Beating The TSX 2020: Looking Back And Staying The Course

To bear trials with a calm mind robs misfortune of its strength and burden.

To bear trials with a calm mind robs misfortune of its strength and burden.

-Seneca

Last year wasn’t just a year of hardship; it was also a year of lessons. The pandemic forced us to change how we work, how we play, how we interact with each other and how we take care of ourselves. This virus has wreaked havoc on our lifestyle, our health (mental and physical), and, for many of us, our investments. We can hate the pandemic, work ourselves into a frenzy of resentment, but the virus doesn’t care. As Seneca advises, our challenge as individuals is not to fight in vain against misfortune, but to control our reaction to it.

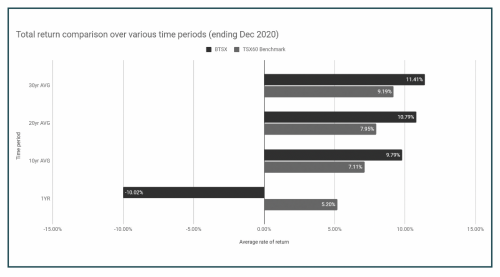

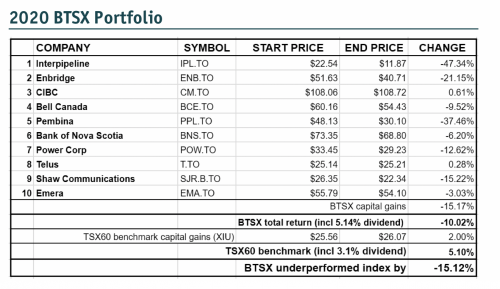

Dividend investors in Canada had an especially tough year. In 2019, Beating the TSX trounced the benchmark index. Unfortunately, the BTSX 2020 portfolio didn’t fare so well; the pandemic and crashing oil prices decimated some key BTSX stocks like IPL, PPL, and ENB, pulling the whole portfolio down. Only two stocks from our January 2020 list had positive returns, CIBC and Telus, and even those were barely positive. Overall, the BTSX total return was -10% for the year vs. +5% for the index.

No one likes negative returns, but they are inevitable if you invest in the stock market. An underappreciated investment skill is the ability to process bad news in good ways. In light of these results, here are three things dividend investors should remember.

1. Don’t Be Blinded By Short-Term Numbers

We are long term investors, so one-year numbers are of limited utility. Sure, we publish an annual review of the BTSX portfolio, but this is just one data point. Ask yourself: What is my investment time horizon? If it is less than five years, you probably shouldn’t be invested in the stock market at all. Even though our short term returns this year aren’t great, the 10-, 20- and 30-year BTSX returns are solid.

*Interpret this chart with your investment time horizon in mind.

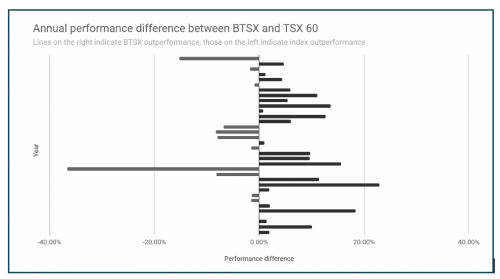

I don’t like the one-year returns on that chart either, but it’s deceiving; remember one year is just one year, and we have over 30 years’ worth of data for BTSX. The following graph shows the performance of BTSX vs the benchmark index for the past 34 years: 2020 is at the top and 1987 is at the bottom. As you can see, BTSX has a strong history of beating the index, with a few notable exceptions—more on that in a moment.

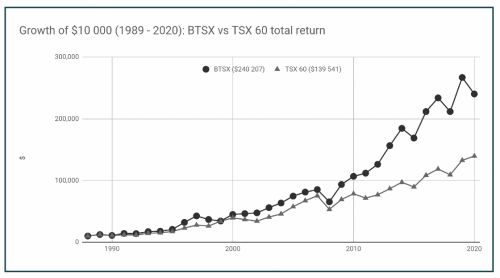

Viewed in an even more meaningful way, consider the growth of $10,000 over the last 34 years using BTSX vs a TSX 60 index fund. Despite the minority of years that BTSX lost to the index, sticking with a BTSX-based investment strategy would have resulted in a 72% larger investment balance.

*After 30 years, your nest egg would be 72% larger using BTSX vs a TSX 60 index fund.

Do not let one year of lacklustre returns derail your investment plan. Every good investment plan will have periods of underperformance. Constantly changing strategies is a much greater threat to our financial goals.

