Investment Lessons From Your Dog

I gained a reputation of being a contrarian investor after selling out of my income trust positions in mid-2006. This was right in the heat of the income trust bubble, where conservative investors were buying these securities and, at the time, earning 8-10% yields plus significant capital appreciation. At the time, nobody seemed to be aware of the risk associated with these vehicles. I lost a client in the summer of 2006 because I insisted she keep the bonds that I had bought for her accounts. Further, I refused to buy income trusts for her, given that I was selling them for other clients. She left for another advisor who promised to buy her a quality portfolio of these securities, where she could expect to double her yield over the bonds she held, and earn capital gains to boot.

I gained a reputation of being a contrarian investor after selling out of my income trust positions in mid-2006. This was right in the heat of the income trust bubble, where conservative investors were buying these securities and, at the time, earning 8-10% yields plus significant capital appreciation. At the time, nobody seemed to be aware of the risk associated with these vehicles. I lost a client in the summer of 2006 because I insisted she keep the bonds that I had bought for her accounts. Further, I refused to buy income trusts for her, given that I was selling them for other clients. She left for another advisor who promised to buy her a quality portfolio of these securities, where she could expect to double her yield over the bonds she held, and earn capital gains to boot.

You may recall the Finance Minister’s drastic change to the tax treatment of the trusts by the fall of 2006—which inspired a massive selloff of the income trust market. My client, who was a widow living off her portfolio, could not have chosen a worse time to sell her bonds and buy income trusts.

The National Post heard about my contrarian play on the income trusts, and wrote this story, called “Contentedly Contrarian” [http://www.financialpost. com/scripts/story.html?id=c89f74a3-fefd-41e0-88381783df094911& k=52721]

Similarly, in 2007 and early 2008, I drastically reduced my exposure to the energy sector. I recall at the time that everyone spoke of “peak oil theory” which promoted the ideal of higher oil prices for years to come as oil production peaks. Maclean’s magazine wrote an article near the end of 2007 giving an argument for $200/barrel oil. Again, I lost a client who transferred to an advisor who was willing to load this client up with stocks like Suncor and Canadian Oil Sands. At the time, oil was about $130/ barrel. It did peak at $147 by June 2008, before falling to $30 in less than a year. I re-bought energy in the summer of 2009 around $40/barrel—in the contrarian manner of doing things.

My tendency to sometimes (not always) invest from a contrarian viewpoint comes from my deeply held belief in the predictive capabilities of sentiment studies. Sentiment studies, in essence, suggest that the unsophisticated “crowd” tends to be wrong at market extremes. Meanwhile, a minority of sophisticated investors tend to be correct with their investment positions at market extremes.

To illustrate the essence of dumb vs. smart money, one can examine the behavioural patterns of small children—or even that of your pet dog. One of the signs of an intelligent dog is the dog’s ability to learn from its mistakes. Dumb dogs repeat their errors, while smart dogs don’t repeat them. My breed of choice is bull mastiffs. The male of this species grow anywhere from 130 to 160 pounds. One of our puppies (weighing about 100 pounds at the time) stuck his head in our dishwasher, enticed by the smell of food on the dirty plates. His collar got stuck on one of those sticks that hold plates in place in the bottom tray. In a panic, he retreated from the dishwasher, but the tray followed him. The dog attempted to run from the tray, which of course stayed with him, spewing plates and cutlery throughout the house. We eventually managed to get hold of the puppy and free his collar. After that episode, to his dying day, he wouldn’t go near the dishwasher. He learned from his mistake. Similarly, small children who have touched a hot stove are not likely to repeat the mistake. Small children have enough sense not to touch the hot stove twice, after experiencing the consequences of doing so once. Dogs and toddlers usually learn from their mistakes.

Interestingly, many fully grown adult investors do not learn from their mistakes. The investors who don’t learn from their mistakes are usually unsophisticated investors who do not use of any type of a systematic discipline. They invest by following the crowd. We call these folks the “dumb money”. Groups of dumb money investors who have a behavioural pattern of buying when markets are high, and selling when markets are low include mutual fund buyers, odd lot stock buyers, and small speculators.

Sophisticated investors, also known as the “smart money”, soften trade in the opposite direction of dumb money when markets reach peak levels or low points. They have a behavioural pattern of buying low and selling high. Smart money includes commercial hedgers, large sophisticated investors like pension plans, and corporate insiders. We want to follow the smart money by buying when they buy, and selling when they sell. We want to fade, or do the opposite of dumb money, by buying when they sell, and sell when they buy.

We can combine the behaviour of these two groups by becoming especially bullish if smart money is buying while dumb money is selling. Similarly, we can be extra confident about selling when we see smart money selling at the same time that dumb money is buying.

