Water

The Trend

The Trend

Hedge fund manager Michael Burry is one of the protagonists in the 2015 movie The Big Short. In 2005, he predicted the impending collapse of the US housing bubble due to the instability of sub-prime loans. In the postlude to the movie it is mentioned that Burry still does some limited investing and it is “…all focused on one commodity: water.”

Water is often marked by its scarcity, sometimes even severe scarcity, in many locations on earth. This scarcity has far-reaching economic and geo-political implications.1 As a result, there are significant demands to improve water capture, use, treatment, transportation and technology. Growing water scarcity represents a secular trend of considerable importance to billions of people worldwide.

Some Facts

Figures on water scarcity are stark and attention-getting: “…two-thirds of the global population (4.0 billion people) live under conditions of severe water scarcity at least 1 month of the year. Nearly half of those people live in India and China. Half a billion people in the world face severe water scarcity all year round.”

We know that even developed countries face water scarcity such as the western part of the United States, Southern Europe and Australia.2

Causes include growing human populations with higher consumption demands, challenges with conservation, land degradation and pollution and changes in climate patterns.3 According to the International Food Policy Research Institute in 2016, there will be a 40% gap between water demand and supply over the next 15 years. Agriculture is the largest consumer of water (70%), followed by industry (20%) and individuals (10%). The three areas where investments may perform well are expanding the water supply, increasing efficiency in the water cycle and improving water quality and treatment.4

As the global human population rises from 7.4 billion to close to 10 billion by the middle of the century, it is estimated that agricultural production will have to rise by 60% to satisfy agricultural demand alone. Power generation will also need to increase to satisfy the needs of the growing world population. Furthermore, global warming is expected to cause wet regions to get wetter, and dry regions to get drier. The increasing frequency of flash floods that do little to replenish aquifers and more frequent and protracted droughts will create ever more pressure on water supplies. The need to plug leaking pipes, improve sanitation, reduce pollution, build more reservoirs and expand water purification works is growing ever more obvious.5

Some are expecting massive new government spending on water in the near future: water infrastructure projects are projected to grow an average of 5%–8% annually and money already being spent in the area of improving water access and quality includes $110B per year in China and about $20B annually in California.6

Risks

As with any investment there are always risks. Yet I view the water trend as good long-term hedge against shorter-term volatility and unpredictability in some sectors (e.g., consumer cyclicals, energy). Thematic investing in water, using a broad-based approach, can provide exposure to industrials, utilities, materials and healthcare sectors, somewhat independently of shorter-term market cycles and fluctuation.

The water theme has been seen from time to time to be a bit of a fad affecting short to medium-term sentiment, but longer-term dynamics should continue to drive the growth in value of businesses that help deal with water scarcity.

As noted, water scarcity is a global theme that represents an opportunity for diversification into broader global equity markets and currencies since many of the companies in this space are located outside of North America and/or are international in focus. Even if international stocks swoon, the underlying pressures driving global water scarcity will remain and this should help buoy investments in this space over a long timeframe.

Ideas For Further Research

I see two main ways to invest in the water theme. One is to buy an exchange traded fund (ETF) that focuses on the theme, and the other is to buy individual stocks in companies involved is some portion of the water value chain.

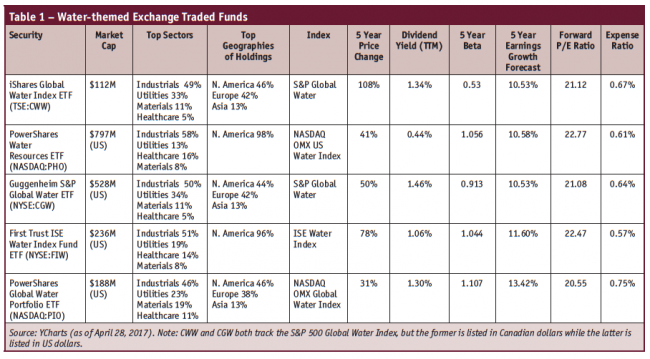

Table 1 shows some ETFs in Canada and the US that focus on water. Note they often use different indexes for their composition.

