Millennial Introduction To Investing - Part 1

This is your introduction to the Millennial Investing Series. Throughout this series, I will walk you through some basic definitions, what you need to know before investing, mistakes made during investing, how to diversify, types of accounts, the mindset to hold while investing and so forth. This is the first of many articles of the series and I hope you will join me through this journey of learning and benefit from it.

This is your introduction to the Millennial Investing Series. Throughout this series, I will walk you through some basic definitions, what you need to know before investing, mistakes made during investing, how to diversify, types of accounts, the mindset to hold while investing and so forth. This is the first of many articles of the series and I hope you will join me through this journey of learning and benefit from it.

Let’s Begin The Journey...

People who can make money through various income streams while working for 40 hours per week are smart. Investing gives you the opportunity to make and grow wealth while you continue to work on your passions and careers.

Everyone talks about investing and business channels such as Bloomberg and CNBC have a ticker of prices and alphabet symbols going— which make no sense. The problem is, you don’t know what the symbols mean and what to invest in. It might seem overwhelming with the amount of information and the talk about stocks, revenues and depreciation. However, the truth is: Anyone can invest, including YOU.

You don’t need to be scared to lose your money, nor feel like you are missing out on making a good return on your money. If you continue reading my series, you will know the basics of investing and how to get started. I will guide you through the process of investing through my investing series.

What Is Investing And Why?

In simple words, investing is trading your money today for (hopefully) more money tomorrow. Investing is not limited to the stock market. Buying a house, building a business and buying assets are also considered investments.

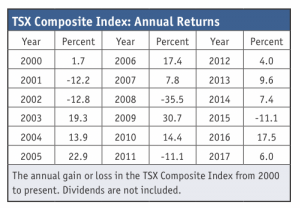

Let’s look at how a section of the market (TSX Composite Index) has performed over time.

Sure the market has had its ups and down, however, on average, your annualized returns would be much higher than when you leave the money sitting in the bank. The 2008 crash doesn’t seem as bad now, does it? (The market recovered within 18 months).

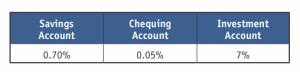

Now let’s us look at how your money would compare if you put $1,000 in your savings, chequing or investment account over the span of 25 years. The average rates of return on your savings, chequing and investment accounts are 0.7%, 0.05% and 7% (20-year Annualized return) respectively.

The chart on the next page shows a $1,000 investment over 25 years in various accounts. The dollar value gains over 25 years shows that with your savings account, you can expect to gain of only $191, a negligent amount with a chequing account, and over $4,000 if you had invested in Canadian market. With a Canadian index investment account, you can expect to earn over 443% more as compared to your checking account and over 356% more as compared to your savings account.

What Is A Portfolio?

The collection of financial assets you own is your portfolio. Your investment accounts, savings and chequing accounts, house, other assets and retirement accounts are all part of your portfolio. Building a good and strong portfolio takes time can ensure you reach your desired financial goals. Just as characteristics or investments can vary, so does the risk that comes with them. Investments and risk go hand-in-hand, and it is important to realize that and diversify accordingly.

Your portfolio should contain various assets with different characteristics. Diversification using different asset classes is the most important component of achieving long-term financial goals while minimizing risk. By investing in various asset classes that would react differently to different market conditions, you maximize your returns.

“A good portfolio is more than a long list of good stocks and bonds. It is a balanced whole, providing the investor with protections and opportunities with respect to a wide range of contingencies.” – Harry Markowitz

Now that we know the importance of investing and building your wealth, let’s jump into some definitions of words you would come across and consider often when investing.

Some Basic Definitions:

Securities: When you invest in the financial markets, you receive a paper right to the asset. The term security includes bonds, share certificates, and other financial instruments that is a tradeable financial asset.

Guaranteed Investment Certificates (GICs): When you buy a GIC, you are agreeing to lend the financial institution your money for a specified number of months in exchange for interest your money will earn. At the end of the specified duration, you get the entire amount deposited plus the interest. As a general rule, the longer the term, the more interest you earn. However, one point to keep in mind is you cannot withdraw before the expiration of the term or you will be heavily penalized for withdrawing from GICs before the end of the term.

Stocks: A stock is a share in the ownership of a company. It represents a claim on the company’s assets and earnings. Owning stock gives you the right to vote in shareholder meetings, receive dividends if they are distributed and gives you the right to sell your shares to somebody else.

