So The Markets Have Advanced For 10 Years, How Much Higher Can They Go?

This is a question that we get from clients almost on a daily basis. And it is a good question. The best way that we can answer this query is to look at past market actions and take away some of their lessons.

This is a question that we get from clients almost on a daily basis. And it is a good question. The best way that we can answer this query is to look at past market actions and take away some of their lessons.

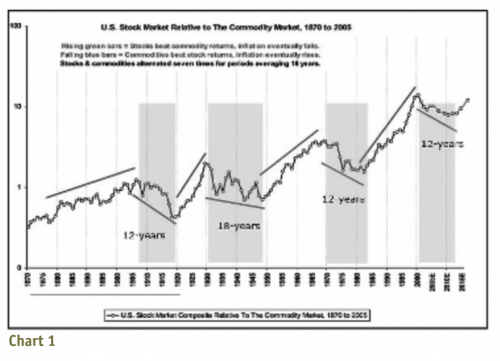

There are several key elements that continue to repeat themselves. First, markets tend to secular phases. Chart 1 illustrates that fact. Chart 1 is a relative performance chart of two very different indexes, the Dow Jones Industrial Average (a deflationary based index) and the Commodity Research Bureau index (an inflationary based index).

Over the last 130 years, secular movements have occurred eight times, both up and down, with each leg lasting on average 18 years. The markets have started a ninth leg in 2011/2012. Based on 130 years of data, the bull market should last until about 2028 to 2030.

Another test for this current bull market is whether it is driven by deflation or inflation. Deflationary-driven trends are typically longer in duration and can last up to 20 years whereas inflationary-driven trends are much shorter, normally about four to five years. Chart 2 is a relative performance comparison between deflationary sectors (financials, industrials, consumer products, technology and utilities) and inflationary industry groups (commodities). As the chart shows, the deflationary sectors are outperforming inflationary groups from 2011 onward. Adding to this evidence is the U.S. dollar. The American currency is stronger in performance against other world currencies during deflationary phases and is weaker during periods of inflation. So, having both deflationary sectors outperforming inflationary groups plus having the USD steadily rising over the past decade adds more evidence to the outlook that the stock markets are in another 18-year bull market phase.

These two measurements (Chart 1 and 2) are primarily technical gauges. Several key economic indicators that we use for analysis are the U.S. Unemployment Rate (Chart 3) and, to a lesser degree, the U.S. Consumer Confidence Index, both provides clear insight into the U.S. market’s strength. At present, the U.S. Unemployment Rate has made a sharp upward spike. This is similar, though not as extreme, as the last two upward runs in 2001 and 2008/09. Note that each time the unemployment rate crested, the S&P 500 had already started advancing. This is because the equity index leads the U.S. Unemployment rate.

Bottom line: Chart 1 shows that bull markets (1920-1930, 1950-1970, 1982-2000), on average, last about 18 years in duration. The current market advance is 10 years old. This would suggest that there is another seven to eight years of upside left. A key component of all the secular bull advances over the last 130 years is that deflationary sectors should outperform inflationary sectors. Chart 2 demonstrates that this action is occurring.

The opposing movement of the U.S. Unemployment Rate and the stock market (S&P 500) in Chart 3 illustrates that the unemployment rate in the U.S. appear to have crested and starting to decline. Again, this is positive news for the stock market.

In conclusion, we do not envision a new bear market starting over the next few years. In fact, we believe that by the end of 2020, the stock market will provide new all-time highs. Our next is target for the S&P 500 is 3450. For the Dow Jones industrial Average is and 30,250 and for the TSX, 17,300.

Donald Dony, FCSI, MFTA, Analyst, Instructor, Editor, D.W. Dony and Associates Inc., Victoria, BC (250) 479-9463, dwdony@shaw.ca, www.technicalspeculator.com