At-A-Glance: Split Share Corporations (Part 1 of 2)

The split share is a unique investment vehicle that offers investors an enticing rate of return, superior to conventional income products. At the cost of higher return of course comes higher risk and split shares are not the exception. Investors need to perform thorough due diligence, look under the hood of these vehicles and understand the prospectus clearly.

The split share is a unique investment vehicle that offers investors an enticing rate of return, superior to conventional income products. At the cost of higher return of course comes higher risk and split shares are not the exception. Investors need to perform thorough due diligence, look under the hood of these vehicles and understand the prospectus clearly.

The first article in this series is designed to be a primer on split shares, how they are structured and whom they are appropriate for. The second part in the series will look closer at performance and examine the finer details of the prospectus.

What Is A Split Share Corporation?

A split share corporation (SSC) is established to invest in a portfolio of dividend-paying common stocks. The underlying stock(s) can be from a single company, from several companies in the same sector, or across multiple sectors.

To finance the stock purchase, the SSC raises money by offering a unit of the corporation, similar to a mutual fund. This unit is then split into two classes of shares - capital split shares (CSS) and preferred split shares (PSS). The SSC does have a maturity date with most arrangements maturing after five to ten years.1

Preferred Split Share Versus Capital Split Share

The PSS is geared towards income-oriented investors with the objective of generating fixed, preferential dividends and to return the original investment.2 The PSS has first claim on the dividends from the underlying portfolio. At maturity, the SSC will pay principal on these shares first, up to the issue price of the PSS. Because of these built-in protections, the PSS typically provides a higher level of safety, but minimal upside potential.3

The CSS is geared towards high-risk investors with the objective of participating in any capital appreciation (or depreciation) in the underlying stock. Often, the CSS also has a targeted payment amount and may pay special dividends. These units are entitled to all of the value in the underlying portfolio over and above what the PSS is entitled to. The structure of the SSC means the CSS uses leverage to generate enhanced returns compared to the underlying common stock. Of course, the CSS holder can also realize magnified losses.4

The process of splitting the common stock into the PSS and CSS allows the risk-reward component of common stock to be broken down and allocated based on risk tolerance. The CSS has a higher level of risk than the underlying common stock and the PSS has a lower risk than the underlying common stock.

Funding Payments

The dividends received on the stocks held in the SSC portfolio are used to fund the fixed payments made to the PSS. Excess dividend income plus option premium received from covered call writing is used to fund the targeted CSS payments. However, the CSS payment is a target and not fixed. If the NAV falls below a quoted threshold level, CSS payments can be missed. On the other hand, if the portfolio has realized gains, the CSS may be entitled to special distributions on top of the target payment. The objective is to pay mostly Canadian eligible dividend income to the PSS and a combination of dividends and capital gains to the CSS. In either case, the monthly payments are tax-efficient compared to bonds.

Performance Characteristics

Let us look at two scenarios to demonstrate how performance differs across the PSS and CSS structure and how leverage is employed. Assume the SSC raises capital to buy one unit of common stock, which trades at $25 and has a yield of 4.0%, or $1. The SSC issues a PSS for $10 and a CSS for $15. One year later, the corporation matures.

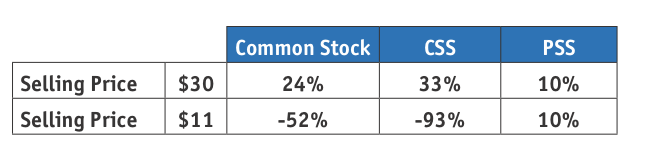

In the first scenario, assume the common stock trades for $30 upon maturity. The PSS receives $1 in dividends and $10 in returned principal. On an investment of $10, this is a gain of 10.0%. The CSS receives $20, which is the capital remaining after the PSS has been paid ($30 - $10). On an investment of $15, this is a gain of 33.3%. Notice the effect of leverage in the CSS unit vs. the common stock holder who earns a return of 24% on the capital gain and dividend. Leverage of course goes both ways and the opposite would be true if the stock were trading at a loss when the SSC matures. See below.

Advantages And Disadvantages

As with any investment, there are always benefits and risks. We feel that in the case of split shares, the negatives outweigh the positives and we would rather invest for total return via the common stock or an ETF product. The concept of the split share is straightforward; less so is the process of understanding the fine details. As Brian McChesney, head of Scotia Capital’s structured products division, said, “In a lot of these products, the devil is in the details.”5

The main risk with split shares is a dividend cut. The PSS payment is a flow-through of distributions received on the portfolio of stocks held. A dividend cut, or an event that impairs the portfolio’s ability to receive income will cause both the PSS and CSS to fall in price. The PSS will then fall in price to a yield level where new investors feel adequately compensated for the risk of either another dividend cut, or, the possibility that they will not receive par value for the PSS at maturity.

