Turn Your Money-Sucking Mutual Fund Portfolio Into A Winning Etf Portfolio

Imagine your $250,000 Canadian mutual funds portfolio is carrying an average annual fee of 2.30%. That’s about $5,750 in its first year. Over a 20-year period on a portfolio that returns 6% per year, that’s about $285,000 lost to fees, or an annual average of $14,250!

Imagine your $250,000 Canadian mutual funds portfolio is carrying an average annual fee of 2.30%. That’s about $5,750 in its first year. Over a 20-year period on a portfolio that returns 6% per year, that’s about $285,000 lost to fees, or an annual average of $14,250!

These fees can make or break your retirement; or pay for your children’s post-secondary educations; or provide a nice down payment on a house in Toronto. You get the picture. Three hundred grand is not something to mess around with—especially when we’re seeing baby boomers work through their retirement or struggling with debt.

If there is something you can immediately cut costs on, it’s the fees in your investment portfolio. The average equity mutual fund Management Expense Ratio (MER) in Canada is about 2.35%, one of the highest in the world. This is the annual fee that you pay, as a percentage of your assets, for holding that fund. The fee includes the operating expenses, management fees, and taxes charged to the fund for that year.

So how do you get rid of these vampire funds if you have no experience managing money?

First grab your investment statement and look up what you have in your portfolio. Look up the name of the fund and the class or series of mutual funds you’re invested in. Mutual fund classes vary based on the compensation charged to the investor and/or the benefits provided.

For example, Series A mutual funds are geared towards retail investors and are typically charged an upfront fee, and then an on-going trailer commission. Together, these fees are hefty.

Look up each fund online (a simple Google search would do it) and go to the fund’s webpage: it should show you information such as the portfolio holdings, fees, performance, etc. You may even want to go into the Fund Facts, a document that is legally required to be delivered to clients prior to their purchase of mutual funds. Take RBC’s Select Aggressive Growth Portfolio Series A. A client of mine had this in her portfolio and was being charged an MER of 2.18%. Under the Fund Facts PDF document, the total fee was actually 2.30%, after factoring in the 0.18% trading fee.

Look up what the fund’s benchmark is.

The benchmark for a mutual fund is the standard or reference point a fund manager uses to measure their performance against, and their goal is to beat the benchmark. Over 90% of finance professionals managing U.S. equity funds have failed to beat the benchmark over a 15-year period. Those numbers are similar for Canadian equity funds, if not worse, after factoring in the mutual fund fees which are one of the highest in the world. If the benchmark keeps winning—why not invest in the benchmark?

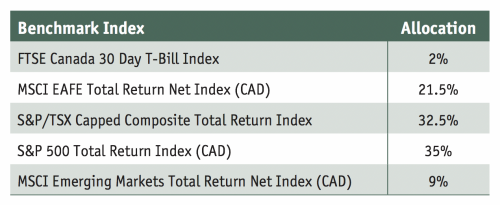

The benchmark for a mutual fund is presented in its respective allocations. For example, the benchmark for the RBC Select Aggressive Growth Portfolio mutual fund is listed on their webpage as:

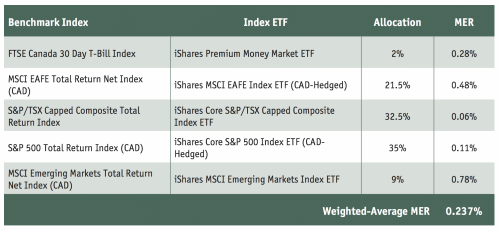

Then, look up an Exchange Traded Fund (ETF) for each respective benchmark index. Again, a simple Google search for each index, like “S&P/TSX Capped Composite Total Return Index ETF” would do the trick. You’ll get BlackRock’s iShares Core S&P/TSX Capped Composite Index ETF. With a price tag of 0.06%, you can own the entire Canadian stock market.

Doing that for each of the benchmarks listed will get you something like:

As you can see, this replicated portfolio has an overall weighted average MER of 0.237%, almost 1/10th of the cost of the 2.30% the mutual fund carries. Your $285,000 in total fees paid over 20 years on that mutual fund has now been reduced to roughly $35,000.

Note that the benchmarks may not always have an ETF that follows it exactly. In this case, there is no ETF that tracks the FTSE Canada 30 Day T-Bill Index, so a money market fund ETF like iShares Premium Money Market ETF would do.

You may never be able to follow exactly what a mutual fund carries in its portfolio, because these funds can be invested in other funds that retail investors would not have access to, or they could be invested in many funds that may not be feasible for an individual investor to hold.

Remember, while there are many funds out there, they’re invested in more or less the same thing. A large-cap Canadian equity fund is very likely to contain all the Canadian banks, as will a Canadian Dividend Equity Fund, or a fund that tracks the S&P/TSX Composite Index.

Rinse and repeat for each mutual fund you hold. You can aggregate all the ETFs you’ve listed and re-allocate your money accordingly.

Be mindful of the tax implications and possible fees on the sale of your mutual funds. If your investments are being held outside of your registered accounts like Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA), you will be subject to taxes. Talk to a financial planner that can help you re-structure your portfolio in a way that minimizes your tax consequences.

Michelle Hung, CFA is the founder and published author of the self-titled book, The Sassy Investor. An advocate for financial literacy, she is on a mission to help as many people as possible achieve financial independence through education and coaching. Michelle can be reached at www.thesassyinvestor.ca, Instagram: @thesassyinvestor, and Facebook: https://www.facebook.com/groups/sassyinvestor/.

Sources:

- https://larrybates.ca/t-rex-score/

- https://www.advisor.ca/news/industry-news/investment-fees-cost-canadians-hundreds-of-thousands/

- http://www.aei.org/publication/more-evidence-that-its-really-hard-to-beat-the-market-over-time-95-of-finance-professionals-cant-do-it/

- https://www.getsmarteraboutmoney.ca/invest/investment-products/mutual-funds-segregated-funds/mutual-fund-series/

- https://www.investmentexecutive.com/newspaper_/newsnewspaper/

news-35316/