Fall In Love With Your Finances

Many of you think of finances, and immediately feel overwhelmed with confusion, angst and embarrassment. But why the fear? Wouldn’t it be awesome to have a plan for buying your first home, paying for your wedding, having children and enjoying your retirement life? The fears stem from a lack of financial understanding, frustration over budget and a feeling of weakness over economic situations. With a brief introduction to the investing world in the previous issue, let’s now rekindle your romance with money and finances.

Many of you think of finances, and immediately feel overwhelmed with confusion, angst and embarrassment. But why the fear? Wouldn’t it be awesome to have a plan for buying your first home, paying for your wedding, having children and enjoying your retirement life? The fears stem from a lack of financial understanding, frustration over budget and a feeling of weakness over economic situations. With a brief introduction to the investing world in the previous issue, let’s now rekindle your romance with money and finances.

Goals

Regardless of your life stage, the first step to reaching any financial goal is HAVING a goal. The first step is to sit down and write out a plan. This involves having three types of goals: short-term, intermediate-term and long-term. Short-term goals can include paying off your monthly credit card, buying a new appliance and starting an emergency fund. Intermediate goals can include taking a vacation and purchasing a car and long-term goals, which require the most planning, include buying a home, college education for children and planning for retirement. Once you have your plan and goals, you need to estimate how much money you’ll need to save for each one. This decision will require some attention so you can plan effectively to achieve them. You will need to consider things such as what kind of car you can afford, how much to save for a down-payment on a house and your monthly credit card liability.

Risk Tolerance

Every investor knows that risk and reward go hand-in-hand. Generally, lower risk means lower returns and vice versa. In simple terms, risk tolerance is the level of risk an investor is willing to take. The real question here is: how do you gauge risk appetite? To some people, risk can be exciting as it means opportunity and possibilities at big gains while others might be worried about being left with nothing at the end. To understand risk tolerance, you must realize that it is both financial and emotional. Are you okay with uncertainty? Are you seeing some straight red days in the market? In years of reviewing portfolios, many managers have noticed one thing in common — most investors exaggerate their risk tolerance. You may not become aware of your risk appetite until faced with a potential loss. Research has found that if you put potential losses in dollar values instead of percentage terms, it will be more evident to judge. For example, for a $100,000 portfolio, how would you feel if there is a 25% drop, or a $25,000 drop? Would your goals be disrupted, or would you be able to withstand the potential loss?

Understanding The Market

Though it is true that you can’t control, time or manipulate the market, you can, however, learn from the market and do your research. Your investment decisions should be based on your comfort level, research and due diligence. To begin with, if you would like to reduce the amount of time you devote to research, you can pick from a variety of low-cost index funds that cover aspects of the market that cater to you the most. For example, index funds of domestic stocks, international stocks, corporate bonds, investment grade bonds and a mix of some or all. Mutual funds are also a way to go, as these funds are professionally managed. However, despite the choices, with some knowledge, research and experience, you can actively manage your investment portfolio of individual stocks, bonds, and funds.

Capital Allocation

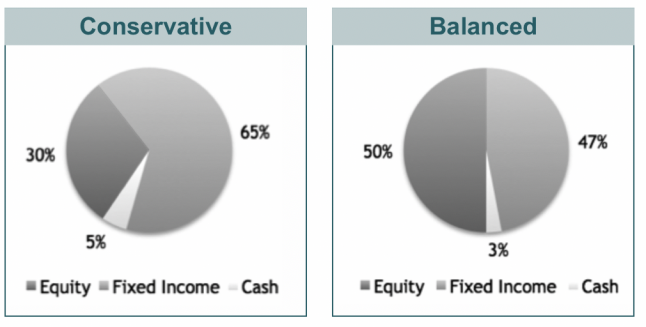

Capital allocation refers to an investor’s unique blend of stocks, bonds, alternative investments, real estate and cash.

My favourite analogy for capital allocation is that of a grocery-shopping cart. Many people like to walk into a grocery store with a list that includes several categories such as fruits and veggies, meat and dairy, household items, pantry items, wine etc. We factor into our list our budget, store sales and essentials; for example, you would pick up some more chicken if it’s on sale and frozen chicken doesn’t go bad. You would, or I am hoping you would, pick milk over wine. Before walking into the store, you have a rough plan of allocating your budget across the various types of groceries. This decision is like the capital allocation decision. In general, we expect to allocate a portfolio across a spectrum of investment categories. Each “asset class” brings something different to the table and selecting the right combination of assets is the objective of capital allocation. This includes keeping in mind the risk level we are comfortable with and the prevailing economic conditions.

Why It Matters

Effective capital allocation can:

• Preserve capital.

• Increase liquidity.

• Decrease portfolio volatility.

• Reduce unsystematic risk (risk that lies within one particular investment).