Right now, dumb money is piling into the market. Recently, I saw a sign outside the office of a “financial planner” asking would-be mutual fund investors: “Are you positioned to take advantage of U.S. Growth?” The US market has been the leading stock market in the world since 2009. At what point would one have to believe that a slowdown in the US stock market will take place. I think that point is soon. These mutual fund advisors and their investors, who have touched the hot stove before, are yet again being drawn like moths to the red surface.

They believe that this time it won’t be hot. They have shorter memory spans than my old bull mastiff puppy.

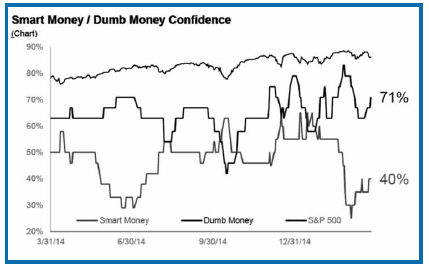

The chart (courtesy of www.sentimentrader.com) shows that dumb money is buying. Meanwhile, the smart money is selling. Commercial hedgers are net short the S&P 500, and insiders are selling. Note how the selling spikes of smart money line up with buying activity of dumb money at or near market peaks. While the smart/dumb money levels are not at extremes, they are getting there. As an aside, commercial hedgers are also now buying the long Treasury bond—an interesting development, given the crowd’s current belief of a pending crash for the bond market. Smart money is pondering whether the US Federal Reserve will prove to be more dove-ish than originally anticipated by market participants this year.

Sentiment indicators such as dumb/smart money do not offer short-term market timing signals. Instead, they offer a heads’-up of the potential for a market correction in the coming weeks or months. In combination with the seasonal tendencies for markets to peak in April, I have reduced my exposure to the stock market. I do expect that a correction is pending, and expect it may be in the order of 20% or so. My reasoning for this is the absence of a 20% or higher correction since the summer of 2011. Traditionally, we might expect at least one such correction every four or five years—and the bear is due to come out of hibernation sooner or later.

I intend to reinvest my cash into quality positions when the time looks right, if/as/when such a correction occurs. Remember, stock market corrections are opportunities to buy great stocks at low prices. But you will need to be holding some cash to take advantage of such opportunities. It always makes me laugh when I hear of buy-and-hold advisors (who are usually trying to sell you a managed investment product of some sort) claiming that a given stock market correction is a “buying opportunity”—how, might I ask, would an investor take advantage of such an opportunity if they followed the buy-and-hold advice to begin with? You need some cash to buy those cheap stocks with—and that cash will only be there if you sell at least some of your holdings at an opportune time.

For now, I am following the smart money by holding cash. I’ll also look at rotating some of my existing positions into lower beta sectors such as consumer staples (via ETFs such as XLP-US as well as individual stocks) and interest-sensitive sectors like Canadian REITs (via ETFs such as XRE-TSX and individual REITs). While these sectors have been a bit out of favour in the recent bull-market rush, there is some evidence to suggest that money may rotate back into them in the event of a market pullback. REITs, for example, are somewhat tied to the movements of Canadian or, in the US REIT market’s case, US interest rate policy. If our rates don’t change much in the coming months, this oversold sector may stage a comeback rally as investors seek their returns through income-oriented securities rather than corporate equity. Similarly, consumer staples tend to be those companies that exhibit less volatility than cyclical or higher growth sectors. Money seeks lower beta stocks to weather a stock market storm. Some investors call this a flight to safety.

Keith on BNN Market Call Friday June 5th 1:00PM

Tune in to BNN on Friday June 5th to catch me live on BNN’s 1:00 pm call-in show. You can email questions now to marketcall@bnn.ca (specify they are for Keith). Or you can call in with questions during the show’s live taping between 6:00 and 7:00pm. The toll-free number for questions is 1 (855) 326 6266

Keith Richards, Portfolio Manager, can be contacted at krichards@valuetrend.ca. He may hold positions in the securities mentioned. Worldsource Securities Inc. – Member: Canadian Investor Protection Fund, and sponsoring investment dealer of Keith Richards.

The opinions expressed are those solely of Keith Richards and may not necessarily reflect that of Worldsource Securities, its employees or affiliates. The contents are for information purposes only and do not represent investment advice. ETFs may have exposure to aggressive investment techniques that include leveraging, which magnify gains and losses and can result in greater volatility in value, and be subject to aggressive investment risk and price volatility risk. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated. Please read the prospectus before investing. The information contained herein was obtained from sources believed to be reliable, however, we cannot represent that it is accurate or complete.