Beating the TSX – 2016/2017 Annual Update

Most investors should be pleased with the positive direction of the stock market this year. As it is said, “A rising tide lifts all boats,” so many stocks will have increased in value. If you had invested in an exchange traded fund (ETF) like the iShares S&P/TSX 60 Index ETF (XIU), which tracks the S&P TSX 60, your total return would have been 21%. How does this compare to the return of your portfolio?

Most investors should be pleased with the positive direction of the stock market this year. As it is said, “A rising tide lifts all boats,” so many stocks will have increased in value. If you had invested in an exchange traded fund (ETF) like the iShares S&P/TSX 60 Index ETF (XIU), which tracks the S&P TSX 60, your total return would have been 21%. How does this compare to the return of your portfolio?

Many investors’ analysis of how well their investments are performing may be as simple as making sure the year ending value of their trading account is greater than the year beginning value without ever calculating what the percentage return was in reality. Everyone may be happy but did they do as well as they could have? I don’t mean to suggest that we should all be less than satisfied with a positive year on the market, but we do need to make sure we are getting the best return from our investments during the good times. This will help to offset the inevitable down years in the future.

If you had invested in the BTSX stocks your return would have been an outstanding 25.4%, clearly beating the TSX this year! Comparing this to the benchmark XIU, you would be pleased. Even if you are not a fan of the TSX 60 as a bench mark, the BTSX 25.4 % return is very good. Knowing that the long-term average of the BTSX strategy is about 12%, you can see that this year’s return will be pulling up the average. Hopefully you know what your 2016 portfolio return was and can compare to the BTSX return.

One piece of advice I often find myself sharing with investors is that they need to keep track of the annual performance of their individual investment portfolio. It is important to track the annual performance so that long term averages can be calculated. Often investors will know what their return was for the last year, but then have lost track of what the average has been over the last five, ten, or 20 years. Once an investor has these annual return numbers they can compare their investment process results to simple strategies such as using index ETFs, the BTSX strategy, or any other strategy they are interested in. The choice of investment strategies you choose should be heavily based on the long term annual return that is generated. As Canadian MoneySaver (CMS) readers will know, I have chosen the BTSX strategy and it has served me well.

For new CMS readers, please note that I use David Stanley’s BTSX process to pick the stocks each Dec 31st for the following year, with a few modifications. If you are interested in the modifications you can reference last year’s February 2016 article which can be found on the CMS website at https://www.canadianmoneysaver.ca/index.php?p=articlehtml&id=3043.

For those that are interested, I have detailed this relatively simple investment strategy in my e-book, Destination: Early Financial Independence.

Jan and Dec. 2016 Results

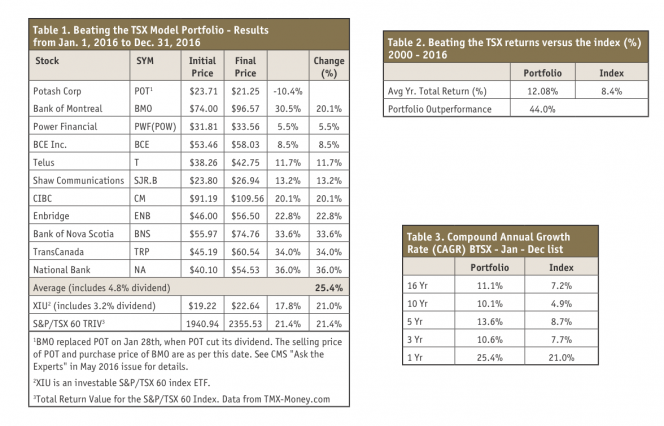

As you can see from Table 1 on the next page, the return for the BTSX portfolio was 25.4%. This was 4.4% more than the XIU of 21.0%. I have also included the Total Return Index Value (S&P/TSX 60 TRIV) for comparison.

2016 was one of the years that investors would be more pleased with the BTSX results than the XIU’s in their portfolio. Although I must point out that the 21% XIU return is great considering an investor would only have to purchase a single ETF rather than the 10 separate stocks in the BTSX. As a simple alternative to the BTSX process, I always suggest using the XIU ETF as a starting point for new investors or experienced investors who don’t have time to invest in individual stocks. I still own the XIUs that I purchased when starting my portfolio decades ago. In years when XIU out performs the BTSX, I am always happy to still own them.

Table 2 shows the average results over the last 16 years. The BTSX portfolio that I have been using is outperforming the index by over 44%. Earning an average of 12.08% will allow many investors to easily meet their financial goals.