If the underlying portfolio falls substantially in price and remains at those levels until maturity, the investor may not receive the par value of their investment. Reviewing a split shares’ downside protection is one approach to assess the risk level of the investment. Downside protection is the amount by which the market value of the underlying portfolio may fall before the ability to repay the PSS par value of the preferred share is impeded.6

Split shares do come with special characteristics that make them superficially attractive to investors. However, they tend to be far more profitable for brokers. Once commissions and split share fees are deducted from performance, it’s unlikely that you’ll wind up with performance that appropriately reflects the risk taken.7 Actively managed split shares can easily have fees in excess of 1.0%. Some common fees in the prospectus include: sales fees payable to the agents, an annual fee payable to the acting investment manager and trust manager and a trailer fee paid to each dealer for clients who hold a specified minimum percentage of the total CSS units at the dealer. On top of this is of course the commission for each purchase and sale.

Additionally, split shares make heavy use of covered call writing. Looking at the holdings of a typical split share portfolio, the investor will likely recognize most positions, as they are often large, blue chip-type stocks. The split share yield however, is often much higher than that of the underlying stocks. To make up the difference, the SSC aims to increase income by writing call options on the portfolio’s securities. Selling calls also tends to diminish any capital gains that its portfolio might generate and leave the fund with more losers than winners as the latter are called-away. This at the expense of the CSS.

Given the varying purpose and degree of risk between the PSS and CSS, the two are not created equal when it comes to advantages and disadvantages. Overall, the PSS is ‘relatively safe’ and there have been few instances of default on the shares. Investors in PSS are often attracted to the shorter life span of the securities, which again, can vary anywhere from five to ten years in most cases. When interest rates change, the relatively short maturity results in less volatile price swings compared to long-term fixed income investments. Finally, split preferreds often have higher yields than traditional preferred shares of similar credit quality. This is partly because most split share issues are too small to be included in preferred share indexes.8 However, this smaller size does also expose the investor to liquidity risk, as a PSS is thinly traded.

In many cases, the PSS distribution is cumulative; if the SSC is forced to cease distributions, missed payments to the PSS are accumulated and must be paid before any additional payment can be made to the CSS. A SSC would not suspend its distributions to the PSS unless the portfolio had deteriorated drastically. For example, assume that the market value of a portfolio has dropped 80% from its initial value and the dividend yield earned on the portfolio assets has been cut to close to zero because of changes in dividend policies of the underlying stocks. The SSC could suspend its dividend payments to the PSS to avoid having to sell portfolio stock to meet distributions. In suspending distributions, the issuer would be aiming to benefit as much as possible from a subsequent rebound in the prices of the portfolio’s stocks. If the portfolio appreciates enough in value, the issuer will be able to repay the preferred shareholders all unpaid dividends along with the full return of principal.9

James Hymas, a preferred shares strategist and president of Hymas Investment Management, recommends preferred shares over capital shares. “The preferred shares are very often a good investment for a fixed income retail investor looking for a short-term investment. Capital shares are almost always a poor investment.”10 He points out that the PSS unit is the easy half to sell. “They could sell as many as they would like. Capital units are relatively difficult to sell and are the limiting factor in how much of these things come out.” He points out that the CSS unit has little place in the investment portfolio on the grounds of high fees, high leverage and absent dividend.

We do agree that the drawbacks of the CSS far outweigh the advertised benefits. However, for the truly aggressive investor who is interested only in gains, the CSS may be appropriate. For example, if such an investor has a strong conviction that the financial sector is going to outperform and wants leveraged exposure to this possibility, a CSS fits the bill. Other than margin lending, which many investors choose to avoid, there exist limited routes the investor could otherwise take to set up such a strategy.

Michael Southern is an Analyst with 5i Research in Kitchener, Ontario.

http://business.financialpost.com/uncategorized/opt-for-dividend-half-of-split-share-companies

http://www.tmxmoney.com/en/research/closed-end_funds.html

http://www.theglobeandmail.com/globe-investor/investor-education/ups-and-downs-of-doing-the-splits/article622696/

http://www.tmxmoney.com/en/research/closed-end_funds.html

http://www.investingintelligently.com/index.php?s=preferreds

Scotia Capital “2015 Guide to Preferred Shares”

http://www.tsinetwork.ca/daily/stock-investing/investing-in-stocks-split-share-corporations/#addcomments

http://www.theglobeandmail.com/globe-investor/investor-education/ups-and-downs-of-doing-the-splits/article622696/

http://www.dbrs.com/research/250166/rating-canadian-split-share-companies-and-trusts.pdf

http://business.financialpost.com/uncategorized/opt-for-dividend-half-of-split-share-companies