Supercharge Your Retirement Savings!

We are approaching the holiday season, and with it comes along some obvious time commitments. However, as we approach the end of the year, you might be better served dedicating some time to your second favourite season – tax season.

We are approaching the holiday season, and with it comes along some obvious time commitments. However, as we approach the end of the year, you might be better served dedicating some time to your second favourite season – tax season.

When it comes to personal tax planning, one of the biggest tools in your arsenal remains RRSPs.

RRSP Breakdown

When you contribute to your RRSP, the amount that you contribute is then deducted from your total income when filing your taxes. Thus, for every dollar that you contribute to your RRSP, you do not have to pay any tax on it in the current year. Tax is paid on these funds when you withdraw the funds from your RRSP, either upon retirement or sooner if required.

The contributions are broken out into two separate timeframes:

• January and February

• March to December

You should be receiving your March to December of 2019 RRSP contribution slip in January. But what happens if you didn’t get around to contributing to your RRSPs in 2019? Well, the government of Canada has given us all a great tool to maximize our RRSP utilization and related tax planning. They allow us to make contributions up until February 28th and have them applied against the previous tax year. So, you can make an RRSP contribution during these two months and can apply it to your 2019 tax year.

Why is this so important?

I like to use this window as an opportunity to maximize RRSP savings and the utilization of your tax refund.

The Supercharger!

The strategy that I recommend is effectively a “loan to yourself” for the exact amount of your tax refund (give or take). Now, this isn’t a technical loan with interest, etc. but rather a minor cash flow loan to yourself. If you are filing your taxes on your own, 2019 tax filing software will be become available for use during the early part of 2020. As you begin to work on your tax filing, you can begin to get a sense of the size of your eventual tax refund. Once you complete your initial entry into the software, you will have a rough estimate of what your return will be.

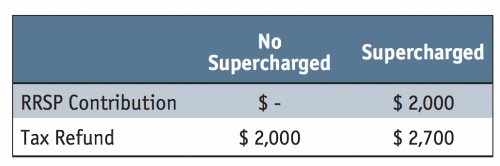

Equipped with a reasonable estimate of your tax refund, you now know the amount that you will “loan to yourself.” For example, let’s say that you are going to expect a $2,000 refund. Once you file your taxes, you will receive a $2,000 payment from the government.

Presuming that you have $2,000 in your non-registered savings account, you can make a $2,000 contribution to your RRSP. Then, once your tax refund comes in, you can “repay” the loan to yourself and replace the $2,000 that you had withdrawn to make the RRSP contribution in the first place.

Now here is where the supercharger ramps up. By making the RRSP contribution, you have now increased your tax refund! Let’s assume that you have a 35% marginal tax rate. Your contribution would have just increased your tax refund by $700!

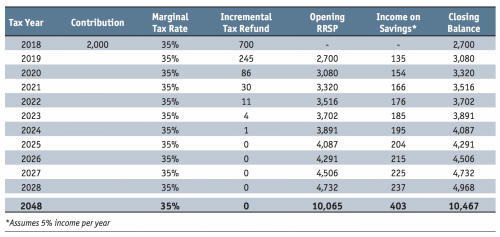

Why stop the supercharger now? If you contribute the incremental $700 to your RRSPs for the 2020 tax year, you have now created an additional $245 in extra cash on the following year’s refund. By making a simple $2,000 contribution, you can create $945 in additional cash flow to yourself in roughly a year. In addition to the cash flow, the new contributions to your RRSP will grow tax-deferred until your retirement. The below table shows how this simple maneuver compounds over 30 years.

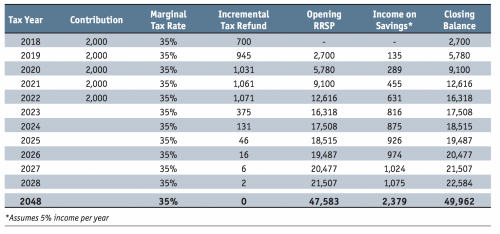

The Supercharge is a strategy that you can execute each and every year. Given that this is something that you can do every year, let’s see what happens if we expected a $2,000 tax refund for the next five years, and used the same approach.

This example shows $10,000 of contributions using the supercharge technique, which equates to over $15,000 in total contributions after the additional refund contributions. Who wouldn’t want to have almost $50,000 more available to them in their retirement?

Tax Refund Estimate

Now you may ask, but what if I don’t have all my tax forms? How can I reasonably estimate my tax refund?

Make the best estimates that you can and enter them into the software. Use your final pay stub from your employer instead of your T4, add up the interest earned in your savings account in place of your T5, etc. As long as the estimates that you use are reasonable and complete, you shouldn’t have any issues coming up with a reasonable estimate of your tax refund. An added bonus of this approach is that if you are slightly off, the increment to your tax refund (the $700 in our example above) acts as a buffer in case you overestimated your original tax refund.

Don’t forget to update your tax software with the correct figures once your tax slips come in.

Does This Make Sense For You?

As with all tax planning, you should only utilize this maneuver if it makes sense for your situation. Some critical aspects to consider are:

- Whether or not you have the cash available in a non-registered account to contribute.

- Whether or not you will need the cash between now and when your tax refund is paid to you.

- Your available RRSP contribution room.

- Your marginal tax rate.

- Your expected marginal tax rate in retirement.

- Workplace pension plan considerations.

- Your overall retirement plan.

The Brass Tacks

Saving for retirement is a critical objective for all Canadians. The January-February RRSP contribution period can provide a significant opportunity to boost your savings. With this simple approach outlined above, you can have a significant impact on your retirement savings. If you need assistance in determining whether or not this approach is right for your personal situation, consult a financial planner.

Eric Vallee, CPA, CA is a fee-only financial planner with Novel Financial Inc. Reach him at eric@novelfinancial.ca.