Yield-to-Maturity (YTM), but this can change over time because bond prices fluctuate. Many investors will simply go with GICs offered by their financial institution, but with GICs, it is worth shopping around to different institutions for a better rate. If you are locking up your funds and giving up liquidity, you ought to make sure you are compensated for that. Most discount brokerages allow investors to purchase GICs from several financial institutions. Smaller banks or credit unions often offer very competitive rates to attract depositors. For example, at the time of writing Oaken Financial, MAXA Financial and Tangerine offer 5-year rates of 3.00%, 2.85% and 2.30% (USD only) respectively. These rates are quite attractive considering a broad bond market fund like ZAG carries a YTM of ~2.15% with an average duration of ~8 years.

The Case For Bonds: Portfolio Smoothing

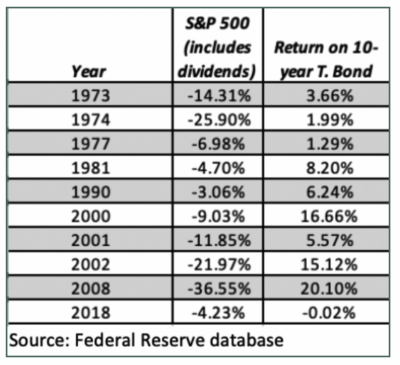

The weakness that bonds have of being susceptible to market risk can also be a source of strength. While GICs do provide certainty, bonds uniquely provide the diversification characteristic of having low correlation to equities. This can prove to be very useful when markets are taking a hit and investors flock towards bonds, resulting in a higher bond price. This is particularly advantageous for rebalancing since the capital gains from a spike in bond prices can be used to repurchase more equities (at discounted prices) to bring asset allocation back to target. The low correlation that bonds have with equities serves investors well in both the short-term and long-term. Over the long run, say 25- 30 years, however, bonds actually have a low positive correlation to equities. A quick glance at almost any long-term broad bond and equity chart and it is easy to see that both are generally pointing upwards, adding to the case of holding bond funds as part of a long-term strategy. While GIC returns on any given year are limited to the promised interest rate, table 2 (showing bond returns during all negative years the S&P500 had over nearly five decades) makes it clear how bonds can come to the rescue in the event of a crisis.

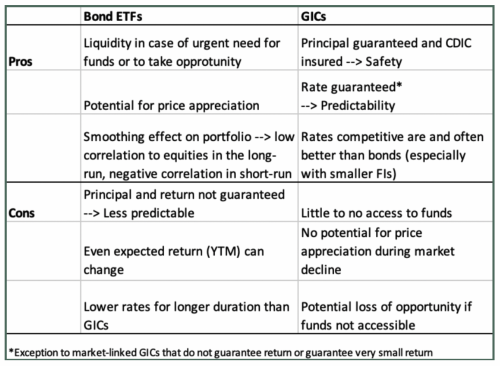

Finding Your Balance

As you might have guessed by now, a good strategy would be to own a mix of bond funds and GICs. This mix comes down to desired yield, risk tolerance and how important liquidity is to the fixed-income portion of your portfolio. If liquidity is very important to you then you are likely to lean more towards bond ETFs than GICs. However, if you are comfortable not having access to your fixed-income portfolio for the medium-term (e.g. 5 years), then you may find a place in your portfolio for more GICs. We would argue that all investors have a need for at least some liquidity in case of any emergency, taking advantage of opportunities and rebalancing your portfolio. To simplify things and help readers come up with their own answers, table 3 explains the pros and cons of investing bonds and GICs.

Table 2.

Table 3.

To conclude, we would like to make mention of the importance of rebalancing to your GIC/bond mix and portfolio in general. A downturn in equities can easily throw off your asset allocation mix and you will be overexposed to fixed-income. For example, if your portfolio is valued at $100,000 and your desired asset allocation is 70/30 with $70,000 in equities and $30,000 in bonds/GICs. If your equity portfolio falls by 30% one year you would be left with a 54/46% mix, or equities at $35,000 and fixed-income at $30,000 (assuming bonds have not been affected by market fluctuations). To rebalance you need to sell $6,300 in bonds and purchase the same amount in equities to bring the portfolio back to that 70/30 equity/ bond mix. Most importantly, to rebalance you also need to make sure you have enough bonds (or cash) available to sell in order to purchase equities to rebalance. This is an important factor to consider when deciding on your bond/ GIC mix. Finally, it is important to note that rebalancing to get back to your target asset allocation also speaks to the importance of not shying away from equities when markets are in a decline as it forces investors to maintain a disciplined approach of buying equities at lower prices when everyone else is selling near the bottom.

Moez Mahrez, CFA , Investment Analyst at 5i Research Inc., Waterloo

Disclosure: The author has no positions in the funds mentioned at the time of publishing.