Renewable Energy

The Trend

The Trend

Renewable energy has existed in passive forms for as long as energy from the sun has reached planet earth. Humans first began harvesting renewable energy by using biomass to create fire for heat and cooking. Wind power has been used to power sailing craft for thousands of years. In the mid-nineteenth century the first form of non-renewable energy came into use: coal. That was quickly followed by oil and gas, the triumvirate of carbon-based fuels.

Renewables include energy produced from the sun, hydro, wind, tides, rain and geothermal heat. They are used to create electricity, heating and cooling, energy for transportation and for off-grid energy generation.

Given the massive importance of carbon fuels as an energy source it is always noteworthy when one of the largest oil and gas producers in the world, ExxonMobil, has whiplash. In 2015, then CEO Rex Tillerson said at his company’s annual meeting that ExxonMobil had not invested in renewable energy because: “We choose not to lose money on purpose.” By February 2018, the current CEO Darren W. Woods said: “We are committed to being part of the solution by investing in new technologies that can provide economic solutions on a globally scalable basis.” ExxonMobil is now investing $1 billion per year ($8 billion cumulative) into researching alternative forms of energy.

ExxonMobil is not alone in hedging against the expected displacement of 8 million barrels of oil per day by renewables over the next few years. For example, Total SA and Royal Dutch Shell are also investing in alternative energy.

Some Facts

According to the International Energy Agency’s Renewables 2017 report, “…renewables accounted for almost two-thirds of net new power capacity around the world in 2016, with almost 165 gigawatts (GW) coming online. This year’s renewable forecast is 12% higher than last year, thanks mostly to solar PV [photo voltaic] upward revisions in China and India. For the next five years, solar PV represents the largest annual capacity additions for renewables, well above wind and hydro.”

Again, according to Renewables 2017, China is the leader in renewable energy growth worldwide, followed by India and the United States. These three countries will account for two-thirds of renewable energy expansion over the next five years. The share of renewables in power generation will reach 30% in 2022, up from 24% in 2016.

According to Germany-based Kaiserwetter Energy Asset Management, as reported in Forbes, the production costs of renewable energy has fallen below that of fossil fuels, from $35 to $54 per MWh for renewables compared to $49 to $174 for fossil fuels.

The US Energy Information Administration states: “Renewables are the world’s fastest-growing energy source, with consumption increasing by an average 2.3%/year between 2015 and 2040.”

The UN Environment Programme and Bloomberg New Energy Finance’s report Global Trends in Renewable Energy Investment 2018 states: “The proportion of world electricity generated by wind, solar, biomass and waste-to-energy, geothermal, marine and small hydro rose from 11% in 2016 to 12.1% in 2017. Global investment in renewable energy edged up 2% in 2017 to $279.8 billion. Solar power rose to record prominence in 2017, as the world installed 98 gigawatts of new solar power projects, more than the net additions of coal, gas and nuclear plants put together. The leading location by far for renewable energy investment in 2017 was China, which accounted for $126.6 billion, its highest figure ever and no less than 45% of the global total… [with] solar investment of $86.5 billion, up 58%. Clean energy share prices rose in 2017, by about 28% on the WilderHill New Energy Global Innovation Index, or NEX.”

While the majority of governments worldwide are publicly committed to combatting climate change, as evidenced by the Paris Climate Agreement, perhaps more importantly, the underlying economics appear to be increasingly driving the growth in the renewable energy sector.

Risks

Three key risks for growth in the sector are the potential for government policy changes (e.g., the U.S. withdrawal from the Paris Accord and energy deregulation leading to cheaper oil and gas), the reduction/elimination of government subsidies for renewable energy and rising interest rates making investments more expensive. More recently, a 30% tariff on solar panels imported into the U.S. will raise costs for Americans. All of these could be negative in the medium term for the sector.

There are also single-company risks in the renewables space evidenced by the bankruptcies of SunEdison and Abengoa SA.

As with any area of emerging technology and growth uneven performance is to be expected. The PowerShares Global Clean Energy ETF (PBD) tracks the NEX index referenced above. Over the last 10 years the ETF has seen a total negative return of 48%, while in the last five years it has risen 54%.

Nevertheless, the growth in renewables is clearly going to continue for the foreseeable future which should lead to increasing equity values given a long enough time horizon.

