Ten Stingy Stocks For 2019

The Stingy Stock method trounced the market since it was created. The idea was, and still is, to try to beat the S&P 500 by picking value stocks from within the index itself using a numbers-based approach.

The Stingy Stock method trounced the market since it was created. The idea was, and still is, to try to beat the S&P 500 by picking value stocks from within the index itself using a numbers-based approach.

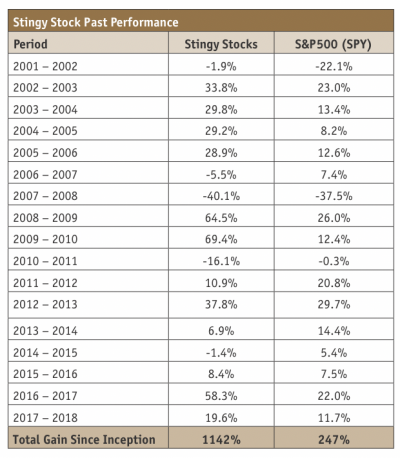

The results exceeded my expectations and last year was another good one. The Stingy Stocks gained an average of 19.6% since my last update. By way of comparison the S&P 500, as represented by the SPDR S&P 500 ETF Trust (SPY) Exchange Traded Fund (ETF), trailed behind with an advance of 11.7% over the same period. The Stingy Stocks beat the index ETF by 7.9 percentage points.

Over the long term, the Stingy Stocks have gained an average of 16.2% per year since the portfolio began at the end of 2001. By way of comparison, the SPDR S&P 500 ETF climbed 7.7% per year over the same period. The Stingy Stocks outperformed the index by an average of 8.5 percentage points annually.

To put that into perspective, if you had split $100,000 equally among the original Stingy Stocks at the end of 2001 and moved into the new stocks each year, your portfolio would now be worth about $1,242,000. On the other hand, an investment in the SPY ETF would be worth about $347,000.

You can see the full performance record in the accompanying table. But be aware that the returns do not include taxes, commissions, or other trading frictions. They do include dividends, which are reinvested roughly annually when each year’s stocks are selected.

The original Stingy Stock method performed well but it was very picky. All too often it selected a handful of stocks and, in recent years, only a couple passed the test. I gave serious consideration to closing the portfolio down last year because the pickings were so slim.

Instead, I decided to tweak the method slightly after a copious amount of back-testing while sticking with the main elements of the old approach.

The new method starts its hunt for good value stocks in the same place as the old one. It stays with firms in the S&P 500 index because the index contains some of the largest stocks in the U.S., which tend to be relatively stable.

Continuing the safety theme, the new method still requires a company to have positive earnings and cash flow from operations over the last year. After all, a business is less likely to go bust when it is profitable and has cash coming in the door.

On the bargain front, the method selects stocks with price-to-sales ratios of less than one. Nothing has changed so far.

The new version of the method diverges from the original by loosening up on three debt-related factors that were previously required. Stocks with lower current ratios, higher debt-to-equity ratios, and lower interest coverage ratios will now be considered instead of being rejected.

In another change, stocks with lower price-to-earnings ratios are now favoured. I’ve also blended in a few secret ingredients for a little extra flavour.

All the changes have been informed by a great deal of back-testing and they will hopefully maintain—or improve— performance while picking roughly ten stocks each year.

So, without further ado, the ten Stingy Stocks for the year are: Allstate (ALL), Delta Air Lines (DAL), Foot Locker (FL), HollyFrontier (HFC), Macy’s (M), Nucor (NUE), Prudential (PRU), PulteGroup (PHM), Tyson Foods (TSN), and United Continental (UAL). Oh, and yes, I own some of them.

The stocks were selected on October 1, 2018 when the group sported an average price-to-sales ratio of 0.7, a price-to-earnings ratio of 10, and a 2.3% dividend yield.

As always, before buying any stock, be sure to do your own due diligence. Make sure the situation hasn't changed in some important way. Read the latest press releases and regulatory filings. Scan news stories for any important developments and make sure it’s a good fit for your portfolio. Be careful out there.

Norman Rothery, PhD, CFA, Founder of StingyInvestor.com, Toronto, ON (416) 243-9580