Turn Your Money-Sucking Mutual Fund Into A Winning Portfolio Part 2 - Cleaning Up Your Portfolio

In the October 2019 issue of Canadian MoneySaver, I walked through the steps to replicate your high-cost mutual funds and turn it into a low-cost Exchange-Traded Funds (ETF) portfolio. I used RBC’s Select Aggressive Growth Portfolio mutual fund, as an example, and converted it into a portfolio consisting of five ETFs, matching the fund’s allocation it was benchmarking.

In the October 2019 issue of Canadian MoneySaver, I walked through the steps to replicate your high-cost mutual funds and turn it into a low-cost Exchange-Traded Funds (ETF) portfolio. I used RBC’s Select Aggressive Growth Portfolio mutual fund, as an example, and converted it into a portfolio consisting of five ETFs, matching the fund’s allocation it was benchmarking.

Now, what if you hold three or five mutual funds? Does that mean you’ll be investing in 15 or 25 ETFs? No. This is where you clean up your portfolio by consolidating ETFs that overlap so you narrow down the number of ETFs you’ll be investing in.

But before you determine your ETF shopping list, re-visit your asset allocation and look at your portfolio in the overall context of your financial plan and goals. Then, determine which ETFs go into which accounts as different investments carry different tax consequences.

Re-Visiting Your Asset Allocation

Your asset allocation should be based on considerations such as the number of years you’re away from retirement, appetite for risk, job security, etc. The closer you are to retirement, the more weight your portfolio will carry in bond investments. Likewise, the further away you are from retirement, the more weight your portfolio will carry in equities. However it was you determined your asset allocation, whether it was through a mindless questionnaire someone asked you to fill out or someone else determined it for you, think about those considerations and how you would feel if you watched your portfolio plummet 35%. If you can’t stomach that, then cushion that with some bond investments. Having your investments in 100% equities is not the right asset allocation for you.

You also want to make sure you’re not pulling money out of your investments during downturns, which is why giving yourself a long-time horizon for your investments is crucial. Your portfolio needs time to recover from the downturns, recessions or corrections. Hence, ensure your emergency fund exists. This is part of your overall financial plan and making sure you have cash in the event of an emergency.

Your asset allocation is a balance between ensuring you’re not selling yourself short in the long run by not having enough equities in your asset mix, versus your tolerance for risk. I always tell my clients you risk more in the long run by not taking enough risk now. Finding a balance that’s suitable for you is a critical part of your investment plan.

Check for Overlap and Recurring Benchmark Indices

You might notice some recurring benchmarks or overlap in your multi-mutual fund portfolio.

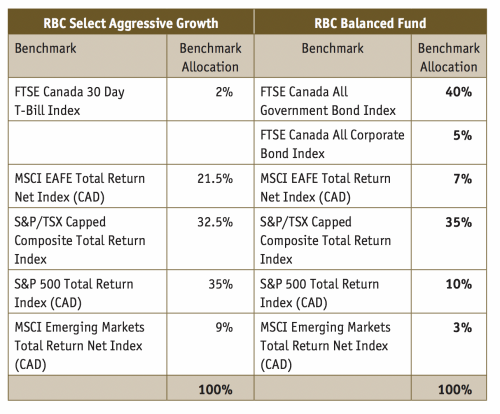

For example, a client of mine was invested in two mutual funds from RBC. One of them was the RBC Balanced Fund and the second one was the RBC Select Aggressive Growth Portfolio. The equities portion of both these funds are the same—the difference was the bond allocation in the balanced fund. (See chart).

What seems to be eleven ETF investments work out to being six or seven ETFs. Six if you eliminate the FTSE Canada 30 Day T-Bill Index, which is essentially holding cash.

Alternatively, if you’re in a balanced fund, you have options such as the iShares Core Balanced ETF (XBAL) or the Vanguard Balanced ETF Portfolio (VBAL) which are both roughly in 60% equities and 40% bonds. You can just invest in a single balanced fund if you’re good with this asset mix. Both funds are similar: they have a good mix of domestic and international funds, along with investments in U.S. and Canadian bonds.

ETFs like the iShares Core Growth ETF Portfolio (XGRO) and the Vanguard Growth ETF Portfolio (VGRO) are another type of “packaged” fund, with an asset mix that’s a bit more aggressive (80% equities/20% bonds) compared to a balanced fund. If you want simplicity, these funds provide a mix of domestic, international equities, and bonds—all for a cost of roughly 0.18% to 0.25%.1

But what if these asset allocations don’t work for you? Then you’ll have to do some manual adjusting yourself.

Adjusting Your Asset Allocation

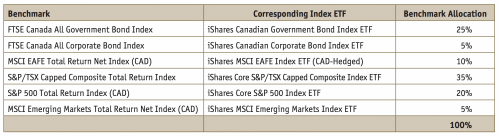

Let’s say you decided on a 70% equities and 30% bonds split. You can achieve this target by copying the asset allocation of RBC’s Balanced Fund above and then moving 15% of the bond allocation into equities.

For example, it could look something like this chart.

Funds are generally re-balanced four times a year so you can always copy their asset mix and re-balance four times a year as well.

Tax Efficiency

With the way interest, dividends, and capital gains are taxed, there are strategies that allow you to minimize your tax payments on your investments. Since interest income is taxed like employment income, you’d want to hold any bond investments or balanced funds inside a registered account like your Tax-Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP), especially if you’re in a high-income tax bracket. Your bond payments can end up being peanuts on an after-tax basis.

Dividends and capital gains are taxed more favourably so once you’ve maxed out your registered accounts, putting equity funds in your non-registered accounts make sense. However, there is a difference when it comes to U.S. investments being held in an RRSP vs. TFSA.

The U.S. imposes a 30% withholding tax on its dividends on Canadians, unless it’s held in an RRSP. In this case, U.S. dividends are not taxed. However, when it comes to your TFSA, U.S. dividends are taxed. You can be eligible for a lower withholding tax rate of 15% when you fill out a W-8BEN form with your broker, which tells the U.S. government you’re a Canadian resident and, thus, eligible for the reduced 15% tax rate under the Canada-U.S. Income Tax Treaty. Therefore, when it comes to your U.S. funds, it’s more tax-efficient to stick them in your RRSP account rather than your TFSA.

Michelle Hung, CFA is the founder and published author of the self-titled book, The Sassy Investor. An advocate for financial literacy, she is on a mission to help people achieve financial independence through education and coaching. Michelle can be reached at www.thesassyinvestor.ca, Instagram: @thesassyinvestor, and Facebook: https://www.facebook.com/groups/sassyinvestor/.

- As of December 16, 2019.

Sources:

- https://www.vanguardcanada.ca/individual/indv/en/product.html#/fundDetail/etf/portId=9579/assetCode=balanced/?overview

- https://www.vanguardcanada.ca/individual/indv/en/product.html#/fundDetail/etf/portId=9578/assetCode=balanced/?overview

- https://www.blackrock.com/ca/individual/en/products/239447/ishares-balanced-growth-coreportfoliotm-fund

- https://www.blackrock.com/ca/individual/en/products/239449/ishares-balanced-income-coreportfoliotm-fund

- https://www.rbcgam.com/en/ca/products/mutual-funds/rbf272/detail

- https://www.rbcgam.com/en/ca/products/mutual-funds/rbf592/detail