Ideas for Further Research

According to ETFdb.com, there are 12 Exchange Traded Funds (ETF) in the alternative energy space. They have an average expense ratio of 0.65% with asset values ranging between a tiny $17M USD to as large as $396M USD. Table 1 shows a breakdown of seven of these ETFs with asset values of about $100M USD or more. Note they all track different indexes and this drives the focus of their holdings (i.e., solar vs. wind vs. all clean energy).

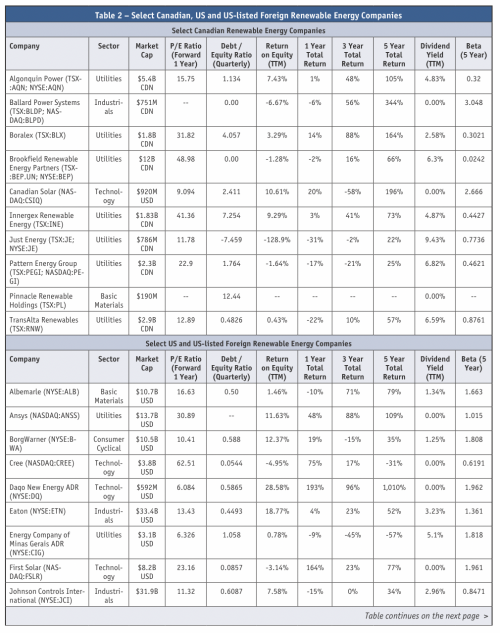

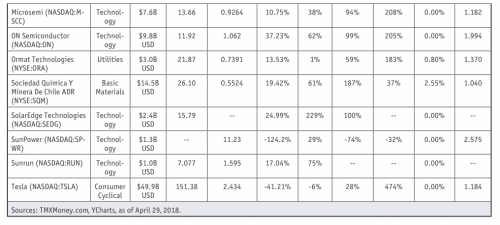

Table 2 identifies some of the publicly-traded

Canadian renewable energy companies and some top U.S.-listed American and international holdings found in the ETFs in Table 1. Clearly there are a lot of options for single-company equity investments.

How to Invest

In The Renewable Energy Trend

Whether to buy single equities or an ETF, or maybe a combination of both, depends on the investor.

ETFs are attractive for their relative diversification in companies, sub-industries, geographic regions, market capitalizations and stock style exposures. Three of the ETFs in Table 1 have more than half their holdings outside the Americas, which could be attractive given how much investment in renewable energy is occurring around the world.

Having said that, a concentrated investment in one or a handful of top performing equities could provide overall better returns than ETFs and will avoid the cost of ETF fees. This will come at a potentially higher risk if the picks don’t work out.

If the investor wishes to invest in Canadian dollars the Canadian offerings are relatively plentiful and can be fairly attractive, especially utilities, which are currently seeing depressed share prices and resulting higher yields due to rising interest rates. Some of these stocks are inter-listed on a U.S. exchange and pay dividends in U.S. dollars.

For (much) riskier investments, there are some Canadian companies listed on the Venture Exchange such as Eguana Technologies (EGT.V), EnerDynamic Hybrid Technologies (EHT.V), Finavera Renewables (FVR.V), Run of River Power (ROR.V), Shear Wind (SWX.V), Solar Alliance Energy (SAN.V) and UGE International (UGE.V).

It can be impractical for the average investor to invest non-North American equities directly, due to cost and regulatory differences of foreign exchanges, unless they are listed on a U.S. stock exchange as an American Depositary Receipt (ADR).

Concluding Remarks

The renewable energy sector would appear to hold promising investment potential as the world continues to shift energy consumption increasingly towards alternatives to fossil fuels. Patience may be required as this is a long-term trend and there are potential headwinds in the short to medium term. Having said that, there are opportunities, especially with green utilities, to be paid dividends while awaiting potential capital appreciation. Since much of the growth in renewables will be driven by Asian countries like China and India, it may be advantageous to participate in these markets.

Michael Patenaude, BA, MA, is a personal finance enthusiast living in Ottawa. money4retirement.ca. McMurtryInvestmentReport.ca. Email: mrpatenaude@gmail.com. This article is not intended as investment advice nor is it a solicitation to hold or trade securities. Michael owns BEP and AQN and has added ICLN to his watchlist.