How To Save Big On International Money Transfers

For investors, travellers and business people alike, currency conversions have always been a royal rip-off. Fees for converting Canadian dollars to a foreign currency like U.S. dollars can be as high as 5%, and even higher if you buy U.S. cash directly from a local Canadian bank branch. These fees are often hidden in the form of inflated conversion rates, so even though the financial institution may advertise “No Fee Currency Conversion”, there is a steep cost indeed. But much like how expensive, high-cost mutual funds are being sideswiped by low-cost Exchange Traded Funds (ETFs), the era of mass-market, low-cost currency conversions has arrived.

For investors, travellers and business people alike, currency conversions have always been a royal rip-off. Fees for converting Canadian dollars to a foreign currency like U.S. dollars can be as high as 5%, and even higher if you buy U.S. cash directly from a local Canadian bank branch. These fees are often hidden in the form of inflated conversion rates, so even though the financial institution may advertise “No Fee Currency Conversion”, there is a steep cost indeed. But much like how expensive, high-cost mutual funds are being sideswiped by low-cost Exchange Traded Funds (ETFs), the era of mass-market, low-cost currency conversions has arrived.

One of the most well-known services for low-cost international money transfer is Transferwise, which was founded in 2011 and has grown quickly, and now facilitates transfers of over one billion dollars per month for its clients. There are many other similar online companies, including CurrencyFair, CanadianForex, World First, and World Remit. These companies all have a similar business model but vary in the number of currencies they support, their pricing structure, transfer minimums and maximums, the speed of transfer, and extended services offered. For most services, the fees will vary with the size of the transfer, the from and to currency, and how you fund your account. But in general, the fees charged for money transfers are usually less than 1% and in some cases much lower than this.

The best way to explain the business model is with an example. I, as a Canadian, decide to take a once-in-a-lifetime trip to Thailand to charter a catamaran. I find a charter company that has the exact style of boat I am looking for, but they only accept Thai baht as payment. As it so happens, somebody in Thailand has purchased knitted hats from a Canadian company for roughly the same amount and must make payment in Canadian dollars. We both decide to use Transferwise to reduce the currency conversion costs we will have to pay. We then independently put in our transfer requests, and behind the scenes Transferwise matches us up, whereby the Thai person deposits Thai baht into his or her Transferwise account which is then paid to the charter boat company on behalf of me, and the Canadian dollars I put into my Transferwise account is paid to the seller of the knitted hats. No money crosses borders and no physical conversion of currencies is done, making it extremely cheap to process the transaction. These companies maintain large pools of money in each country and currency to smooth out the times when they have more transfers coming into a currency than they have going out. This way, you are always able to get your transfer done and it does not depend on finding an actual individual wanting to transfer money in the opposite direction.

The exchange rate you get (called the “mid-market” or “interbank” rate) is the one you see quoted online through Google or any other x-rate service, and before the advent of these new transfer services, was normally only available to the big banks and financial institutions. In fact, some services (such as CurrencyFair) even allow you the possibility of getting rates below the mid-market rate using a bidding system.

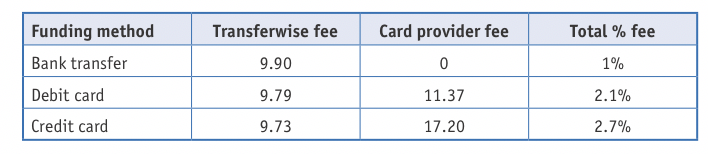

Many of these services allow you to transfer very small amounts of money, with a correspondingly small service charge. Your account can be funded in a variety of ways, from a direct transfer from your bank account, to using your debit card, to using your credit card, although using cards results in higher fees. Because most of these companies operate online only, it is not possible to use cheques or cash to fund your account as these companies generally do not have any physical locations.

These companies do not offer transfers between every single country and currency in the world, but they do support many of them, and the number of supported countries is growing constantly as the demand grows and they obtain operating licenses in each country. There are also specific rules for transferring money to and from particular countries, which depend on local laws and requirements. The country-specific rules, regulations, and associated transfer costs are usually clearly listed on the service websites.

As an example, I just checked Google and it tells me the CDN/USD currency conversion rate is currently 0.7994. At Transferwise.com they provide you an instant, guaranteed rate, so I enter CDN$1000 and it gives me a rate of 0.79960 and the following three options:

The rate for transfers for Canadian dollars is actually on the higher side compared to many other currencies. For example, the rate to transfer Australian dollars to USD is only 0.7% and the rate for Euro is a measly 0.5%. But at 1% for Canadian dollars it is far, far cheaper than what a bank or traditional money transfer company like Western Union would charge.

One concern that must be addressed is the level of safety of these services. Because they are operating as financial companies they must be licensed by the regulatory body in each country they operating in and comply with all legal requirements for electronic money transfer. In Canada, these services are licensed by Authorité des Marchés Financiers (AMF) in Quebec and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) for the rest of Canada. Most services also claim to use bank level security and technical measures to prevent unauthorized access to your account. Like many online services in the sharing economy, it is easy to find customer reviews on the services, which may provide a certain level of comfort.

The increasing popularity of these international money transfer services is helping to bring down the cost of currency conversions for the mass market and deprive large financial institutions of what has traditionally been a high margin business. So, the next time you need to convert money to pay for a vacation, a foreign property purchase, your child’s educational expenses, or an online purchase, consider one of these services.

Kris Olson, B.Comm, DIY Investor, Traveler, Author of “The Found Vagabond”, Paris, ON, kris@lifeisgrand.org www.lifeisgrand.org