Dividends: A dividend is a distribution of a portion of a company’s earnings, decided by the company to be paid to its shareholders. Dividends can be issued as cash payments or as shares of stock. Many stocks do not pay out dividends, and instead reinvest profits back into growing the company.

Index: A stock index is a measurement of a section of the stock market and is often used as a benchmark for performances. It is computed by taking a weighted average of selected stocks (depending on what kind of index). For example, the most popularly used Standard and Poor’s 500 Index (S&P500) is calculated by combining 500 large-cap U.S. stocks into one index value. Each stocks weight is calculated by dividing the market capitalization of each stock by the total market capitalization of S&P500 (calculated by adding market capitalization of all 500 large-cap U.S. stocks).

Outstanding shares: Outstanding shares refer to a company’s stock currently held by all its shareholders. Shareholders include all investors and shares held by company’s insiders and board of directors.

Market Capitalization: Market Cap (or Market Capitalization) refers to the total value of all a company’s shares of stock. It is based on multiplying the stock price of a stock and the shares outstanding of the company.

Mutual Funds: A mutual fund is an investment vehicle made up of a collection of stocks, bonds, or other securities owned and managed by an investment company. When you put money into a mutual fund, it is added into the pool of money that is used towards buying these securities.

ETF: An Exchange-traded fund (ETF) is a tradeable security that tracks an index, a commodity, bonds or a basket of different indices. Unlike mutual funds, an ETF trades like a common stock on a stock exchange and can have price fluctuations throughout the day.

Commodities: An interchangeable good or material, bought and sold freely as an article of commerce of the same type. Commodities include agricultural products, fuels, and metals and are traded in bulk on a commodity exchange or spot market.

What Is A Stock Market And How Do I Participate?

A stock market is a place where shares or other securities are bought and sold. Share prices fluctuate for various reasons including current economic conditions, buying and selling activity and company news/growth.

To be able to participate in buying and selling, you need to set up a brokerage account. A brokerage account is an arrangement between an investor and a licensed brokerage firm permitting the investor to deposit funds with the firm and place investment orders through the brokerage. Many Canadians simply go to the bank they are already using as their brokerage firm.

Three Main Asset Classes:

In the stock market, you are looking at three main asset classes:

• Cash: Cash investments include chequing and savings accounts, fixed-term deposits such as GICs and any currency you hold in hand.

• Equities: Equity investments include common shares, equity-based derivatives (warrants, options, futures), convertible bonds and convertible preferred shares.

• Fixed Income: Fixed income investments include government and corporate bonds, preferred shares and other debt instruments.

You can hold your investments in a registered or non-registered account. Each type of account comes with its own applications, features, uses, eligibility requirements and restrictions. It is important to understand which account (or accounts) suits your needs, provides advantages and helps your current situation.

Registered accounts can offer tax advantages and here are the two main registered account options:

Tax-Free Savings Account (TFSA) is a savings account registered with the federal government that lets your savings grow tax-free. You make contributions to the account with after-tax dollars and are not taxed further on your investments. There is a limit to how much you can contribute to a TFSA per year, but if you don’t make the full contribution, you can carry forward the unused amount to the next year. Your TFSA contribution limit is recorded on your income tax Notice of Assessment.

Registered Retirement Savings Plan (RRSP) is an account registered with the federal government and is intended to help you save money for retirement since your contributions are tax-deferred. In other words, you don’t pay tax on your income used for contributions, but withdrawals are fully taxable at your marginal tax rate, depending on what tax bracket you fall into when you make the withdrawal.

There is a maximum you can contribute to a RRSP in a year. If you don’t make the full contribution, you can carry forward the unused amount into the next year. Your RRSP contribution limit is recorded on your income tax Notice of Assessment, but if you have a registered pension plan with your employer, your contribution limit will be less.

I hope this has helped you learn about some basic investing definitions. Please feel free to connect with me on my twitter account @5iBarkha to keep up to date with the latest news that catches my attention. I would like to end this article with this quote of Peter Lynch, my role model:

“In the long run, it’s not just how much money you make that will determine your future prosperity. It’s how much of that money you put to work by saving it and investing it.” – Peter Lynch

Keep learning and investing peeps!

Barkha Rani, Investment Analyst at 5i Research. barkharani@5iresearch.ca, @5iBarkha