Insights From Sector ETFs

The unprecedented nature of the coronavirus has taken all industries across the board by surprise, however some have been more impacted than others. It is often helpful to look to the performance and valuation of individual sectors rather than the broad averages of equity indices provide to discover opportunities and understand certain trends.

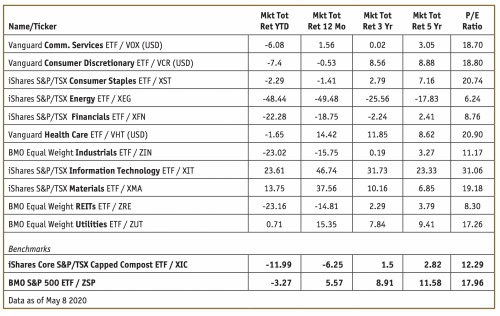

In the table below, we have listed ETFs that represent the main 11 sectors and indicated their performance over different time periods as well their Price-to-Earnings ratio. Letís take a look at a few sectors that have stood out so far this year in light of the COVID-19 pandemic.

Technology

XIT has returned a whopping 23.6% so far this year while nearly everything else in Canada is in the red. This is not surprising if you have kept up with the performance of companies like Shopify (SHOP) and Constellation Software (CSU) which are up 92% and 15% at year-to-date at the time of writing. While the strength this ETF has seen is a case of strength from a few individual companies, this is what the Canadian technology sector is; a handful of companies that have shown outstanding growth. Traditionally seen as a risky sector, the flexible and ‘minimal contact’ nature of technology companies has allowed many of them to thrive, even in the face of pandemic slowdowns.

Materials

Based on the market-capitalization weighted ETF reflecting the materials sector in Canada (XMA), the sector is about 89% metal and precious metals mining companies, which have benefitted from the increased value of precious metals this year; gold in particular. Gold is generally seen as a ‘safe haven’ and in times of crisis, but does not make it an asset that is free from risk. The mining and materials sector can be a volatile one. Gold, like other commodities will fluctuate based on supply and demand factors. Gold companies also present their own company specific risk which means their performance will not likely have a direct correlation with gold bullion. However, Canadian mining and materials companies have generally benefitted from the rise in gold seen since the end of 2018.

Energy

Energy has undoubtedly taken a big fall given the double hit from overproduction of oil on OPEC’s part (more supply) and the coronavirus (less demand). This led to an oil storage crisis and to negative oil prices — something we have not seen before — and now oil prices are at levels which make oil production unprofitable for even the largest energy companies. While the energy sector may seem cheap (price to earnings of 6.24), as a whole, it has significantly underperformed over the last three to five years, which indicates that its underperformance is not just related to the coronavirus. Broad exposure to energy using ETFs may not actually be the best way to go as you end up getting a lot of exposure to oil prices (something out of our control). If one wants exposure to the energy sector, a better idea might to be to go with quality individual companies with strong balance sheets like Enbridge (ENB) or Suncor (SU).

The coronavirus pandemic has brought a shock to our economy that may change the dynamic of some industries going forward and challenge some of our assumptions on the valuations of companies. Hopefully, we will see a recovery in even the most hurt sectors by this coronavirus in one or two years from now, but perhaps what provides just as much insight as how sectors are performing recently due to the virus is how they performed before the virus as well by looking at long-term returns.

Disclosure: Authors, directors, partners and/or officers of 5i Research have a financial or other interest in XIT and ZRE.

Moez Mahrez CFA, Investment Analyst, 5i Research