For those of you that have other financial strategies you use or have turned your investments over to a financial advisor, it is important that you compare your long term returns to these numbers as one potential bench mark. It is the longer-term results that all investors need to focus on. The returns of any one year are much less important.

In Table 3 the Compound Annual Growth Rate (CAGR) is shown, rather than the simple average numbers I usually work with. The CAGR number will allow a comparison to mutual fund returns or any other investment returns that indicate their CAGR number. As you can see the BTSX portfolio currently is outperforming the index in all time frames.

2017 BTSX Portfolio

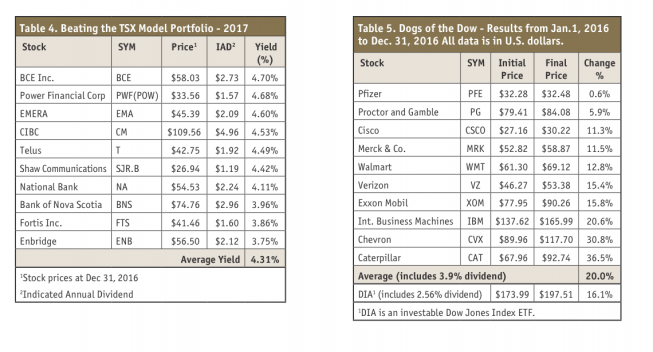

Table 4 lists the stock picks for 2017. These stocks are purchased Jan 1st and held until the end of the year, unless they cut their dividends.

You can use this list as you choose. You may wish to purchase all the stocks or perhaps use this list as a suggestion of high yielding stocks from the S&P/TSX 60 to review further.

This year’s average yield of 4.3% is lower than the 4.8% from last year’s list. The current lower average dividend yield is understandable due to the rapid price increase of the stock prices this year. Last year, I indicated that the high yield was a good indicator that the stocks appeared to be a good buy. In retrospect, this proved to be the case.

Emera (EMA) is new to the list due to its addition to the S&P TSX 60 index. It has a good history of steadily increasing dividends and I suspect it may make many appearances on the BTSX list in years to come.

The 4.3% dividend yield of this year’s list is another one of the exciting things about this strategy. If you can live off 4% or less of your portfolio, as is often recommended by financial experts, then you can fund your retirement income from the dividends received without having to sell any capital, making portfolio income management quite simple.

DOGs Of The Dow Portfolio

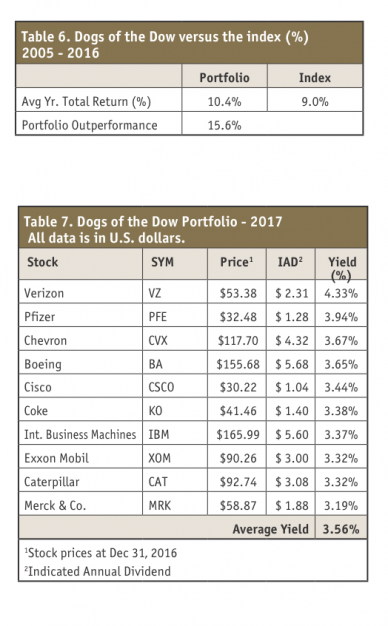

As readers of my book know, I also invest in Dogs of the Dow, so I have decided to provide this list of stocks as well. This provides me with a U.S. portfolio of high dividend paying blue chip stocks. As you can see from Table 5, for 2016 we had a return of 20 % and beat the index by 3.9 %. This return is in U.S. dollars and does not take into account any changes in the portfolio due to the varying exchange rate. Table 6 shows the average results from the last 12 years with an outperformance factor of 15.6%. This result is lower than the BTSX result, but still in our favour.

Table 7 lists the stock picks for 2017 with the new addition of Boeing (BA) due to its recent December dividend increase of 30%.

I will be purchasing all the new stocks in the 2017 lists for BTSX and Dogs of the Dow, and hoping for the best, as usual. Due to the dividend increases, one of the benefits of owning these dividend stocks is that the total income from the portfolio is growing at or above inflation each year. The total income gets an extra boost in January when the lower yielding stocks that move out of the top 10 are sold and then replaced with higher yielding stocks.

It is fortunate that with this system, all that is left to do for the next 12 months is to watch for any dividend changes. Hopefully there will be many more increases than decreases.

Ross Grant is the e-book Author of Destination: Early Financial Independence, available on Amazon and Kobo for $5.99. Free e-reader software is available for PCs, MACs, etc. to view the book. Please email Ross if you need the links. You can reach him at RossGrantEFI@gmail.com