2. BTSX Shines After Bad Years

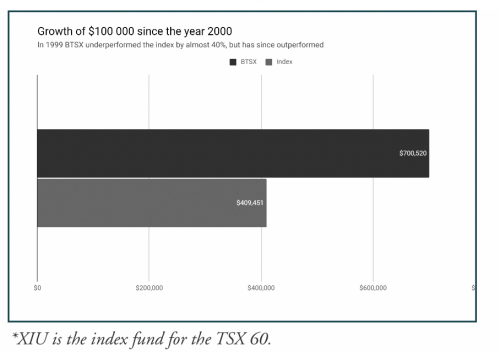

Furthermore, Beating the TSX has an incredible track record of bouncing back after bad years. Consider 1999: that was BTSX’s worst year on record with a return 37% worse than the index. Horrible, yes, but if an investor had invested $100,000 using the BTSX method starting right after this horrendous performance, by now it would have grown to over $700,000 vs. only about $400,000 if they had chosen an index fund.

2020 was BTSX’s second worst year, but my bet is that investors who stick with a dividend-based investment strategy like BTSX will be glad they did. When we re-focus on timeframes that matter, dividend investing is clearly the way to go. A good investment plan is not one without periods of underperformance, but one that is durable enough to recover and outperform.

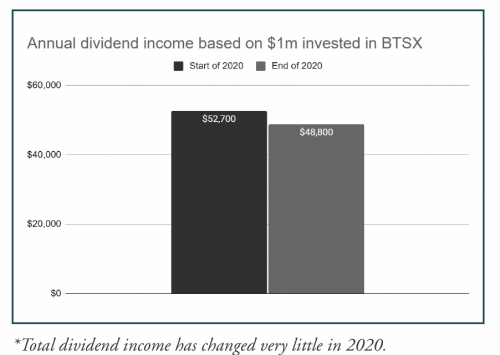

3. Dividend Investors Have The Luxury Of Ignoring Stock Prices

Lastly, it’s important to remember that stock prices are just stock prices. When you are invested for the long-term and fund your living expenses primarily with dividends, it doesn’t matter what stock prices do. It’s the dividend payments that matter—and BTSX stocks rarely cut their dividends. Even though IPL did cut its dividend payment by 72% this year, this was largely offset by six other BTSX stocks (ENB, CM, BCE, PPL, POW, and EMA) raising their dividends in 2020.

You Could Do Better

Beating the TSX is a tool, not an instruction manual. Some will follow the method exactly, most will adapt it to suit their needs by:

- holding on to good stocks with slightly lower yields.

- avoiding stocks with worrisome fundamentals.

- buying more or less stock based on personal assessment.

- investing in stocks other than BTSX for diversification.

For example, when I reviewed IPL on my blog in 2019, some readers expressed concern that the dividend payout ratio was too high and weren’t comfortable owning it. In hindsight, their assessment was right. Foresight is another story.

There is value in following a rules-based investment strategy, but investors need to be comfortable with their investments. I mention this for two reasons. First, to emphasize that Beating the TSX is a means of identifying potential investments for your portfolio and does not need to be followed dogmatically. Second, in case these one-year results seem scary, don’t let them dissuade you from dividend investing in general. The evidence for a dividend-based investment approach is sound and you can customize your own approach.

Performance Of BTSX Versus TSX60 In 2020

If you are not familiar with Beating the TSX, it is a simple rules-based method of selecting blue chip dividend-paying Canadian stocks. For over twenty years, annual articles in the Canadian MoneySaver have tracked its performance. For a full explanation of the method and many useful articles on Do-it-Yourself (DIY) dividend investing, visit www.dividendstrategy.ca.

For those who are chomping at the bit for this year’s details, the full accounting of the 2020 BTSX portfolio is at the top of the next page.

Beating the TSX 2021

On the second chart on the opposite page is this year’s list of stocks, generated based on closing prices and yields on December 31, 2020 (the stock selection method can be found at www.dividendstrategy.ca/stock-selection-method).

The average yield for the current portfolio is a generous 6.13%, far higher than anything investors can find in fixed income these days, with the added benefit that dividends receive preferential tax treatment.

Final Thoughts

If you felt stung as a dividend investor in 2020, you are not alone. On the other hand, it’s just one year. I hope this update helps you understand how to keep these inevitable periods of underperformance in perspective.

In summary, remember these three things:

- Don’t be blinded by short term numbers, it’s the long term that matters.

- Beating the TSX has a history of out-performing the index, especially after bad years.

- Dividend investors have the luxury of ignoring stock price fluctuations; even in 2020, dividend income was remarkably stable.

The longer we dwell in our misfortunes, the greater is their power to harm us.

-Voltaire

Matt Poyner is a DIY investor who has been using the BTSX strategy for over ten years to achieve financial independence. He recently completed a one year trip around the world with his wife and four boys and is now enjoying small town life in Picton, Ontario. You can find him online at www.dividendstrategy.ca.