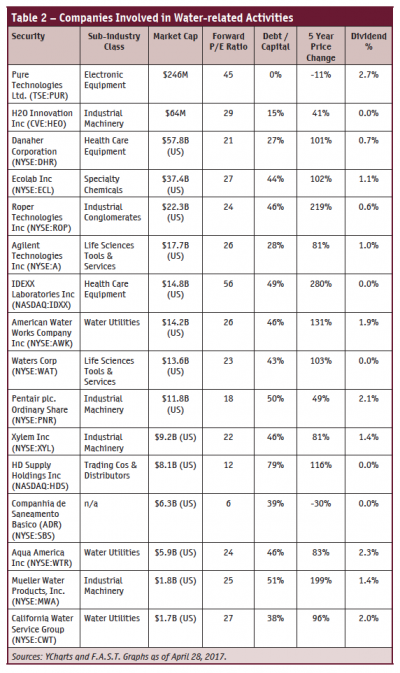

Table 2 on the next page shows some of the individual securities one could purchase. Note that this list includes many of the top holdings of the ETFs listed in Table 1. As can often be the case in specialized areas of investing, Canadian representation is minimal in the water theme, with only two companies noted. Forward price/earnings ratios can be a bit high for some water stocks so that is something to consider from a value perspective.

Another area of research would be to investigate what Alphabet (Google’s parent company) is doing in the water space. It has taken on several water-related projects7 and was recently granted a US patent for a water drone designed to harvest rainwater in the oceans.8 This exciting technology facilitates the capture of rainwater falling over the oceans into a huge pool in the middle of the drone and brings it back to shore for harvesting and consumption. Will it work? I don’t know, but it is an innovative development and one to watch.

How To Invest In The Water Trend

Personally, for this investment theme, I am more inclined towards investing in an ETF. The main reasons are I like the diversification, I don’t know which companies or parts of the value chain in water-related businesses are going to be the biggest winners, and because it can be difficult to find “pure play” water companies (some water-themed companies also do things that are not water-related).

For a Canadian investor, I believe CWW represents a very good opportunity due to its Canadian dollar denominated listing with a high proportion of international holdings. One of the US-denominated ETFs would be an alternative if one prefers to hold a fund in US dollars (e.g., CGW) or if one prefers more concentration in US companies (e.g., PHO). Holding CWW along with a US ETF could provide an additional currency hedge for a larger position in water.

For “growthier” options in Canada, I think both HEO and PUR are showing some potential. HEO is a micro-cap and trades on the Venture exchange so be very cautious. To me it is far too risky now but one to watch. PUR has a small market capitalization and can have lumpy revenues but it trades on the TSX. It is showing some good promise but its technology to examine pipelines can be used for oil or water infrastructure, so is not purely a water play.

Concluding Remarks

Water, and its growing scarcity, is a well-established secular trend. Investing in the theme requires a long-term perspective since the underlying drivers of the trend reflect long-term forces at play. I doubt anyone will “get rich quick” by investing in this theme, but for steady, extended performance (e.g., 5-10 years or more) I believe there is solid potential in this theme.

Michael Patenaude, BA, MA, is an avid personal finance enthusiast living in Ottawa. money4retirement.ca, co-Creator of the McMurtry Investment Report.

Email: mrpatenaude@ gmail.com.

Disclaimer: this article is not intended as investment advice nor is it a solicitation to purchase securities. Disclosure: Michael owns shares in CWW and GOOG.

- http://globalriskinsights.com/2016/12/economic-cost-global-water-scarcity/

- http://advances.sciencemag.org/content/2/2/e1500323.full

- https://www.unesco-ihe.org/sites/default/files/wwdr_2015.pdf

- http://www.forbes.com/sites/toddmillay/2016/11/28/investing-in-water/#2dae423a44f0

- http://www.economist.com/node/21709530

- http://www.forbes.com/sites/toddmillay/2016/11/28/investing-in-water/#2dae423a44f0

- http://www.valuewalk.com/2016/11/google-water-harvesting-raft-save-water-scarcity-africa/