The Six Best Strategies To Minimize Tax On Your Retirement Income

After you retire, you will be entitled to more tax savings than before you retire.

After you retire, you will be entitled to more tax savings than before you retire.

If you earn a salary, you may have limited tax deductions or tax-saving strategies. When you retire, the situation changes.

You can essentially determine the amount of income you will be taxed on once you retire. You can decide:

- How much you withdraw from your investments.

- How much you withdraw from your Registered Retirement Savings Plan (RRSP) vs. Tax-free Savings Account (TFSA) vs. non-registered.

- How tax-efficient your investments are.

- When you start your Registered Retirement Income Fund (RRIF), work pension and government pensions (Canada Pension Plan (CPP) and Old Age Security (OAS).

These six best strategies will give you an idea of the flexibility you have to minimize your tax with effective tax planning.

These ideas are most effective if you plan for within 5 or 10 years of your planned retirement date.

1. Plan To Retire In A Low Tax Bracket With The Right Mix Of RRSP And TFSA:

Your taxable income can be very different from the cash you receive. You can have a lower taxable income by having the right mix of fully taxable, low tax and tax-free incomes.

You are fully taxed at your marginal tax rate on income received from your pensions, RRIF withdrawals and interest, but only partially taxed on tax-efficient non-registered investments and there is no tax levied on TFSA withdrawals.

The goal is to have your taxable income below $46,000, regardless of how much cash you get. This is the lowest tax bracket. Even better, if it is under $25,000 for a single person (or under $37,000 total for a married couple), you can also receive the tax-free Guaranteed Income Supplement (GIS).

For example, you want a taxable income under $46,000. Your government CPP and OAS pensions are $15,000 and you have no work pension. That means you can have up to $30,000 taxable income from your investments.

You could achieve this by having no more than about $750,000 in your RRSP and the rest in a TFSA.

With $1 million in investments, if it is all RRSP, you are required to withdraw at least 4%, or $40,000. Of that $30,000 is in the lowest 20-23% tax bracket, while $10,000 is in the middle 30-33% tax bracket.

If you have $750,000 in your RRSP and $250,000 in your TFSA, then you can withdraw $30,000 from your RRSP, all at the lowest tax bracket, plus $10,000 from your TFSA all tax-free.

2. Plan To Retire In A Low Tax Bracket With Tax-Efficient Investments

If you have non-registered investments, the type of investment affects your ability to stay in a low tax bracket.

You can receive income from your non-registered investments as interest, dividends, capital gains, or deferred capital gains, depending on how you invest.

For example, if you want to stay in the lowest tax bracket and receive $30,000 taxable income from your investments, here is how much cash you can receive:

|

Income Type |

Cash to You |

Effect on Taxable Income |

|

Dividends |

$22,000 |

138% |

|

Interest |

$30,000 |

100% |

|

Capital Gains |

$60,000 |

50% |

|

Deferred Capital Gains (Est.) |

$120,000 |

25% |

Eligible Dividends are “grossed-up” by 38%. Multiply the dividend by 1.38. That means $22,000 of dividends is $30,000 taxable income.

Interest income is straight-forward - $30,000 income is $30,000 taxable income.

Capital gains: only 50% of the amount of the capital gain is taxed. Multiply by .5. That means $60,000 of capital gains is $30,000 of taxable income.

I’ll explain deferred capital gains in strategy #4. Essentially, they are a mix of capital gains and getting your invested money back. The effect on your taxable income can range between 0% and 50%, depending on how much your investments have gone up so far.

3. Plan To Avoid The Clawbacks

The highest taxed Canadians are seniors with incomes under $25,000. Shocked? This is because, for every dollar of taxable income, the amount of the maximum payable Guranteed Income Supplement is reduced by $.50.

For higher income seniors, their OAS is clawed back at 15% of their income from $75,000-$121,000.

Many other government benefits are based on your taxable income, such as the amount you receive in a GST credit, the amount you pay for your provincial drug coverage, and the rent payable in retirement and long-term care facilities. Governments are increasingly calculating benefit programs based on taxable income.

This means that the tax strategies wealthy people benefit from because of their high tax rates also work for seniors in the clawback income ranges.

Planning to have a lower taxable income with the right RRSP/TFSA mix and tax-efficient investments saves you much more tax if your income will be in these clawback ranges.

If you realize you will be affected by either of these clawbacks, it might be worthwhile to cash in some or all of your RRSPs before age 65 to avoid the clawbacks. This only works if you can withdraw your RRSPs at a low or moderate tax rate.

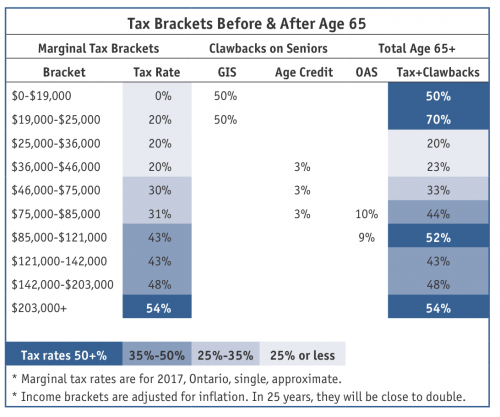

The table below shows the tax brackets that affect seniors, once you include these clawbacks. Seniors have more dark blue income ranges with very high tax rates:

4. Use A Systematic Withdrawal Plan (SWP) To Get The Lowest Tax On Your Investment Income

The lowest tax rate on investment income is on deferred capital gains at almost any income level.

Capital gains are taxed at preferred rates. With tax-efficient equity investments, you can defer the gain and pay capital gains tax years from now, instead of this year.