It is important to develop a strategy that works for you and your needs. In addition, it should honor your risk and volatility tolerance. The goal is to get a good return on your capital while effectively managing risk. Over time, as various investments perform differently, your capital allocation pie chart will look different at various stages. In other words, capital allocation isn’t a “set it and forget it” decision; it requires ongoing diligence and oversight.

Target capital allocation is based on your personal:

– Financial needs.

– Expectations.

– Risk tolerance.

– Time horizon.

An investor with a long timeline and an appetite for risk would have a high allocation to stocks. Conversely, an investor with high-risk aversion and short-term objective would hold more bonds or cash.

Rising Interest Rates And Its Effect On Your Portfolio

The most anticipated economic factor in the recent quarters has been interest rates. The U.S. Federal Reserve has began the process of raising short-term interest rates after a prolonged period of low interest rates to stimulate the economy after the great recession. With the positive economic indicators such as employment, GDP, housing data and the rates rising higher, we are yet to see how these will affect the economic cycle and the investment market.

In such an economic state with positive macro economic growth and elevated valuations on the market, you should turn towards asset classes or segments of asset classes that have underperformed in the recent years. For example, instead of picking large cap stocks such as Apple and Microsoft, investors should now gravitate towards ‘value’ stocks.

Getting Started

Ask two questions:

– How long do I have to invest?

– How much risk can I tolerate?

Your asset allocation will look very different at age 25 than it will at age 55 and at age 75.

In your 20s, when you have 30-40 years to invest before you need to withdraw, you can choose aggressive investments that have high growth potential but also higher risk. Closer to retirement, you do not have the flexibility of allowing your portfolio to be down 20 percent in a bad year and do not have decades for your money to grow. You will therefore look for more conservative investments that will preserve your wealth and provide a stable income.

Diversification Versus

Capital Allocation

On the surface, asset allocation may sound very similar to diversification. Both principles are closely related as they are designed to reduce risk and volatility in your portfolio. In simple terms, diversification means spreading money among various different investments to mitigate the chances of loss should some perform poorly.

Asset allocation takes this principle one step further by diversifying your portfolio not just among different investments, but among different classes: stocks, fixed income alternatives such as bonds, cash and real estate and other tangible assets.

Portfolio Construction

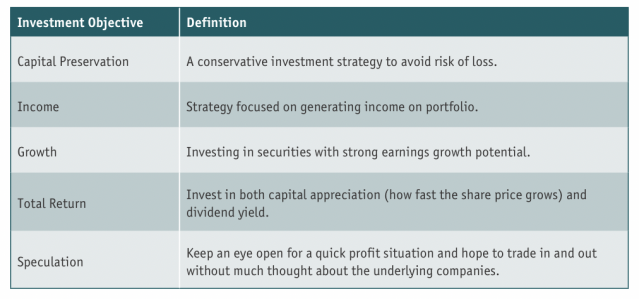

Now that you are armed with your financial goals, risk tolerance and some knowledge, let’s look at various ways of portfolio construction. Different investment objectives have different looking portfolios. These are not a set of rules and are intended to provide a general idea of what your portfolio should look like. Feel free to change it up to suit your needs.

Capital Preservation:

Strategy intended solely to avoid risk of loss while beating the inflation rate. Look for assets that provide low returns but are also effectively low-risk and offer security of capital.

Demographic:

Retiring people, wealthy clients and those in the spending and gifting phases.

Portfolio generally made of:

Time deposits, low-yielding bonds and money market funds.

Income

Seek maximum amount of income given their risk tolerance with the trade-off of capital appreciation and growth of income. Two ways of going about it: dividends and interest.

Demographic:

Retirees or any investor looking to generate income.

Portfolio establishes a constant income stream that provides cash for certain current needs, such as tuition for their children’s education, payment for housing or monthly household expenses.

Portfolio generally comprised of:

High-coupon paying bonds, high dividend stocks, high-yielding time deposits and preferred stocks.

Growth:

Looking for investments that offer a high rate of return that could make the capital grow exponentially over time. With higher reward comes higher risk and using this strategy may produce a loss. Investors should have the appetite to see red days and not fear daily market fluctuations. Investments to be picked on their long-term growth potential.

Demographic:

- Young adults with a long investment horizon and ability to take risks.

- Should be able to remain invested for enough time to achieve the full potential of their investment.

Portfolio generally made of:

Growth stocks, REITs.

Total Return:

Combines both capital appreciation and current income. This investor type seeks to maximize growth and income consistent with a modest degree of risk.

Demographic:

- Working age group.

Portfolio generally made of:

High dividend-paying stocks, time deposits, mutual funds, bonds, stocks.

These are some of the ways you can construct your portfolio. These would vary as you go along the various stages of your life. Portfolio construction is important as it plans out your risk, income stream and returns. Good luck with your due diligence and portfolio construction. You are never too late to begin falling in love with your finances! Happy lovemaking!

Next up in this series: The world of stocks.

Barkha Rani, Investment Analyst at 5i Research. barkharani@5iresearch.ca, @5iBarkha