Insights From ETFs: Which “All-in-one” ETFs are best?

All-in-one or ìasset allocationî Exchange-Traded Funds (ETF) are a convenient creation for everyday investors who want to put their portfolios on autopilot. The idea is that an ETF company will provide a suite of ETFs that have essentially the same underlying holdings, but different allocations to bonds and equities that match various investor profiles for risk and time horizon. Some investors also use these ETFs as core positions, around which they experiment with individual stocks or other ETFs to gain alternative or more concentrated exposure. Regardless, due to the broad nature, diversification and generally purpose of these funds, an investor is more likely to make one of these ETFs a sizable portion of their portfolio. So which ETF provider provides the best asset allocation ETFs? Letís look at the ETFs for each provider and compare.

All-in-one or ìasset allocationî Exchange-Traded Funds (ETF) are a convenient creation for everyday investors who want to put their portfolios on autopilot. The idea is that an ETF company will provide a suite of ETFs that have essentially the same underlying holdings, but different allocations to bonds and equities that match various investor profiles for risk and time horizon. Some investors also use these ETFs as core positions, around which they experiment with individual stocks or other ETFs to gain alternative or more concentrated exposure. Regardless, due to the broad nature, diversification and generally purpose of these funds, an investor is more likely to make one of these ETFs a sizable portion of their portfolio. So which ETF provider provides the best asset allocation ETFs? Letís look at the ETFs for each provider and compare.

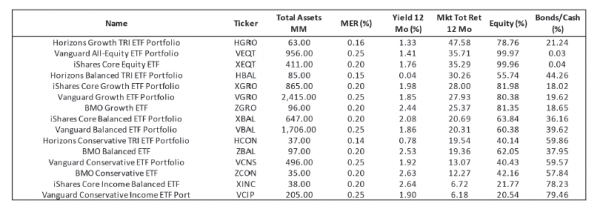

The following page shows the ETFs in order from most conservative to most aggressive for each Vanguard, iShares, BMO and Horizons:

Fees

The competition in the fee category is fierce with all funds ranging between 0.14%-0.25%. Vanguard, who was the first to launch asset allocation ETFs, comes in the highest with all ETFs at 0.25%. iShares and BMO are next with fees at 0.20%, then Horizons, doing things quite differently, has different fees for different investor profiles (conservative: 0.15%, balanced: 0.16% and growth: 0.17%), with higher equity allocation resulting in higher fees. A pattern we notice here is that the more recent the launch, the lower the fees, so we wonder if this is reflective of the fact that there is little to compete on when it comes to passively managed products other than lower fees, especially when there is little to no history/track record for performance.

Horizons takes the points for lowest fees. However, these points are not worth very much because your portfolio size would have to be quite large for the differential in fees to influence your decision. Using the range of fees mentioned above, a $10 million investment would cost $16,000 annually versus $25,000 annually resulting in a differential of $10,000 versus an investment of $10,000 resulting in a differential of only $10. Compared to the rest of the fund industry, any of these ETF providers would be a good choice when it comes to fees for the average investor.

Asset Base

Vanguard is the clear winner in this category. While the ETF giant was the first to introduce asset allocation ETFs to Canada at these fees, Vanguard launched these ETFs as recently as 2018, making their asset accumulation quite impressive over the last two years, with all five of its asset allocation ETFs having assets over $100 million, two of which are over $1 billion. Blackrock comes in second with three of its funds over $100 million in assets, none over $1 billion. For all funds, the growth and balanced portfolio ETFs tend to have the most in assets given the general appeal of the ~80/20 and ~60/40 equity/bond mix. BMO and Horizons funds still seem behind in the game of attracting investors to their asset allocation ETFs, however BMOís assets are beginning to catch up with nearly $100 million in assets for its top two funds (Balanced and Growth) which are just over a year old. We think it wonít be long before BMO is neck in neck with Vanguard and iShares. Horizonís unorthodox approach of using derivatives and total return swaps, as well as a different approach to security selection is a double-edged sword, as it allows them to compete on many aspects, but may keep investors wary of more ìexoticî strategies at bay for some time.

Variety

Blackrock and Vanguard come out as the kings of variety here, offering additional ìconservative incomeî and ìall-equityî options which give investors an ultra-conservative 80/20 bond/equity split and a more aggressive 100% equity exposure option. This expands the range of the Blackrock and Vanguard offerings compared to the standard Conservative, Balanced and Growth asset allocations that BMO and Horizons offer.

Geography & Sectors

Vanguard loses some points here for having a high Canadian bias in its equity portions compared to peers. While we would not consider this an overly negative point, we find a ratio of about 2:1 more appropriate for U.S. to Canada exposure, as seen with the BMO and iShares funds, since the U.S. is more diversified than Canada when it comes to sectors, and generally has more potential for economic growth. Horizons has certainly taken a bigger bet on U.S. growth with about a 60-65% weighting in the U.S. for the equity portion of their portfolio. We are not surprised here, as Horizons seems to take a non-standard approach in many aspects compared to other ETF providers. The bias towards the technology sector is attributed to Horizonsí bias in U.S. equity, while Vanguardís bias towards the financial sector comes from the bias in exposure to Canadian equity.

Performance

There is little to say about performance as return history is quite brief and we think it would be unfair to assign points based on performance in the short-term. However, we think it is worth noting that Horizonsí ETFs substantially outperformed their peers on every investor profile category. While we think this is likely attributed to Horizonsí higher weighting towards U.S. equities (large tech companies in particular, which saw a substantial recovery from the COVID-19 crash compared to other large-caps), we think this bet on the U.S. may also serve Horizons funds well in the long-term.

Structure and Tax-Efficiency

Both BMO and Horizons earn points in this category for having structures that encourage tax-efficiency. BMO has a good reputation for holding international (non-U.S.) securities directly in its ETFs rather than through other U.S.-listed ETFs, resulting in one less layer of withholding tax on foreign dividends. This is an area that Blackrock and Vanguard funds have come up short, as many of their ETFs use U.S.-listed ETFs as their underlying holdings. Horizons takes a different approach altogether and uses total return swaps to turn dividends into capital gains, which are taxed at a lower rate than dividends. However, this comes with the caveat of giving up the stream of income that investors normally receive from a distribution yield. Some investors may not appreciate this, so Horizons does not earn as many points as BMO in this category.

And the Winner is...Vanguard!

Taking the asset allocation trophy, we would consider the Vanguard line-ups to be the ìgo-toî option when investors are looking for an all-in-one solution, and their significantly higher assets are a testament to this. That said, it was a close call with iShares and BMO ETFs which offer similar exposures. BMO in particular, offers strong potential with their proven ability to accumulate assets among ETF investors as well the tax-efficiency they offer on some international funds. Although they do not come close when it comes to assets under management for all three of their asset allocation ETFs, Horizons deserves an honorary mention for having a differentiated approach in asset allocation and tax-efficiency compared to the Vanguard, iShares and BMO line-ups which have very similar offerings.

Admittedly, we are being quite picky here. In the end, we do imagine there will be drastic differences in the performance of these funds over time, but since this will likely be a big purchase for any potential investor, we think it is worth the extra due diligence.

Moez Mahrez, CFA, Analyst for 5i Research Inc.

Disclosure: Authors, directors, partners and/or officers of 5i Research have a financial or other interest in XIT and ZRE.