To get deferred capital gains, just sell some of your stocks, mutual funds or Exchange Traded Funds (ETFs) each month. This is called a Systematic Withdrawal Plan (SWP). You are taxed on the gain that has built up in the investments so far.

If you just bought your investments, then the SWP is tax-free. You are just taking back some of your own money. If you owned these investments for years and they have increased in value, you could be receiving almost entirely capital gains.

For illustration purposes in the chart, I assumed your investments have doubled since you bought them, so half of your SWP is a capital gain and half is tax-free, because it is your original investment.

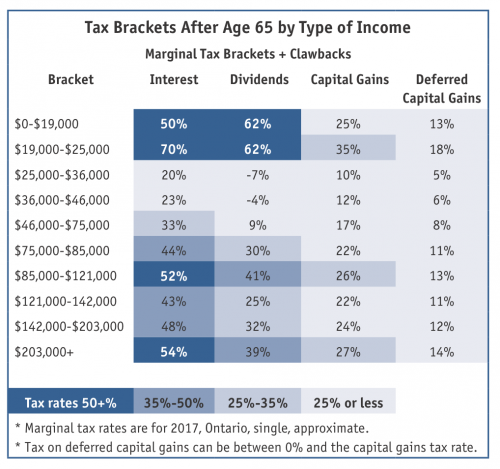

The chart below shows the marginal tax brackets, including the clawbacks, on different types of investment income. Note that deferred capital gains are always in light blue, low brackets.

5. Invest For Dividends Only If Your Income Is $25,000-$46,000

Dividends from publicly traded Canadian companies actually have a negative tax rate if your taxable income is in this range. That’s right – negative tax.

The danger, though, is that dividends are taxed at an extremely high 62% rate if your income is below $25,000.

You need to be careful because dividends are the highest taxed investment income if your taxable income is below $25,000, but the lowest taxed income from $25,000-$46,000.

Why is the dividend taxed so high for the lowest income? The GIS clawback is on the grossed-up dividend. Dividends are a disaster for low income seniors!

Dividend tax on low income seniors is strange - but important to understand. If your income is under $25,000 and you receive a $1,000 dividend, it is grossed-up by 38% and adds $1,380 to your taxable income. The 50% GIS reduction on this $1,380 is $690. This is a 69% GIS clawback, which is reduced by 7% negative tax on the dividend to get an effective tax rate of 62%. The government gets $620 of your $1,000 dividend.

If you can plan to have a lower income and keep some of the GIS, then you should avoid dividends entirely. However, if your income will be at least $25,000 without the dividends, then you can take advantage of the negative tax.

For example, let’s say you will get $15,000 from CPP and OAS, and $10,000 from your company pension. Your income is already too high to qualify for any GIS supplement. You can now get up to $21,000 taxable income from dividends at a negative tax rate. That would be $15,000 of cash from dividends (before the gross-up).

If your income is above $46,000, there is no real advantage of dividends. They are taxed about the same as a SWP (deferred capital gains) up to $75,000 of income and then the dividend tax rate leaps to 30% if your income is over $75,000.

Dividend investing has the disadvantage that the negative tax only applies to Canadian companies on the stock market that pay dividends. This can limit the diversification of your portfolio. SWPs with deferred capital gains work with any company anywhere in the world.

Negative tax rates on dividends only exists in Ontario, B.C., New Brunswick and the three territories.

6. Defer Converting Your RRSP To Do The “Eight-Year GIS Manoeuvre”

You can get up to $10,500/year of GIS tax-free ($12,600 for a couple) from age 65 to 72, if you have no taxable income other than OAS. You can still receive non-taxable income, such as from your TFSA or investments.

This is a cool strategy if you have enough in your TFSA or non-registered investments to give you income for these eight years. You could plan for this by cashing in some RRSP before you turn 65 to maximize your TFSA or build up non-registered investments.

To qualify, you could delay converting your RRSP to a RRIF until the end of the year you turn 71. You can also delay starting your CPP until age 70.

You could also make a large RRSP contribution before age 65 and defer the deduction until you need it during these eight years to give you the maximum GIS.

At age 72, you have to start withdrawing from your RRIF, but you will still receive GIS for one more year, since it is based on the prior year’s income. You will likely lose some or all of your GIS after that.

Deferring CPP to age 70 means you get 42% more CPP for the rest of your life. Delaying converting your RRSP gives it an extra eight years to grow. The Eight-Year GIS Manoeuvre can mean you have a more comfortable retirement after age 71.

Creative Retirement Tax Strategies

The number of effective tax saving strategies is only limited by your creativity. There are more effective strategies, but I believe these are the 6 most effective that almost anyone can do.

You can effectively decide your own taxable income. You can plan to be in low tax brackets, avoid the clawbacks, and possibly qualify for GIS.

Your tools include your mix of RRSPs and TFSAs, deciding how much to withdraw from your RRIF, TFSA and investments each year, investing tax-efficiently for deferred capital gains or dividends, using tax-efficient withdrawal strategies such as SWPs, using “T-SWPS” to defer capital gains, deferring CPP and/or OAS to age 70, starting CPP early at age 60, deciding on the best time to convert your RRSP to RRIF, and contributing to your RRSP or cashing in some RRSP before you retire.

If you had a salary all your life, you may have had limited tax deductions or tax saving strategies. When you retire, it is completely different. You have many options, especially if you plan for them before you retire.

Ed Rempel, CPA, CMA, CFP®, Certified Financial Planner® Professional. Email: ed@edrempel.com. Unconventional Wisdom blog: www.edrempel.com