Portfolio Confidential

Real world confidential portfolio discussions:

Real world confidential portfolio discussions:

Q: I’m looking for portfolio diversification and wondering if there is any way I can invest in art. Are there art ETFs?

A: There are no art Exchange-Traded Funds (ETFs) available today. There are some art investment funds, but they tend to have high minimum investments (US$500K and up) and are therefore suitable only for ultra-high net worth investors. Assuming a maximum five per cent weighting in an art fund, an investor would need a US$10 million plus portfolio to think about investing in these funds.

Gabrielle Segal is an NYC-based art consultant. She partners with collectors and their financial and tax advisors to incorporate collections of fine art, jewellery, and other passion assets into wealth management and tax-planning strategies. Segal confirms that there has been an increased interest from private investors in the art market:

“Despite huge variation between market segments, art’s unique financial characteristics (and headline-grabbing auction results) have piqued the interest of intrepid investors. Due to their low correlation with other asset verticals, blue-chip artworks may hedge inflation and potentially outperform the S&P in market downturns, making it a useful store of value and a portfolio diversification tool despite inherent obstacles to liquidity. Recent disruption to debt and equity markets in the wake of the COVID-19 pandemic may renew interest in art’s hedging and diversifying capabilities.”

I spoke with Deloitte Luxembourg’s art and finance expert Adriano Picinati Di Torcello who co-authored the Deloitte & ArtTactic’s 2019 Art and Finance Report. Their survey found that while 85% of collectors name “emotional value” a key acquisition driver, half list “portfolio diversification” or “investment returns.” I asked Torcello about how a retail investor can access the art market:

“To the best of my knowledge, there are no big money management firms that make direct investment recommendations in the art market and I’m not aware of any type of Exchange-Traded Fund in this category. On the other hand, there is a lot of discussion these days around the tokenization of digital art assets or physical art assets, but this is likely a longer-term outcome. If you are interested in art purely as an investment there are a few specialty boutiques that invest in art funds, managed accounts, club deals, ... however, we are seeing increased interest for wealth managers dealing with ultra-high net worth individuals to consider offering services to protect, monetize and transfer wealth allocated to collectibles. One approach will be to use external art professionals to have access to in depth knowledge of the art market.”

It is worth noting that although art as an asset class has low correlation with other asset classes (which is a good thing for portfolio diversification) the absolute returns have been lacklustre. According to a study by CITI, between 1985 and 2018 impressionist art returned five per cent annually, while contemporary art did better at 7.5%. But that lagged real estate, most fixed income, hedge funds, equities and private equity investments, which all had eight per cent or better annual returns.

Until there is an art ETF available for the average investor, I would advise that you buy (perhaps with advice from an art professional) some art that you actually value emotionally. Your return on investment can come from years of appreciation of having it in your home or office as well as supporting the artist who created it. If it goes up in value too, that’s just an added bonus!

For more information: www.deloitte-artandfinance.com.

Q: I’m a doctor and my husband is a primary school teacher. I know we have enough money saved for retirement (well over a million dollars in various assets and home equity) but neither of us knows anything about finance and investing. Is there an app that you can recommend that can run the numbers for a financial plan?

A: Invest in a professionally-prepared high quality financial plan instead of some app. A properly done independent plan is not cheap (about $5,000) but it is worth it for the peace of mind. A good plan will include cash flow projections for multiple different scenarios that might play out post-pandemic. Include scenarios such as becoming suddenly single: 90% of women will be single at some point in their lives due to divorce or widowhood. And many women will become “virtually single” at some point due to incapacity in their partner, with 10% of all Americans over 65 having been diagnosed with Alzheimer’s.

One important thing to keep in mind: Financial planning is a process, not a product. Don’t accept any offers from your bank or elsewhere for a “free financial plan”—these so-called plans are invariably cookie cutter templates designed to sell you mutual funds or other high fee products. If you need help finding a fee-only independent financial planner here are two Canadian resources:

Fee-only planners & coaches directory: https://docs.google.com/spreadsheets/d/1iGzy9kkSXqjGbhXfcfczs9qwSQfI1PdRuNUOMybxvl4/edit#gid=0

Financial Planning Association of Canada member listing: https://fpassociation.ca/entity/grid/listing?ListingId=c244924b-7ca8-4616-89af-a2083ade7b96&EntityTypeId=543c2c57-32db-4c8a-af63-12b06bdf0ac7

Q: I keep hearing that companies that are rich in intangible assets are becoming a bigger part of the S&P 500. How can I invest in these types of businesses?

What are intangible assets? Investopedia says “Intangible assets are non-physical assets that have a monetary value since they represent potential revenue. Intangible assets are intellectual property that include: patents, trademarks, franchises, goodwill, copyrights, and brand equity.” Most people tend to think of the brand equity: it’s why someone pays more for a Rolex than an equally good Swiss watch from a less well known manufacturer. But intellectual property (IP) is becoming ever more important in today’s tech-dominated world…and investable!

Is the trend your friend?

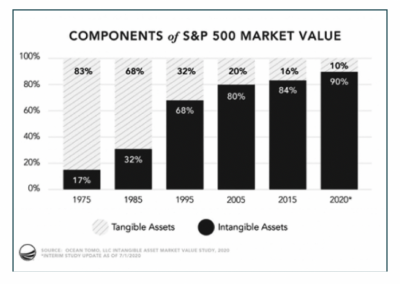

To gather some insights, I spoke with Lally Rementilla, Managing Partner, Intellectual Property-Backed Financing at Business Development Bank of Canada (BDC). In July 2020, the investment arm of BDC launched a $160 million fund to invest in companies that have a portfolio of IP. BDC will provide capital based on the due diligence they do on the companies’ IP portfolios. This information provides great perspective on the future potential of the business. Rementilla says that it isn’t uncommon for a company to have more value in its IP than in its tangible assets and confirmed that intangible asset investing is where the world is headed. According to a 2020 study, 90% of the market value of the S&P 500 is made up of intangible assets, up from 17% in 1975.

How can a Canadian retail investor participate in intangible asset investing? Here are some options:

- Vancouver based TIMIA Capital Corporation (CVE: TCA) is a specialty finance company that provides revenue financing to technology companies.

- Hercules Capital Inc (NYSE: HTGC) in Palo Alto, CA specializes in providing venture debt, debt, senior secured loans, and growth capital to privately held venture capital-backed companies at all stages of development.

- Espresso Capital has a private venture debt fund that is available to accredited investors. They have offices in Toronto, Chicago, San Francisco, and Montreal.

Do you have questions about your own investment portfolio? I have recently set up The Rich Thinking® Financial Advice Hotline. This will be a win/win: you get a free 30-minute confidential Zoom chat offering an independent, unbiased perspective on your financial situation with no sales pitch! In exchange, I get to use the anonymized data that will come from these conversations to make my Rich Thinking research even better. Email me to book your Zoom discussion: barbara@barbarastewart.ca